Photographs: Reuters Arvind Subramanian

India's economy has been growing rapidly, at about 6.5 per cent for three decades since 1980, and about nine per cent over the last decade.

As a result, it has emerged as a major power with an economy ($4.7 trillion) that in 2012 became the world's third largest in terms of purchasing power - surpassing Japan and now behind only China and the US.

Its trade in goods and services is close to a trillion dollars, and expected to double every seven years.

This dynamism has expanded opportunities for US business. US exports of goods to India have increased close to 700 per cent in the last decade.

Exports of services have doubled in the last four years. US foreign direct investment (FDI) has increased from $200 million to $6 billion.

Moreover, trade and investment flows between the two countries are broadly balanced, minimising the scope for macroeconomic and currency-related tensions.

However, India is currently encountering a bout of severe turbulence. On the economic front, growth has decelerated sharply - from 9 per cent to 4.5 per cent.

And macroeconomic vulnerabilities - high fiscal deficits (nine per cent of the gross domestic product or GDP), stubbornly elevated and double-digit inflation, and a deteriorating external balance (over four per cent of GDP) - have been mounting.

...

Why US needs to learn to live with India's frailties

Image: US President Barack Obama (R) toasts alongside India's Prime Minister Manmohan Singh during a state dinner at Rashtrapati Bhavan.Photographs: Jason Reed/Reuters

Politically, India is heading toward its next general election, which has to take place before the spring of 2014, complicating and imparting uncertainty to economic policy-making.

In response to adverse developments, the government has undertaken, since late 2012, major domestic economic reforms.

Reforms have also included an ambitious opening up of the economy to FDI and to foreign financial investors.

Indeed, since the global financial crisis, few countries have opened up to foreign capital to the extent that India has.

Significantly, and reflecting a domestic bipartisan consensus, there have been no major macroeconomic reversals of opening to foreign trade and capital.

However, US business faces three major challenges in India. Two challenges common to all foreign business are: first, the weak and uncertain regulatory and tax environment; second, although the broad macroeconomic picture is one of opening and surging trade and investment, protectionism in selected sectors has resurfaced.

India is seeking increasing recourse to localisation - in telecommunications, retail, and solar panels among others - which favours domestic providers of inputs and equipment over foreign providers.

Thus, broad trade and macroeconomic policies toward foreigners are moving in the right direction, but sectoral policies have experienced setbacks.

...

Why US needs to learn to live with India's frailties

Image: Pascal Lamy, director general of the WTO. US should address frictions through WTO dispute settlement procedures.Photographs: Denis Balibouse/Reuters

Third, American firms are increasingly facing implicit but substantial discrimination in India's large and growing market because of India signing (or on the verge of signing) free trade and economic partnership agreements (regional trade agreements or RTAs) with its largest trading partners that are all major competitors to the US: Europe, Japan, Singapore, the Association of Southeast Asian Nations (Asean), and possibly Asean-plus 6.

Soon, if not already, this discrimination may be the bigger challenge for US business than some recent sectoral measures.

These RTAs are neither as comprehensive in their coverage across and within sectors as RTAs negotiated by the US, nor as expeditious in the time frame for implementation.

But they provide more favourable access to non-American suppliers and because India's tariffs and barriers can be high, the discrimination can be substantial.

Combined with the fact of India's large and growing market, US suppliers can really be disadvantaged.

These challenges must be seen in the context of a recent past that has seen surging Indian trade and FDI, with enormous benefits for foreign and American businesses; and in the context of a future that promises great potential not least because of India's dynamism.

Looking ahead, the US should adopt the following multi-pronged strategy for solving trade conflicts and maximising the underlying potential.

First, the US should address frictions, especially where Indian policies are demonstrably protectionist (as in the case of some local content requirement policies) through multilateral (the World Trade Organisation or WTO) dispute settlement procedures.

...

Why US needs to learn to live with India's frailties

The US should not be reticent in this regard. As the picture above illustrates, India has an excellent record of compliance with the WTO rulings against it.

And one of India's most sweeping trade reforms occurred after a US-initiated WTO dispute panel found that India's broad quantitative restrictions on consumer goods violated the WTO's rules.

Second, US initiatives such as the Trans-Pacific Partnership and the Trans-Atlantic Trade and Investment Partnership will complicate relations with China.

But by discriminating against Indian companies and exporters, these initiatives will inevitably, even if with a lag, exert natural pressure on India to open up either directly, or by nudging it into participation in these and other trade liberalising initiatives.

Third, there is merit in initiating deeper bilateral trade integration between India and the US as a framework for giving recognition to the broader strategic imperative of closer cooperation between the two countries, and reversing the discrimination that each is inflicting on the other.

But deeper US-India trade relations are also necessary for revitalising the multilateral trading system by moving beyond the Doha Round to a possible new China Round of multilateral trade negotiations.

This revitalisation is the best way of ensuring that China remains a benign quasi-superpower in terms of supporting an open, rules-based, and non-discriminatory trading system.

...

Why US needs to learn to live with India's frailties

Finally, there is little prospect that India will at any time soon establish standards of rule of law and legal certainty that will match those found in most advanced countries; nor will it be able to provide the investment-friendly climate that is associated with effective top-down systems such as China.

This creates a dilemma for American business. Waiting for India's regulatory regime to change risks ceding ground to competitors from other countries in one of the world's largest markets.

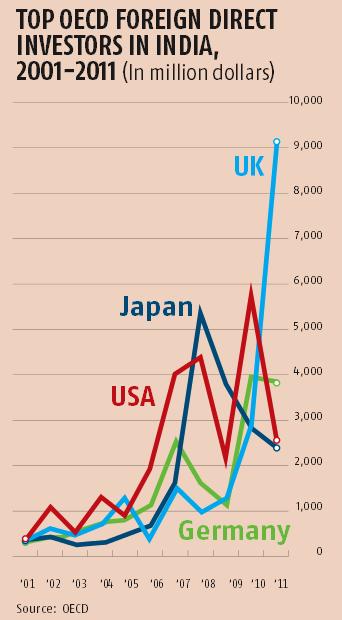

Indeed, in many sectors such as infrastructure, this may already be happening. The table shows that the US is not consistently the top provider of FDI to India, which suggests under-performance.

For American business, with its visceral need for rule of law, the challenge will be to navigate messy foreign economic environments, such as India's, or else risk losing business to more pragmatically nimble counterparts in other countries.

India will need to change, but so too will American business. And, unfortunately, to paraphrase the line from the great Italian novel, The Leopard, the more things stay the same in India, the more American business will have to change.

This is an edited version of testimony presented by the author to the United States Congress on US-India trade relations on March 13

The author is Senior Fellow, Peterson Institute for International Economics and Centre for Global Development

article