| « Back to article | Print this article |

15 stocks that promise high returns

Here are 15 companies that research houses believe could see significant impact due to the Budget proposals.

The Budget proposals for 2014-15 announced by Finance Minister Arun Jaitley has several measures for everyone, but more importantly, they suggest the government is moving in the right direction. HSBC Global Research, led by Frederic Neumann, Co-Head of Asian Economic Research, said, "While there was no big bang, the overall tone was positive which should keep the country's feel-good factor going".

Among the strongest moves were for the infrastructure and housing sectors, which will benefit lenders like SBI, HDFC and IDFC. SBI and HDFC will also benefit from higher FDI in insurance.

In the real estate space, analysts see more gains for DLF and Prestige Estates. Higher FDI in defence and focus on boosting India's manufacturing sector should benefit L&T, BEL, UltraTech and steel makers like JSW Steel and Tata Steel among others. For individuals, too, the higher tax exemption and savings incentives and continuation of rural-focused schemes are positives and should help increase consumption.

This is positive for HUL, Dabur and Godrej Consumer. ITC, which may see some impact on volumes due to hike in excise on cigarettes, should also gain from higher consumption of FMCG and paper products.

Morgan Stanley's analysts said in a note that from a stock market perspective, the investment push together with higher FDI limits in insurance and defence and steps to ease taxation should augur well for the progression of the share of profits in GDP.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

15 stocks that promise high returns

BATA INDIA

Bata as well as Relaxo Footwear will be the key beneficiaries of the halving of excise duty on footwear (priced between Rs 500-Rs 1,000 per pair) to six per cent. Footwear priced below Rs 500 is already exempt from excise duty. While Bata's footwear across all segments (leather, rubber and plastic) has average realisations between Rs 166 and Rs 587 per pair, the average realisation stands much lower at Rs 112 per pair.

Bata as well as Relaxo Footwear will be the key beneficiaries of the halving of excise duty on footwear (priced between Rs 500-Rs 1,000 per pair) to six per cent. Footwear priced below Rs 500 is already exempt from excise duty. While Bata's footwear across all segments (leather, rubber and plastic) has average realisations between Rs 166 and Rs 587 per pair, the average realisation stands much lower at Rs 112 per pair.

Thus, these moves will enable the two companies to pass on the gains and provide further impetus to their volume growth. Importantly, lower duties would mean that the companies will be able to compete more effectively with the unorganised sector, which accounts for a large share of the industry.

Both these companies enjoy strong return ratios and have posted consistent financial performance over the past few quarters.

Bata, though, with its larger size and industry leader position is better poised to gain from these incentives, say analysts. MOSL says Bata's EBITDA margins can expand by 50-60 basis points led by excise duty cuts.

Please click NEXT to read more…

15 stocks that promise high returns

BHARAT ELECTRONICS

Bharat Electronics (BEL), a leading player in the defence sector, will be a key beneficiary given the increase in defence capital expenditure - by Rs 5,000 crore to Rs 95,000 crore in FY15 and increase in FDI limits for the defence equipment sector.

Bharat Electronics (BEL), a leading player in the defence sector, will be a key beneficiary given the increase in defence capital expenditure - by Rs 5,000 crore to Rs 95,000 crore in FY15 and increase in FDI limits for the defence equipment sector.

BEL has been looking for technological tie-ups and alliances to bridge the technology gap. With the proposal to hike FDI limit in defence sector from the current 26 per cent to 49 per cent, it now opens more avenues for companies like BEL, as it will enable them to attract foreign companies.

While the Street is concerned with the move, analysts are not worried.

"Market has perceived increase in FDI as negative, as it will attract competition. We think, increase in FDI will help BEL enter into joint ventures with foreign tech partners while its domestic business from products designed by the defence research agencies, etc. can't be given to foreigners," said Axis Direct.

Higher FDI could be crucial for BEL's efforts to push for high-value projects thereby easing concerns over its profit margins.

Please click NEXT to read more…

15 stocks that promise high returns

DLF

On a broader level, DLF and Prestige Estates stand to gain because of the higher tax exemptions provided on home loan interest and higher income tax limit for individuals, as this will mean higher demand for homes.

On a broader level, DLF and Prestige Estates stand to gain because of the higher tax exemptions provided on home loan interest and higher income tax limit for individuals, as this will mean higher demand for homes.

Also, lowering of the minimum capital norms for FDI will be positive for both. This will help attract investments and ease liquidity issues in the light of their leveraged balance sheets.

