| « Back to article | Print this article |

Why Gujarat's power story is hard to replicate

Between March 2004 and January 2013, Gujarat witnessed a 166 per cent growth in power capacity -- from 8,974 Megawatt to 23,887 Mw - far outpacing most other states, rues Sudheer Pal Singh

The turnaround story of Gujarat's power sector over the past decade under Narendra Modi is often cited to substantiate the so-called 'Gujarat model' of growth.

The turnaround story of Gujarat's power sector over the past decade under Narendra Modi is often cited to substantiate the so-called 'Gujarat model' of growth.

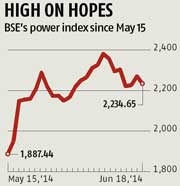

The historic rally of power sector stocks after the Bharatiya Janata Party's landslide victory in the general elections testified to the widely held perception of the state as the theatre of power reforms.

Gujarat has more power than it needs even as tariffs have remained low and electricity is available 24X7, claim the proponents of the Gujarat model.

Modi has moved to New Delhi as prime minister now and many expect the Centre to make Gujarat the role model for electricity reforms across the nation.

An analysis of the key sectoral growth indicators -- including capacity addition, power deficit and the health of power distribution companies -- reveals Gujarat's breathtaking rise from a power deficit to a surplus state within a decade after 2004 on the back of strong implementation of reform measures.

However, some of the key factors responsible for this growth may not be available for replication in other states, making it difficult for the Centre to bring about a similar turnaround of the power sector at the national level.

Click NEXT to read further. . .

Why Gujarat's power story is hard to replicate

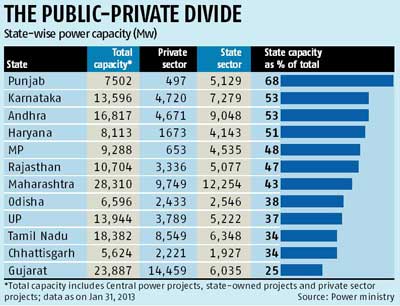

Between March 2004 and January 2013, Gujarat witnessed a 166 per cent growth in power capacity -- from 8,974 Megawatt to 23,887 Mw -- far outpacing most other states, according to power ministry data.

This is a huge achievement given the long-drawn clearance process that power projects go through.

They often take between seven and nine years from planning to commissioning.

However, a closer look at the state's power capacity growth during the period reveals an equally startling fact -- the share of private sector in the overall capacity shot up from a dismal 25 per cent (2,226 Mw) in 2004 to over 60 per cent (14,459) in 2013.

At the same time, the share of state sector projects slumped from 58 per cent to 25 per cent.

In fact, the share of public sector in the overall capacity in Gujarat at 25 per cent currently is the lowest among all the states.

Click NEXT to read further. . .

Why Gujarat's power story is hard to replicate

"The addition of power capacity from state sector projects in Gujarat may have been lower when compared with that of the private sector, but it has not been stagnant," says Dipesh Dipu, associate professor of energy, Administrative Staff College of India.

The gradual takeover of power capacity by private companies may be attributed to the business-friendly environment that Gujarat was able to create.

However, a similar level of private interest may not be available in other states, particularly those grappling with poor law and order situation or a slow bureaucracy, like Uttar Pradesh and Bihar.

24X7 supply

Not surprisingly, the spectacular growth in power capacity addition in Gujarat under Modi was accompanied by better availability of electricity.

Not surprisingly, the spectacular growth in power capacity addition in Gujarat under Modi was accompanied by better availability of electricity.

Peak power deficit in the state had reached a worrisome 25 per cent in 2004, according to Central Electricity Authority data.

Today, the figure stands at zero.

This means the state is able to efficiently meet the entire demand for power even during peak hours when demand shoots up.

This explains the pride over "24X7 power supply".

However, Gujarat is not the only state with zero deficit.

There are at least five other states -- including some big ones like Haryana, Rajasthan and Madhya Pradesh.

Interestingly, the common thread running through these states, including Gujarat, is an early initiation of distribution sector reforms, particularly management of the heavily subsidised rural load.

Click NEXT to read further. . .

Why Gujarat's power story is hard to replicate

This implies that replicating the Gujarat story in any other state would require a similar level of distribution reforms to improve availability and rein in deficits for the industry.

However, given the states' experience with distribution reforms, this may be a distant dream.

Consider the fact that Indian states had accumulated losses of Rs 2.4 lakh crore as on March 2012.

The bulk of these losses, a result of years of neglect of the economies of power generation in favour of political interests, is concentrated in seven states, including Tamil Nadu, Rajasthan, Uttar Pradesh, Haryana, Jharkhand and Punjab.

Notably, Gujarat is the only state where discoms still register profits. This makes Gujarat an exceptional case.

Gujarat's success story in reining in power deficit is distinct also because the state managed to pull down deficit to zero from a higher base of 25 per cent reported in 2004.

Click NEXT to read further. . .

Why Gujarat's power story is hard to replicate

Nationally, distribution reforms were initiated with the enactment of the Electricity Act of 2003 that mandated breaking up the loss-making state electricity boards into vertically integrated corporatised utilities handling generation, transmission and distribution functions.

A financial restructuring programme for distribution utilities had already been kicked off in 2001.

Over a decade since, thanks to subsidised farm sector load and stagnant tariffs, the discoms of most states continue to reel under heavy losses that are making survival difficult.

Here, too, Gujarat is an exception.

Its four discoms -- Dakshin, Uttar, Madhya and Paschim Gujarat Vij Company - are the only ones with profitable operations among the 39 state discoms nationally.

These four companies have been registering profits consistently since 2005.

The reasons are multiple: They have the highest cost coverage ratio of close to 1.0 among all the state utilities due to better collection efficiency; low aggregate technical & commercial losses; cost-reflective tariffs; gains from unscheduled interchange (a mechanism that incentivises a states to draw lower power from the national grid against committed quota); and sale of surplus power in the spot market that boosted trading by the Gujarat Urja Vikas Nigam, the power trading arm of the state government.

There is no other Indian state that can boast of such a healthy financial situation of its distribution sector.

Replication of the Gujarat model, therefore, would first require an overhaul of the power distribution set-up to sort out the mess that is prevalent there.

Click NEXT to read further. . .

Why Gujarat's power story is hard to replicate

Mapping consumers

There is something else that the state did in 2005 that made Gujarat the poster boy of power reforms and which may be difficult to implement in other states.

Under a Rural Feeder Segregation Programme, Gujarat bifurcated its transmission lines catering to rural areas into those serving the households and those meant for use on the farm.

The idea was to identify the heavily subsidised farm sector consumers and provide them cheaper power on a single phase line for a fixed number of hours each day.

Residential consumers were supplied costlier power on a three-phase line throughout the day.

This eliminated the diversion of subsidised power for household use -- a key reason for losses historically.

Several attempts by other states, including Rajasthan and Madhya Pradesh, to segregate consumers have met with little success due to the dismal availability of data on power demand, a pre-requisite for the feeder segregation scheme.

"Gujarat utilities have been progressive and have constantly worked out new models of operation," says Dipu.

"Also, the functioning style of the state leadership percolated to the management of discoms."

The success of the Gujarat model can also be attributed to high collection efficiency.

Not surprising, therefore, separate identification of subsidised farm load may not work if collection itself becomes an issue, says Dipu.

It's a challenge that faces many states, especially those that have poor law and order situation and where distribution bottlenecks are rampant.