| « Back to article | Print this article |

Why gold loan business will be hit

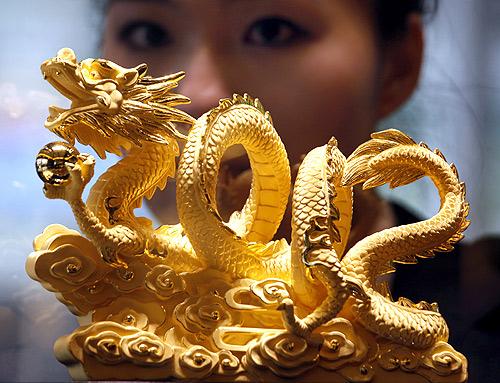

Gold is one of the most influential financial instruments in the India. Banks, NBFCs and unorganised lenders are actively engaged in providing loans against gold value.

The loan against value of gold has played a great role by providing liquidity for an idle asset kept in the lockers.

However, in its latest move, RBI has come up with a norm for NBFCs that does not allow them to offer a loan above 60 per cent of the value of gold.

RBI grew uncomfortable with the high growth rate of gold loans for NBFCs.

Click NEXT to read more...

Why gold loan business will be hit

It has increased its inquiry of the gold loan portfolios, even for the banks.

RBI wants interest rates and growth rates on gold loans to come down, especially for NBFCs considering concentration risk and the risk of a fall in gold prices.

Furthermore, RBI's directive that a bank credit to NBFCs for giving loans against gold jewellery will not be treated as exposure to the agricultural sector would hinder companies to raise easy funds for gold financing.

Click NEXT to read more...

Why gold loan business will be hit

Some of the key points from the RBI's latest guidelines for NBFCs include transparency in interest rates, due diligence in understanding the repayment capacity of the borrower, awareness of his existing debts, explicit loan agreement etc.

Also, NBFCs that have gold loans of more than 50 per cent of total financial assets have to maintain Tier -1 capital ratio of 12 per cent from April 2014.

Click NEXT to read more...

Why gold loan business will be hit

Why it is a setback for NBFCs?

RBI's guideline is a setback for NBFCs because the new rules require greater capital adequacy for the financing companies and the thresh hold for the value of loan against gold is proposed to be at a lower value.

This would mean that ornaments of the same value are expected to result in a lesser loan amount and that too at a slightly higher cost.

Let's check out other aspects where NBFCs could be adversely affected.

Click NEXT to read more...

Why gold loan business will be hit

Earlier, NBFCs used to provide up to 80 per cent loan against the gold now it would be reduced to a mere 60 per cent of the gold value.

Gold loans from banks would now become more attractive than NBFCs until they are allowed to lend more on the value of pledged gold.

The cost of funding for NBFCs would go up due to the RBI's restriction to allow the NBFCs to finance its gold loan from the banks as an exposure to agricultural loan.

Click NEXT to read more...

Why gold loan business will be hit

NBFCs might have to reduce the interest rate to sustain hold in the gold loan market. Hence the current profit margin would come down significantly.

What's in favour of NBFCs?

Though this regulation would hit hard on the revenue as well as bottom-line of the NBFCs there still some positive aspects to this move:

NBFCs would continue to enjoy the niche segment advantage due to its deep presence in the gold loan market. At present, NBFCs have a 32% share of the total gold loan market.

Click NEXT to read more...

Why gold loan business will be hit

The gold loan would still be cheaper than the personal loan, so the size of market is set to grow bigger in coming days.

There are many untapped areas where NBFCs could have a better reach than the banks.

The advantage of trouble free and quick loan processing by NBFCs would give them the edge over the banks. NBFCs can raise funds through market borrowings, i.e. commercial papers to lower the cost of the fund.

Click NEXT to read more...

Why gold loan business will be hit

On gold loans

The RBI move would create a gap between bank and NBFC gold loan operations.

The banks are expected to make an aggressive take over on the gold loan segment in the absence of a strong NBFC presence.

In the current scenario, RBI's recent regulations have hit the top as well as bottom-line of the NBFCs.

Click NEXT to read more...

Why gold loan business will be hit

In India, gold buying is a regular process, and people are expected to continue its inclination towards gold in the future.

The regulations may negatively affect the gold loan business in the short term for NBFCs but in the long term, the overall gold loan market is set to grow as long as the demand for gold is growing in the country, and NBFCs just need lay the foundation to pick up the pace again and devise ways to cater to their customer base in an innovative manner.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2024 www.BankBazaar.com. All rights reserved.