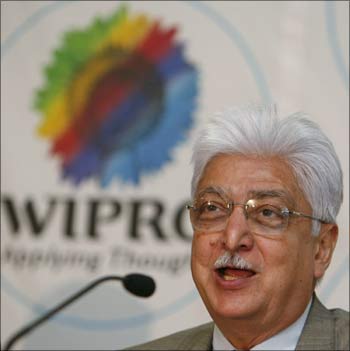

Photographs: Reuters Viveat Susan Pinto and Arijit Barman Viveat Susan Pinto and Arijit Barman in Mumbai

It's portfolio churning time at Wipro.

The information technology-to-edible oil major has identified some of its consumer business brands in the portfolio as non-core and is keen to sell these, two people familiar with the internal strategy said.

Wipro derives 75 per cent of its Rs 26,340 crore (Rs 263.40 billion) annual revenue from IT.

The two consumer brands identified as non-core are Sunflower vanaspati and Wipro Baby Soft diapers. These are small businesses that together have around Rs 45 crore (Rs 450 million) annual revenue. Sunflower is the bigger one, with a Rs 30 crore (Rs 300 million) topline.

To sharpen its revenue streams, Wipro has similarly initiated a formal selloff process to find a buyer for its three-year-old water business, which they entered after acquiring water treatment firm Aquatech.

. . .

Wipro keen to sell diaper, vanaspati brands

Photographs: Reuters

The company implements water treatment projects for large industrial customers, including PepsiCo, Coca Cola and United Breweries.

Sources said many companies like Bunge (which owns Dalda vanaspati), KS Oils, Marico and even Jain Irrigation have in the past explored these two brands but the matter did not progress.

Even now, there is no formal divestment exercise or bankers who have been mandated. But the company has identified these as non-core and would be keen to sell.

When asked, Vineet Agrawal, president, Wipro Consumer Care & Lighting, said, "We do not comment on market speculation."

. . .

Wipro keen to sell diaper, vanaspati brands

Photographs: Reuters

Background

However, company officials said on condition of anonymity that it was keen to streamline its various non-IT businesses and intensify its focus and investments in the high-growth brands and sectors.

The water business is part of the infrastructure engineering division, which contributes less than 10 per cent of revenues to Wipro. The same is the case with the consumer business, which contributes about nine per cent to the company's topline.

Wipro Consumer has been shopping aggressively overseas to scale its businesses. In the past seven years, for instance, Wipro Consumer Care acquired energy drink Glucovita (2003), followed by Chandrika soap (2004) and North-West Switches (2006).

Its Unza buyout in Indonesia happened in 2007, while in 2009 they acquired Yardley's Asia, West Asia and Africa franchise.

Wipro Baby Soft and Sunflower Vanaspati, in contrast, are in-house brands.

. . .

Wipro keen to sell diaper, vanaspati brands

Photographs: Reuters

Diapers, vanaspati

The baby diaper market is a Rs 630-crore (Rs 6.30 billion) market, growing at 28 per cent per annum.

The key players are P&G's Pampers with a share of 56 per cent, followed by Huggies from the Hindustan Unilever and Kimberly Clarke stable (the two have a joint venture which produces the brand) at 32 per cent, and Mamy Poko Pants from Japanese baby and feminine care major, Unicharm, with a share of seven per cent, respectively.

Wipro is fourth with a share of under five per cent.

While the baby diaper market has steadily grown, its penetration remains small at 14 per cent in urban India and one per cent in rural India.

The challenges, according to analysts, are the lack of awareness in rural areas and the tendency to indulge in dual usage in urban areas.

. . .

Wipro keen to sell diaper, vanaspati brands

Photographs: Reuters

"Typically, mothers tend to use diapers for their babies on outings or functions, while at home, cloth-based diapers are preferred," says a Mumbai-based FMCG analyst.

Many also believe that with cheaper imports from China flooding the market, over time, Wipro has also lost the cost arbitrage.

The women's hygiene market also underwent a similar challenges a few years earlier.

To boost consumption, excise duty on both diapers and sanitary napkins was slashed to one per cent from 10 per cent during the 2011-12 Budget announced this February.

Market leader P&G was quick to pass the benefit to consumers by slashing prices by three to 15 per cent of select stock keeping units (SKU) of Pampers in March. Rivals such as Wipro blinked at slashing prices by five to seven per cent on select SKUs subsequently.

. . .

Wipro keen to sell diaper, vanaspati brands

Photographs: Reuters

Vanaspati, on the other hand, constitutes about 15 per cent of the Rs 75,000-crore (Rs 750 billion) edible oil market in India, growing at a sluggish pace of about four per cent per annum.

The key players include Dalda with a share of close to 20 per cent, followed by regional brands Jhula and Gagan at about 14-15 per cent each, and Raag Vanaspati from Adani Wilmar at 12 per cent.

Wipro's Sunflower Vanaspati, according to industry sources, is small, available in some parts of Maharashtra.

"A key reason for the single-digit growth of vanaspati is its perception of not being a healthy cooking medium. Consumption has been largely driven in rural areas, where people still prefer frying foodstuff in vanaspati," said Anghsu Mallick, chief operating officer, Adani Wilmar. Typically, a litre of vanaspati costs Rs 60, while more healthy forms of cooking oil such as soyabean and sunflower cost Rs 70 and Rs 80, respectively.

article