Bibhu Ranjan Mishra & Pradeesh Chandran in New Delhi

Outgoing Infosys chief executive officer S Gopalakrishnan is not perturbed by the fact that the company has lost some of its sheen.

Reasoning why others were doing well, he said they were in different phases of their transformational journey.

In a discussion with Business Standard, executive co-chairman designate talks about the challenges Infosys faces.

Excerpts:

What is the need for an executive co-chair when the company has a CEO and a full-fledged chair?

My role will be to work with key clients and key leaders within the company to have a pipeline for the future.

Of course, I will continue to meet investors.

I will support Shibu in executing strategies and his plans; work with the board and also work with industry fora and others in building brand Infosys.

. . .

Gopalakrishnan on challenges facing Infosys

Image: Infosys campus.So, your task will be more challenging since the competition is hotting up?

An important point is that the industry has come out of the downturn very well.

From single-digit growth to 18 per cent average growth.

These are extremely good companies and whatever is happening to each one is for the good.

We are working towards a strategic direction of moving up the value chain and broadening our footprint from an industry perspective by adding industries such as healthcare, public services etc.

We are expanding our geographical focus.

For example, we are expanding our presence in continental Europe; we are investing in France, Germany, China, India and Japan.

We are also looking at South and Latin America for growth.

We are also adding service lines such as the cloud, sustainability, enterprise mobility, platform-based services, learning services.

These are engines that will give us revenues over the next three to five years.

. . .

Gopalakrishnan on challenges facing Infosys

Image: An Infosys unit.What did you learn during the slowdown? What was your strategy?

We have a strategy in execution.

This year, we started with a guidance of 17-19 per cent growth, but we ended with 25.8 per cent growth.

We started with a recruitment target of 25,000 and ended with 43,000.

Based on our experience, we are starting this year with a guidance of 18-20 per cent and a recruitment target of 45,000.

It is higher because we have learnt from our experience that we need to prepare ahead of time to take advantages of the growth opportunities that come our way.

So, we have grown faster than what we projected and we have grown faster than the industry average.

Nasscom projected the industry average as 18 per cent; our growth rate was higher than that.

. . .

Gopalakrishnan on challenges facing Infosys

Image: L-R:Nandan Nilekani, S Gopalakrishnan, N R Narayana Murthy, K Dinesh, N S Raghavan and S D Shibulal.A lot has been said about Infosys, that it has lost the tag of being the IT bellwether and that it had the best margins in the industry, but is losing to others. What is your comment?

These are all good companies, so I am not saying anything against anybody. I can only talk of Infosys.

We came out of the Software Technology Parks of India scheme, and our effective tax rate is 26 per cent.

This is the highest among our peers.

In spite of an increased effective tax rate, we have maintained our margins.

So, the comparisons has to be apples to apples, rather than apples to oranges.

The reason why others are picking up is because they are in different phases of their transformational journey.

That's all I can say.

. . .

Gopalakrishnan on challenges facing Infosys

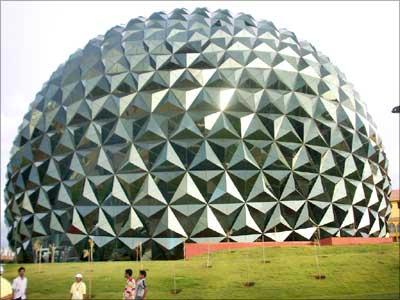

Image: The Infosys Leadership Institute at the company's Mysore campus.Most analysts say Infosys should look at volumes. What is your take?

We have grown to 26 per cent from just three per cent growth compared to the previous year.

I believe there is strong recovery and strong growth.

We need to remember that no other company gives you annual guidance.

At the most, they give quarterly.

Most of them would not give quarterly guidance.

So when you look at four quarters out, typically you tend to be on a safer side because our track record is that we have never missed our guidance till date.

In 2008, in the first time in the history of the company, in the third quarter we revised our annual guidance.

But from 1993 till date, we never missed our quarterly guidance.

So, when you give a guidance every quarter you want to make sure you give a guidance which you are very confident about in a volatile environment.

We are giving you a guidance of 18-20 per cent.

If the performance is better we will revise the guidance.

. . .

Gopalakrishnan on challenges facing Infosys

Image: Infosys Leadership Institute.The industry and analysts speak of Infosys as a conservative organisation. What do you think about that?

We are not a conservative company if you look at all the aspects.

Which company has campuses such as we do, and have significantly invested in infrastructure?

Which company has a training programme like ours?

Attrition is a challenge for the industry but we do not hesitate to invest in our employees. We train our entry-level employees for five months.

Now we are planning to invest $130 million to build a campus in China.

We recruited 45,000 people during the downturn.

We honoured 16,000 offers for employees and we have grown 26 per cent; it is not a bad growth rate.

Acquisition is probably the only area where people say we are conservative. However, the track record says we have not lost out.

. . .

Gopalakrishnan on challenges facing Infosys

Image: Infosys unit.You changed the retirement age of non-executive chairman from 65 to 70 years. Do you think in this phase of transformation you need to change the rules?

The change in the retirement age of non-executive chairman to 70 was done two years ago.

We have looked at our ability to attract the right people to the company.

If we want to bring somebody with an executive experience, typically they can spare the amount of time required, which means we have to look at people over 65 years.

That's why the decision.

. . .

Gopalakrishnan on challenges facing Infosys

Image: Mohandas Pai.If the co-founders' family members want to join Infosys, is it okay for them to do so? Does the company have any regulations that none of the founders' family can become board members?

We as founders, took a decision long ago that we will not change any rule for ourselves.

We will only do it for others and betterment of the company.

We did not change rule in 1993 when we instituted a stock option plan.

We are the only company where we said the founders would not be part of any stock option plan. Consciously, we reduced our holding in the company.

Here it's the same thing. We changed the retirement age of the non-executive chairman, but not for the founders.

article