With the losses incurred by oil marketing companies (OMC's) on selling regulated fuels below their market prices (under-recoveries) reaching alarming levels, an urgent corrective action, like hiking the price of diesel, has become imperative.

Here's why diesel prices must be hiked according to a Crisil report.

Diesel prices were last revised in June 2011 along with kerosene and LPG prices.

Non-revision of the administered prices of these fuels, since then, has severely impacted the liquidity and profitability of OMCs and massively inflated the government's subsidy burden.

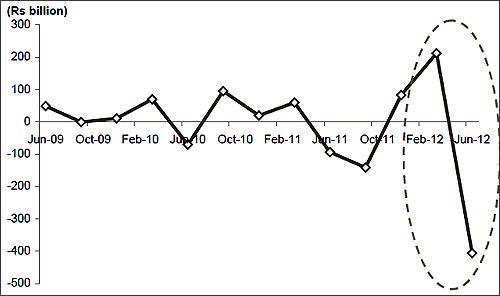

OMC's post biggest ever loss in the first quarter of 2012-13

The aggregate losses of over Rs 40,500 crore (Rs 405 billion) in a single quarter reported by the three public sector OMC's (IOC, BPCL and HPCL) is certainly a cause for concern.

Losses increased sharply primarily because of the absence of any government compensation towards under-recoveries incurred in the quarter. Increase in interest costs and inventory and forex losses aggravated the situation.

...

Why India must hike diesel price

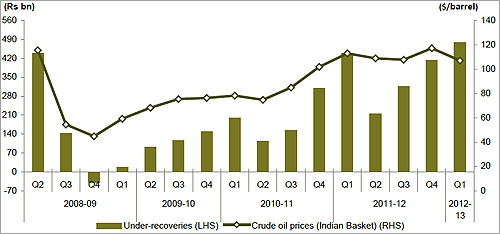

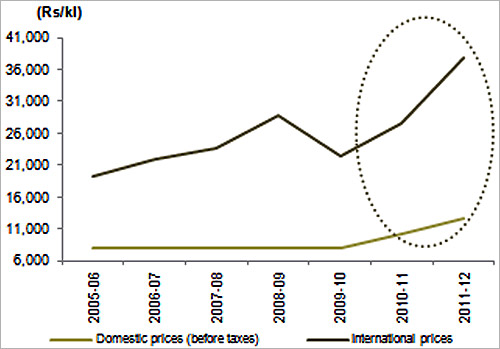

Image: Trend in crude oil prices and under-recoveries.At present, OMCs are incurring record-high losses of Rs 14 per litre on diesel, Rs 29 per litre on kerosene, and Rs 250 per cylinder on LPG.

This is largely on account of inadequate revision of domestic prices, despite a sharp increase in international prices.

As a result, the under-recoveries, which had already increased by 77 per cent in 2011-12 to Rs 1,385 billion (up from Rs 782 billion in 2010-11), will continue to be higher in 2012-13 also.

In the first quarter of 2012-13 itself, the under-recoveries have increased to Rs 478 billion, which is the highest ever quarterly figure.

The increase in under-recoveries can also be attributed to increased consumption of regulated fuels (like diesel) by private car owners due to significant difference in prices as compared to other alternate fuels like petrol.

The difference between the running cost for a petrol car vis-a-vis a diesel car has gone up by 85 per cent in the last 7-8 years.

...

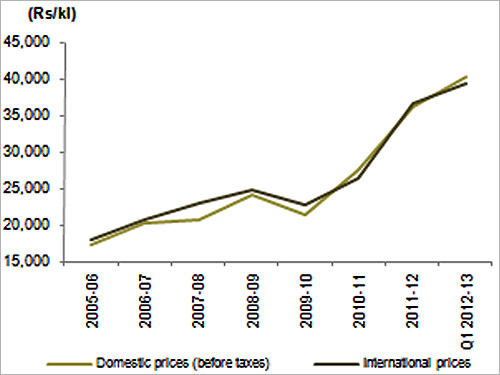

Why India must hike diesel price

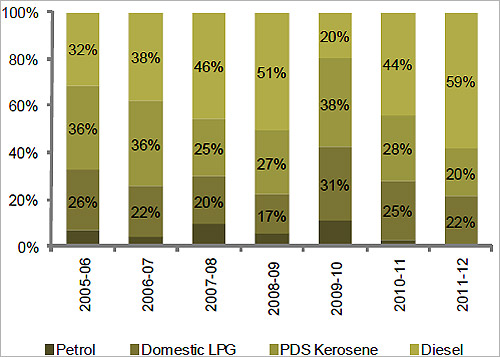

Image: Petrol prices.Diesel cars have therefore become more lucrative for buyers; the proportion of diesel cars in total car sales has increased to 38 per cent in 2011-12 vis-a-vis 20 per cent in 2005-06.

This, in turn, has pushed up the share of diesel in overall petroleum product consumption to 44 per cent from 36 per cent during this period.

Thus, given the crippling under-recoveries of OMCs and a fast deteriorating fiscal situation, a hike in prices of regulated fuels, especially diesel, which accounts for 60 per cent of underrecoveries, is essential and inevitable.

