Photographs: Reuters

The Sensex started the day 472 points lower at 16,518, and soon touched a low of 16,432. The NSE Nifty broke the 5,000-mark, for the first time since June 2010, in early trades to touch a low of 4,946 - down 3.4%.

However, renewed buying interest mainly in select rate sensitive stocks - from the auto and realty space - led to a smart recovery. At one point, the recovery turned out to be broad space, as the European markets opened on a flat to positive note, and the US futures too indicated a sharp recovery on the Dow Jones futures.

The buying momentum was so strong, that the Sensex rallied all the way to a high of 17,135 - up over 700 points from the day's low. The Nifty too touched a high of 5,167, up 4.5%. However, the recovery was quite short-lived, thanks to the European markets.

The major European markets, - FTSE 100, CAC 40 and DAX plunged almost 3-5% each after the slightly optimistic start. Losses on European bourses widened due to selling in banking and commodity shares ahead of the US Federal Reserve Policy expected later today. The Dow futures also changed course, and traded back into the negative terrian.

This led to a fresh round of selling, with the Sensex falling nearly 300 points into red at one point. The volatile markets eventually ended in red, albiet off the day's low. The Sensex finally settled with a loss 132 points at 16,858. In the process, the index has declined 1,456 points in the last six consecutive days. The NSE Nifty declined 46 points at 5,073.

For the third day running, IT stocks were the major draggers. Infosys and TCS together accounter for a loss of 82 points on the Sensex. Reliance Industries, ICICI Bank, Tata Steel and Tata Motors were the other major draggers.

The markets losses could have been higher had it not been for stocks like ITC, HDFC and Mahindra & Mahindra, which collectively contributed 82 points to the Sensex.

In terms of per cent age, Tata's trio of TCS, Tata Motors and Tata Steel were the major losers, all down over 4% each. Cipla, Infosys, Sun Pharma and Wipro were the other major losers.

On the other hand, Mahindra & Mahindra soared nearly 5%. DLF, ITC, Jaiprakash Associates, Bajaj Auto and HDFC were the other major gainers, up around 2% each.

The BSE IT index plunged 3.5% to 5,041. Apart from the three IT majors - HCL Technologies, MphasiS and Patni Computer also ended with steep losses.

The BSE Metal and the Health care indices ended with losses of 2.5% each. Tata Steel, National Aluminium, JSW Steel, Coal India, NMDC, Sesa Goa, Bhushan Steel and Hindalco were the top losers in the metal space. While, Strides Arcolab, Aurobindo Pharma, Glenmark Pharma, Ranbaxy, Dr.Reddy's. Cipla and IPCA Labs were the major losers among the pharma stocks.

Given the broad-based sell-off, the market breadth remained unfavorable yet again. Nearly 70% of the BSE traded stocks ended lower, while 28% stocks advanced on Tuesday.

. . .

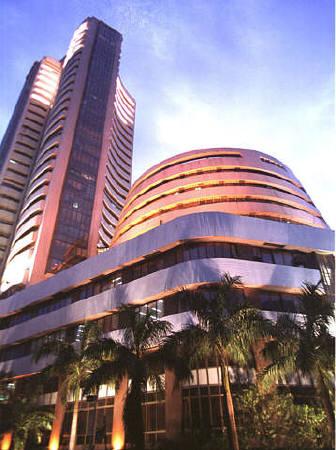

Global markets crash; Indian stocks recover

Photographs: Reuters

US, Asian markets crash!

Investors continued to flee out of equities on fear that Europe and United States may not be able to stick to their budgets and quell the spread of a double dip recession.

Also, Standard & Poor's cut Freddie Mac and Fannie Mae's long-term ratings by one notch on Monday citing its direct reliance on US government.

Asian markets plunged on Tuesday morning session following sell-off in the US equity markets with banking shares taking a bigger hit. Hong Kong's Hang Seng Index tumbled 6%, at 19,223 after falling almost 7.2% in the early morning. China's Shanghai Composite slipped 1.1%, Japan's Nikkei Stock Average plummeted 4.3% and South Korea's Kospi Composite slipped 9%.

The Kosdaq market in South Korea was temporarily halted for 20 minutes following steep cuts in the local stock market according to news reports.

. . .

Global markets crash; Indian stocks recover

Photographs: Reuters

Standard & Poor's in a note to clients said, "The US rating change, together with the weakening sovereign creditworthiness in Europe, does point to dampened market sentiment, potentially raising funding costs in offshore markets, and reversal of capital flows." Earlier on Friday, S&P downgraded US credit rating to AA+ from AAA which sent red ripples across the world equity markets.

Back in India, analysts expect the markets to continue to remain volatile. Going forward the Federal Open Market Committee meeting will be closely watched for any signs of quantitative easing three. In India the industrial production data for June will be released this week which will give an indication of the economic health.

Among the sectoral indices, BSE IT index continued to be hammered by the investors as they feared that the sector would get worst hit if the west was to slip back into a recession. Wipro fell over 5%, TCS lost 4.9% and HCL Technologies was off 3.1%.

. . .

Global markets crash; Indian stocks recover

Photographs: Reuters

BSE Metal index was also the top loser for the third straight session. NALCO was down almost 6%, Tata Steel lost 4.5% and Hindalco Industries gave up 3.8%.

Top losers on the Sensex were Tata Motors, down 5%, Sun Pharma slipped 4% and DLF plummeted 3.4%. ONGC was the only component trading in the green, up 0.2%.

Among the broader markets, the midcap and the smallcap indices were down over 2% each. Markets breadth was extremely negative, 1,671 stocks declined for 204 stocks which advanced.

. . .

Global markets crash; Indian stocks recover

Photographs: Reuters

IT stocks remain under selling pressure

Shares of IT companies continued to witness heavy selling pressure in the stock market on Tuesday amid the global chill caused by the credit rating downgrade of the US, from where these companies earn about 60 per cent of their revenues.

Shares of blue-chips like TCS, Wipro and Infosys bore the brunt of the bearish trading sentiment and fell sharply on the bourses.

TCS, the country's' largest IT exporter, plunged by 6.46 per cent to hit an early low of Rs 948 on the BSE. Similarly, IT bellwether Infosys lost 4.78 per cent to touch a one-year low of Rs 2,350.

. . .

Global markets crash; Indian stocks recover

Photographs: Reuters

Wipro, India's third largest IT exporter, too, witnessed massive selling pressure and fell by 5.28 per cent to hit an early low of Rs 339.70.

Investors also dumped the stocks of other IT companies that have significant export exposure to the US and Europe. In early trade, HCL Tech shed 3.99 per cent, Tech Mahindra slipped by 2.84 per cent and Patni Computer went down by 1.91 per cent.

. . .

Global markets crash; Indian stocks recover

Photographs: Reuters

Rupee down 41 paise at 10-week low

The Indian rupee depreciated by 41 paise to a nearly 10-week low of Rs 45.38 against the US dollar in early trade on the Interbank Foreign Exchange on Monday, largely on capital outflow concerns.

The rupee closed down by 23 paise at a nearly six-week low of Rs 44.97/98 against the US dollar in Monday's trade as institutional investors took out funds amid a slump in global stocks following the downgrade of America's sovereign rating.

Forex dealers said weakness in the equity market and capital outflow concerns continued to put pressure on the Indian rupee, which has fallen to its lowest level since May 25 this year.

article