Photographs: Reuters Nayanima Basu & Indivjal Dhasmana

The coming Budget will try to ease conditions for doing business in India, says Commerce & Industry Minister Nirmala Sitharaman, also Finance Minister Arun Jaitley’s deputy.

She tells Nayanima Basu & Indivjal Dhasmana the government is assessing the current land acquisition Act to make it friendlier to industry and farmers.

Edited excerpts:

The Budget is being prepared at a time when the economic growth requires a boost. But the tax-GDP (gross domestic product) ratio has not kept pace with the target. How is the government planning to strike a balance? What will be the broad contours of the Budget?

This Budget will set a direction to increase the ease of doing business and restore confidence in the economy. We will create a fair and simpler system of taxation.

We will first restore confidence, so that many get back to doing business because many (in industry) have told us they have taken their core business out of India due to difficulties in doing business here.

There will be ease of reporting, compliance and due-diligence. We hope to simplify these, so that they have more energy to manage their businesses. They have also said they are not able to do business in compliance with the present form of the Companies Act.

...

'Budget will bring a simpler tax system for businesses'

Image: Commerce and Industry Minister Nirmala Sitharaman.Photographs: Courtesy, PIB

So, will you either amend the Companies Act or rules therein on the basis of the feedback you have got from industry?

There is a clear attempt to go into the depths of what is ailing the industry. A final call on whether tweaking of rules will be sufficient or the Act will have to be amended will be taken after the report prepared by the (corporate affairs) ministry comes in.

It seems the new government is keen to throw open the defence sector to foreign direct investment (FDI) and a Cabinet note has been passed for this. When is a decision expected?

We have started discussing this. We have not taken a position. We are saying, let us talk about it, not just within the ministry but with other stakeholders as well.

A lot was talked about defence during the PM’s (Narendra Modi’s) election campaign. India’s indigenous capability should be increased. So, if investments can be brought in to enhance production, upgrading equipment has to be kept in mind.

We cannot keep sending the money outside. We need to use these investments in indigenous production. We do not want a resource drain. We should have our own preparedness.

So, we are trying to see if FDI is going to bring in just the money or also the technology. That is why we have opened the discussion in the very first month of coming to power.

...

'Budget will bring a simpler tax system for businesses'

Photographs: Reuters

How soon are the decisions on FDI in railways projects, e-commerce and real estate expected? All work was already done under the previous government and was only awaiting the Cabinet’s approval.

We have started talking in all these areas. And we are talking about it afresh. We want to make sure the money comes in with the required capabilities.

We are not in any rush. On e-commerce, we have got a lot of inputs.

Some are saying it is a backdoor entry for FDI in multi-brand retail, but the finance minister will take the final call on that.

Is FDI in multi-brand retail on the back burner now? What happens to the existing proposals, such as the one by Tesco?

From the Bharatiya Janata Party’s point of view, it was never on the ‘front burner’. We have got a mandate with which a stable government has been created. We are not in favour of FDI in multi-brand retail.

We got the votes on it. We are firm on it. It was an executive order that was brought through the back door, even as Parliament was in session.

They (the UPA government) made the excuse that it did not need a Parliamentary approval.

That led to a lot of controversy even then. Delhi and Rajasthan have also said they do not want it. So, the response to the executive order is clear. We will see how we are going to work out the details.

...

'Budget will bring a simpler tax system for businesses'

Image: A farmer works in a sunflower field in Khatihari village.Photographs: Parth Sanyal/Reuters

Are you also planning to review the land acquisition law to make it more investor-friendly?

We are definitely looking at aspects that are not helping us. There are huge obstacles that are going to come in the way of industry if one goes by the current Act.

So, we are trying to see if some proposals can be handled in a different way.

We are raising all sorts of questions because we have to move the economy forward and, at the same time, give justice to those handing over their pieces of land.

Why is there a renewed push to the Special Economic Zones (SEZs)? As commerce & industry minister and the MoS for finance, you have a contrasting demand on MAT (minimum alternate tax) and DDT (dividend distribution tax) on SEZs. How are you going to resolve the matter?

It is an issue that we are assessing. There is no renewed push, as such. We are trying to see why the SEZs could not deliver as much as they were expected. It is more of reviewing to understand what ails it, why it could not deliver.

We have got inputs on MAT and DDT. From the revenue angle, we have to understand what has been the income generation from SEZs. I will have to find a balance.

...

'Budget will bring a simpler tax system for businesses'

Photographs: Reuters

Will retrospective amendments to the Income-Tax Act be reversed in the Finance Bill of this year? If yes, will the government not go for arbitration with Vodafone and take back the tax demand notice?

On Vodafone, an arbitrator has been named, so it will not be proper for me to comment. On retrospective amendments, let us see what the finance minister (Arun Jaitley) decides.

Is it true that you are going to go slow on negotiating the free-trade agreements (FTAs)? What about the big ones like the one with the European Union (EU)?

We are first trying to see what is ailing the present FTAs. But we are not going to delay the FTAs that need to be acted upon faster. I cannot get into a newer FTA before understanding what is ailing the present one.

We have not leveraged the imports properly. We have not found markets for our services and project exports. So, an assessment is required before we embark on a new one. We are assessing each one by one.

...

'Budget will bring a simpler tax system for businesses'

Photographs: Reuters

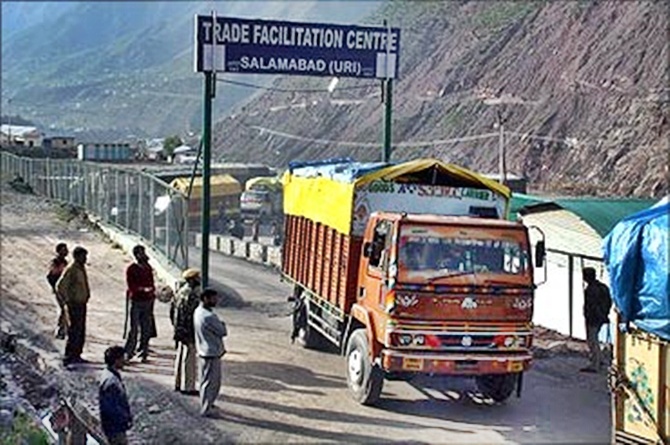

Are you keen on trade normalisation with Pakistan? Is that on track because reports of firing across the border are again coming in?

We are engaged with them. Pakistan is keen to bring in more products through the border.

There is tremendous market potential for Pakistani goods in India and Indian goods there. There is a great deal of opportunity waiting for us and a lot of things have to worked upon. Mutually, it’s a win-win situation for both.

Coming to the Special 301 report, will you allow the US to carry on the proposed out-of-cycle reviews (OCRs)? Will you take up the matter during the upcoming trade policy forum meeting?

This is one area where we would like to clearly tell them that our intellectual property law is well within the WTO rules and we need to keep our national interests intact. We will have to engage with them and tell them that every nation is allowed to protect its IPR. We will tell them that our position is well within WTO rules and we are not in violation.

Do you see any impact on our oil import bill due to the Iraq crisis?

The petroleum ministry is clear that it will not affect our oil imports.

article