The size of projects eligible for FDI has been reduced from 50,000 square meters to 20,000 square meters along with halving of minimum investment limit to $5 million. The government has also proposed to ease norms for affordable housing thus enabling higher FDI in the sector.

Besides, clarity on the dual taxation and tax pass through on REITs is positive for commercial real estate developers like DLF. Also, allocation of fund for affordable housing, revival of the SEZs (benefit for its SEZs like DLF IT SEZ Chennai) and development of new cities will be marginally positive for both companies.

Please click NEXT to read more…

15 stocks that promise high returns

GAIL INDIA

The government plans to double the gas pipeline network from the existing 15,000 km to 30,000 km, wherein GAIL could contribute meaningfully.

The government plans to double the gas pipeline network from the existing 15,000 km to 30,000 km, wherein GAIL could contribute meaningfully.

However, most of its new pipelines are running below their rated capacities, which is why, analysts say pick-up in gas transmission volumes is key to the company's prospects which could be partly addressed by increased imports of LNG.

Positively, the finance minister has proposed to ramp up use of piped natural gas (PNG) rapidly as it is a clean and efficient fuel. The Budget also proposed exemption from basic customs duty on re-gasified LNG for supply to Pakistan.

"Gail may import LNG either at Petronet's LNG terminal in Dahej or at its Dabhol facility after re-gassifying it.

Later, GAIL will transport gas to Jalandhar and may plan to lay a 110-km pipeline to transport the gas near Lahore for delivery into Pakistan", Kotak Securities wrote in a note.

Both these measures may prop up gas transmission volumes for the company. Analysts though are cautious for now.

Please click NEXT to read more…

15 stocks that promise high returns

HDFC

HDFC and other housing loan companies stand to gain from the host of measures for the housing sector.

HDFC and other housing loan companies stand to gain from the host of measures for the housing sector.

Raising of tax exemption limit on interest on home loan (for self-occupied property) by Rs 50,000 to Rs 200,000 will benefit existing and potential borrowers. Raising of income tax exemption by half under Section 80C to Rs 150,000 will also enable individuals to claim higher exemption on the principal repayments towards home loans.

Higher allocation to low-cost housing and rural housing are other positive steps. All these steps will provide an impetus to home loan demand from various segments. On a consolidated basis, positive measures for HDFC Bank (10 per cent of its SOTP valuations) and life/general insurance businesses (3-4 per cent of SOTP) in the form of hike in FDI to 49 per cent will add to HDFC's gains.

The stock has under-performed Sensex in recent months and any fall offers a buying opportunity given the company's strong prospects.

* Net sales for HDFC & IDFC represent income from operations

Please click NEXT to read more…

15 stocks that promise high returns

HINDUSTAN UNILEVER

Custom duty on oils for soaps is reduced from 7.5 per cent to nil. Abneesh Roy of Edelweiss Securities believes this is positive and will result in about 200 basis points savings on margin of soaps business; other analysts see margin gains of 50-100 basis points.

Custom duty on oils for soaps is reduced from 7.5 per cent to nil. Abneesh Roy of Edelweiss Securities believes this is positive and will result in about 200 basis points savings on margin of soaps business; other analysts see margin gains of 50-100 basis points.

The actual impact on volumes will depend on the extent to which companies pass on this benefit to end users in a bid to boost demand.

Soap companies such as Hindustan Unilever (HUL), ITC and Godrej Consumer Products stand to gain from this move.

Reduction in excise duty on specified food processing and packaging machinery is also a positive for FMCG companies and is aimed at boosting domestic manufacturing.

Analysts say, HUL's packaged foods (Knorr, Kissan, etc) will also gain. Excise duty on RO membrane used in household water purifiers is reduced to six per cent and is favourable for HUL's Pureit brand of water purifiers.

Please click NEXT to read more…

15 stocks that promise high returns

IDFC

Reforms towards infrastructure sector, namely extension of 10 year tax holiday for power companies, infrastructure investment trusts and expansion of corpus of Pooled Municipal Debt Obligation Facility to Rs 50,000 crore from Rs 5,000 crore will give a push to infrastructure companies.

Reforms towards infrastructure sector, namely extension of 10 year tax holiday for power companies, infrastructure investment trusts and expansion of corpus of Pooled Municipal Debt Obligation Facility to Rs 50,000 crore from Rs 5,000 crore will give a push to infrastructure companies.