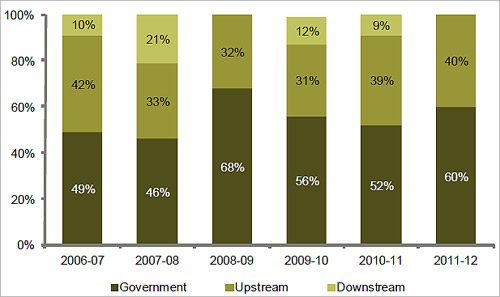

Losses arising from under-recoveries are typically shared by the government, upstream oil companies (ONGC, OIL India and GAIL) and OMCs (IOCL, BPCL and HPCL) according to a proportion determined by the government at the end of every fiscal year.

...

Why India must hike diesel price

Image: Diesel prices.Even though the OMCs didn't share any under-recovery burden in 2011-12, the absence of a fixed annual sharing mechanism for under-recoveries and the uncertain timing of cash payouts by the government have adversely affected their profitability and liquidity.

The OMCs' liquidity position has worsened over the years, as clearly indicated by their rising gearing levels. The debt-equity ratio of these companies has almost tripled from 0.6 times in March 2005 to 1.7 times in March 2012.

As a result, their interest costs have also gone up. Over the last one year itself, the interest costs have more than doubled to Rs 105 billion in 2011-12 from Rs 51 billion in 2010-11.

Consequently, profits of OMCs dropped to Rs 62 billion in 2011-12 from Rs 105 billion in 2010-11.

...

Why India must hike diesel price

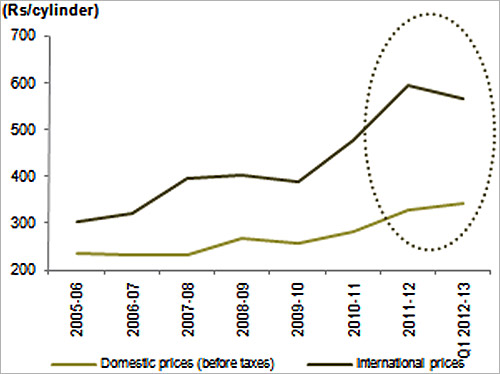

Image: LPG prices.Even though the OMCs didn't share any under-recovery burden in 2011-12, the absence of a fixed annual sharing mechanism for under-recoveries and the uncertain timing of cash payouts by the government have adversely affected their profitability and liquidity.

The OMCs' liquidity position has worsened over the years, as clearly indicated by their rising gearing levels. The debt-equity ratio of these companies has almost tripled from 0.6 times in March 2005 to 1.7 times in March 2012.

As a result, their interest costs have also gone up. Over the last one year itself, the interest costs have more than doubled to Rs 105 billion in 2011-12 from Rs 51 billion in 2010-11.

Consequently, profits of OMCs dropped to Rs 62 billion in 2011-12 from Rs 105 billion in 2010-11.

...

Why India must hike diesel price

Image: Kerosene prices.Rising under-recoveries worsen government's fiscal position

Rising under-recoveries are not only hurting the OMCs but also adversely impacting the government's finances.

In 2011-12, oil subsidies constituted 32 per cent of the government's total subsidy burden, amounting to Rs 835 billion.

Out of the government's total share, it had already provided for Rs 450 billion in 2011-12 and the balance Rs 385 billion was to be paid in 2012-13. However, for 2012-13, the government has made an overall provision of merely Rs 436 billion towards oil subsidies.

...

Why India must hike diesel price

Image: Comparison of running cost.Of this, more than 80 per cent will be exhausted towards payment of the balance subsidy for 2011-12.

If the prices of regulated fuels are not revised upwards, the under-recoveries will remain high in 2012-13 and may even surpass 2011-12 levels.

Consequently, the share of oil subsidies in the fiscal deficit, which has already increased to 16 per cent in 2011-12 from 6 per cent in 2009-10, will continue to be high in 2012-13 as well.

...

Why India must hike diesel price

Image: Product-wise trend of under-recoveries.The government will be left with no option but to borrow additional funds to compensate the OMCs during the year, thereby adversely impacting the government's fiscal position, assuming other factors remain constant.

This, in turn, could exert further upward pressure on interest rates and will also limit the government's ability to fund critical social and infrastructure projects.

...

Why India must hike diesel price

Image: Subsidy sharing formula.Alignment of domestic prices with international prices critical to rein in subsidies and strengthen India's energy security

Given the seriousness of the problem, it is absolutely crucial that prices of regulated fuels be raised by at least 10-15 per cent immediately and gradually be linked to international prices.

The alignment of regulated fuel prices with international prices may affect domestic fuel inflation in the short term, but in the long term, the move would help ease the government's subsidy burden and reduce wasteful consumption of regulated fuels like diesel.

...

Why India must hike diesel price

Image: Trend in consolidated gearing of OMCs.In addition, it will help the OMCs reduce their dependence on the government for reimbursement of under-recoveries and give them enough flexibility to undertake capital expenditure and make acquisitions.

This, in turn, would help strengthen India's energy security

article