| « Back to article | Print this article |

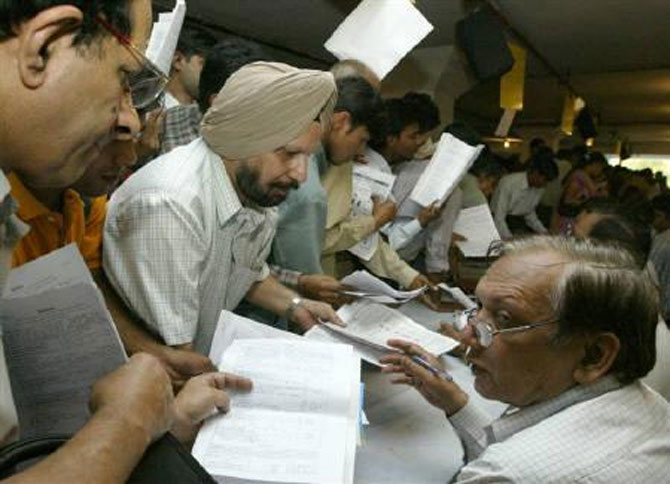

Think before you go shopping: The taxman is watching

Database planned to capture more individual purchases, reduce tax evasion

The next time you shop online, pay by card at a merchant outlet, or buy or sell a house, check that you have filed your return and have nothing due with the taxman. For, the income tax department is planning to set up a database on individual spending habits to curb evasion.

The Central Processing Centre (compliance management), to be set up in south India, will be a warehouse for information on taxpayers, trawling the internet for large transactions, seeking data from other departments and external agencies, and digging into annual information returns needed for big purchases. Taxpayers will be profiled by type.

“For many transactions the (taxpayer’s) permanent account number is not required. This will be worked upon by this centre to generate actionable intelligence. It will use business tools to deepen and widen the tax base,” said an income tax official. He said a request for the proposal was being written for setting up the centre and a tender would be floated soon.

Click on NEXT for more...

Think before you go shopping: The taxman is watching

The official added the new centre would be on the lines of two existing ones — for filing returns and for tax deducted at source — and the capital expenditure would be borne by the vendor.

Information technology services provider Infosys made the capex for the Bangalore centre. The government pays it a processing fee on every return filed there.

“To identify evaders, the tax department can use data available with hotels, banks, car companies, jewellers and real estate transactions,” said Amarpal S Chadha, partner, EY.

As a pilot, 33 million people who do not file or have stopped filing their tax returns have been identified. Last year, notices were sent to 1.2 million; 536,220 filed their returns and paid Rs 1,018 crore (Rs 10.18 billion) in self-assessed tax and Rs 898 crore (Rs 8.98 billion) in advance tax.

Click on NEXT for more...

Think before you go shopping: The taxman is watching

The tax department has also identified another 2.17 million potential non-filers and sent letters to 50,000 in the first batch; more will be sent this year.

“It’s a good exercise. The department is not imposing any penalty yet. At times, the department’s data are incomplete and it is unable to match e-returns with physical ones, but in many cases, people are willful defaulters,” said Sudhir Kaushik, co-founder and CFO, TaxSpanner.

The notices seem to be working—collections from income tax are up, while corporate tax mop-up is languishing.

Earlier, the government had planned to set up centres in Manesar and Pune for processing bulk income tax returns and digitising paper returns, but logistics came in the way. As of now, a centre in Bangalore processes e-returns and another in Ghaziabad processes tax deducted at source.

I-T compliance management

- All information and data about taxpayers to be at stored at a single place

- This will help tax dept carry out thorough profiling of assessees and nab evaders

- Information can be taken from PAN, internet, annual information returns, banks

- Data will also be available from hotels, car sales, mobiles, jewellery, real estate deals

- It will work on the model of CPC Bangalore for processing e-returns