Allocation of funds towards NHAI and Metro rail projects are other positive measures for the infra sector. All these measures could boost credit demand for key financiers such as IDFC.

The company which recently bagged a banking licence will also benefit from the steps to promote infrastructure lending while raising long-term funds with minimal pre-emption via CRR, SLR and PSL routes.

Earlier the company had stated that it will go slow on its infra loan book (due to CRR, SLR requirements). As a result, the markets were worried about a potential slowing of growth rates in the medium-term.

Please click NEXT to read more…

15 stocks that promise high returns

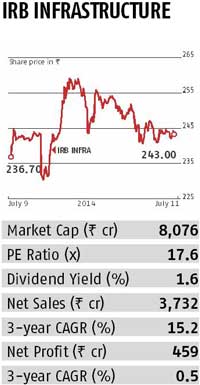

IRB INFRASTRUCTURE

The finance minister proposed an investment of Rs 37,880 crore in highways and roads. IRB, which is a leading player in the road space with a strong balance sheet, should benefit significantly from the emerging opportunities.

The finance minister proposed an investment of Rs 37,880 crore in highways and roads. IRB, which is a leading player in the road space with a strong balance sheet, should benefit significantly from the emerging opportunities.

Besides, the proposal to work on expressways parallel to industrial corridors and investment of Rs 14,389 crore for rural roads will be the key growth drivers for companies like IRB.

On the funding side as well, the proposal allowing banks to give long-term loans to infrastructure projects will sort out or ease issues with regards to the financial closure of projects, and thus, speed up execution.

Also, exemption to banks from statutory norms (CRR, SLR) for raising long-term loans for infra sector will mean lower costs, which could be passed on to infrastructure builders. Since most of these projects require long-term funding, these measures will help the sector in boosting growth and lowering costs.

Please click NEXT to read more…

15 stocks that promise high returns

ITC

The sharp 11-72 per cent hike in excise duty on cigarettes will impact ITC's cigarette volumes, say analysts.

The sharp 11-72 per cent hike in excise duty on cigarettes will impact ITC's cigarette volumes, say analysts.

In fact, volumes have been falling in the past few quarters. The upper band of hike (72 per cent or 50 paisa on current price of 70 paisa per stick) is applicable to 64mm cigarettes, while on others the duty is up by 11-21 per cent.

The weighted average increase stands at 21 per cent. Analysts believe ITC would need to hike prices by 12-17 per cent to protect EBIT margins of cigarette business, which should not be difficult given the company's past track-record.

Not surprisingly, the stock was flat at Rs 342.5 (up 0.32 per cent) on Thursday, and gained a per cent on Friday. Meanwhile, ITC's FMCG business will benefit from removal of custom duty on oils (used in soaps) and lower excise duty on food processing/packaging machinery.

Its hotel business will gain from steps to promote tourism and paper segment from revival in urban growth.

Please click NEXT to read more…

15 stocks that promise high returns

JSW STEEL

The steel manufacturer can see a good traction with revival in steel demand. JSW Steel is a domestic player and recovery in investment cycle will boost its prospects.

The steel manufacturer can see a good traction with revival in steel demand. JSW Steel is a domestic player and recovery in investment cycle will boost its prospects.

The focus on infra development, particularly rural roads, national highways and railways supported by public private partnership is expected to revive the investment cycle and boost steel demand, especially of long products.

The push for automobile sales and consumer durables will boost flat steel product demand and help JSW. However, Sheshagiri Rao, Joint MD and group CFO, JSW Steel, says that looking at the current shortage of domestic coal, the increase in customs duty for coking coal from nil to 2.5 per cent and for steam and bituminous coal from two per cent to 2.5 per cent requires to be reconsidered.

Analysts, though, are not much concerned as they feel it leads to minor cost increase compared to the increase in profitability from other measures.

Please click NEXT to read more…

15 stocks that promise high returns

LARSEN & TOUBRO

India's largest engineering company, Larsen & Toubro (L&T), which has presence across segments in infrastructure, power, oil and gas sectors, etc., will be a key beneficiary of higher government spending in ports, roads, etc.

India's largest engineering company, Larsen & Toubro (L&T), which has presence across segments in infrastructure, power, oil and gas sectors, etc., will be a key beneficiary of higher government spending in ports, roads, etc.

L&T also has significant advantage and should be able to grab a sizeable pie in the airport segment wherein the government wants to develop airports in Tier-I and Tier-II cities through public-private-partnership.

In fact, the finance minister has announced that 16 new port projects will be awarded in FY15 alone.

That apart, the government proposes to spend Rs 11,635 crore towards setting up harbour projects in FY15 and has also increased defence capex by Rs 5,000 crore to Rs 95,000 crore which is good news for L&T which has sizeable presence in these segments.

The higher FDI in defence is also positive and should hopefully see some more action in the private sector.

Please click NEXT to read more…

15 stocks that promise high returns

State Bank of India

There were a host of positive announcements for SBI and other public sector banks (PSBs).

There were a host of positive announcements for SBI and other public sector banks (PSBs).

Setting up of six new debt recovery tribunals among other measures will help boost efficiency and address asset quality issues which have been a bane given that the gross non-performing assets (NPAs) of larger PSBs remain as high as 5-6 per cent of total loans.

For SBI, this metric stood at five per cent at the end of March 2014 quarter. Government's plans to sell shares in PSBs (while retaining majority stake) is another major positive and will help boost PSBs' capital.

The impact of equity dilution will be limited for SBI whose tier-1 capital was higher than peers at 9.7 per cent in FY14.

The move allowing banks to raise long-term funds for lending to infrastructure sector without requirement to maintain CRR, SLR and priority sector norms will benefit all banks. Higher FDI in insurance will benefit SBI's life and general insurance businesses.

Please click NEXT to read more…

15 stocks that promise high returns

SESA STERLITE

The government's decision to double export duty on bauxite to 20 per cent would mean higher availability and lower domestic prices for the commodity (an input for aluminium production).

The government's decision to double export duty on bauxite to 20 per cent would mean higher availability and lower domestic prices for the commodity (an input for aluminium production).

While Hindalco uses captive bauxite, the move will benefit Sesa Sterlite which purchases the raw material to run its Lanjigarh refinery as it was disallowed to mine bauxite from Niyamgiri hills and has not been allocated an alternative supply.

Also, Sesa has multiple business verticals and energy is one of them. The government's stress on increasing power production and coal supplies too will help. Besides, the higher divestment target can expedite stake sale in Hindustan Zinc and BALCO.

This can be another catalyst for Sesa if it is able to buy the government's residual stake (Sesa currently owns majority stake in the two companies). Higher iron ore mining volumes will be another positive though increased royalties by states can offset some gains.

Please click NEXT to read more…

15 stocks that promise high returns

TATA POWER

Renewed focus on availability of coal for power generation and commitment to provide power supply 24x7 to all households has brought in good news for power generation companies.

Renewed focus on availability of coal for power generation and commitment to provide power supply 24x7 to all households has brought in good news for power generation companies.

Tata Power, the largest private sector player, along with other power producers stands to gain from these proposals. The impact of clean energy cess, however, may be marginal for companies with cost pass-through clauses.

That apart, the Street is also positive about the company's long-term prospects because of the higher impetus on solar energy, where Tata Power has emerged as a large player in the country.

The finance minister has provided Rs 500 crore for ultra-modern solar power projects, exempted photovoltaic cells from excise duty and lowered customs duty on solar equipment to five per cent.

Besides, Tata Power (and some others like NTPC, Adani Power) will also benefit because of the extension of tax benefits under section 80-IA (to FY17) for its Maithon project and Mundra UMPP.

Please click NEXT to read more…

15 stocks that promise high returns

ULTRATECH CEMENT

The Budget proposals to promote infrastructure and real estate projects, as well as expediting economic and industrial corridors will provide impetus to cement demand too. The infrastructure segment accounts for about 40 per cent of cement demand.

The Budget proposals to promote infrastructure and real estate projects, as well as expediting economic and industrial corridors will provide impetus to cement demand too. The infrastructure segment accounts for about 40 per cent of cement demand.

Additional cement demand will be generated from new housing projects led by increased incentives for those aspiring for new houses.

The extended additional tax incentive on home loans, low cost affordable housing, etc., will lead to increased demand, say analysts. UltraTech (and Grasim its holding company) being a pan India player that has been consistently adding capacities will start reaping benefits now.

All-round demand growth will boost volumes as well as realisations. The increase in clean energy cess on coal, though, is marginal.

While UltraTech is likely to benefit, some analysts like Giriraj Daga at Nirmal Bang believe that Grasim will gain more as the holding company discount that the stock gets will start narrowing in a bull market.