The history of Micromax (2011-12 revenue: Rs 1,978 crore or Rs 19.78 billion), which ventured into the mobile phone market in 2008, is one of the most fascinating success stories in the Indian consumer electronics industry.

In barely five years, the company has come to occupy the third position (by volume) in the mobile handset market in India and is at No. 12 globally.

It leads the Indian tablet market with a share of 18.4 per cent, ahead of veterans Samsung and Apple.

The Gurgaon-headquartered company owes its success not just to the ticket it puts on its products or the speed with which it puts new designs on the shelves but to how it has managed these two crucial product inputs by leveraging China.

To be more specific, the labour cost advantage and the production flexibility that China offered.

Big deal, you may say, given that almost every other handset brand in the world manufactures its products in China.

Right from the Apples to the Samsungs to many of our home-grown brands like Karbonn, a whole host of players reaped China's arbitrage advantage.

But here is the stumper: the strategy that offered Micromax its biggest advantage in its first five years is under threat and it will require a re-examination by the company - and a number of other multinationals with Chinese production - of their overall supply-chain strategies.

...

The reason is simple. At Shenzhen, where some of China's largest electronics manufacturers are located, the minimum wage is set for a 13.3 per cent hike from this year - a move that could have a ripple effect across the world's major technology companies.

According to some estimates, between 2005 and 2010, basic manufacturing wages in the country have soared roughly 70 per cent.

"Eventually, Indian companies sourcing products and components from China need to develop local infrastructure. The reports of underage labourers and inhumane work conditions at some Chinese factories can have a cascading effect on the reputation of brands that source from China," says a telecom expert.

What has made Micromax's life a little more complicated is its recent entry into categories like tablets and LED TVs.

In short, if you were to add the increasing cost of monitoring suppliers and of compliance, that labour cost advantage Micromax enjoyed when it started out looks even more precarious.

To understand what Micromax needs to do here on, we need to first understand how the company harnessed China to reach the Top 5 bracket in the Indian mobile phone market.

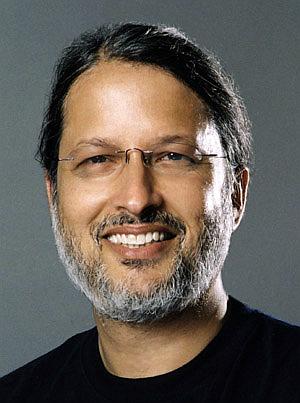

In an earlier interview to The Strategist, Rahul Sharma, co-founder, Micromax, had said: "The strategy is simple: create high volumes, reach the customer base through effective distribution, give them products that are innovative and cost-effective. Finally, create a strong brand."

...

Micromax's strategy of associating with Bollywood and cricket has also helped. The company's advertising and marketing spend last year, according to experts, was to the tune of Rs 150 crore (Rs 1.5 billion), which would be roughly what Britannia or Heinz spent on their brand communication that year.

What has also set Micromax apart is the speed at which it has been able to put products in the market and its tremendous reach.

According to Mritunjay Kapur, country MD, Protiviti, the world's largest independent business and risk consulting firm, "Players like Micromax are constantly pushing the product profile - they have been able to identify their markets well and be where the customer is."

So, where Micromax takes barely a month or two to launch products, another big international brand requires roughly 18 months for a similar product to go through the retail pipeline.

In effect, Micromax's growth strategy has followed three clear stages, explains an industry insider.

When it started out, the company picked handsets from China, rebadged them and sold them in the India market.

In the second stage, it realised the need to do extensive research in terms of Indian consumers' demands and product development.

Now it has crossed over into a new phase, where the company has started following a mix-and-match strategy - getting some products manufactured in China and other countries, sourcing components from abroad and manufacturing some of the newer lines in India.

...

Hitting A Home Run

In a way, the changes in Micromax's growth strategy have followed the evolution of the mobile consumer in India.

When it started its journey in 2008, the mobile phone market in India was pretty much a sellers' market.

"Consumers were adapting to what was being offered," Micromax's Sharma told The Strategist in an earlier interview.

"We worked the other way round, trying to understand what the consumer's needs really were."

This focus on the consumer led to the launch of its first product - a phone with a 30-day power backup.

"People in Indian villages needed mobile handsets with enormous battery backup given the precarious electricity situation," explained Sharma.

According to Anshul Gupta, principal research analyst, Gartner, a technology research firm, by getting products manufactured in China, Micromax could offer products at a price about 40 per cent less than what other global players were offering.

"An Apple or a Samsung, which were also getting their products manufactured in China, would demand a mark-up based on the brand value; for a newcomer like Micromax that was never an issue. So they could offer similar features at a lower price," says an industry hand.

"The basic strategy of Micromax has been 'affordable innovation'," says an ex-employee of Micromax.

...

In his view, the strategy at Micromax has always been clear: to look at four critical components of a phone which also determine its price. These include the screen, the camera, the chipset and the memory used in the device.

It's here that the cost of each model of handsets is determined. Deepak Mehrotra, chief executive officer at Micromax, says the company is driven by what customers want. So, the cost is also determined to what the consumer back home expects.

"So, if my target consumer doesn't particularly require a great camera feature, instead of giving an 8 megapixel camera, our handset will have a 5 megapixel one, which will obviously bring the price down," explains Mehrotra.

"Pick up a box (of a mobile handset from any company) and you will see most are produced in China. The country clearly has built economies of scale and knows how to play it right. Why just us, manufacturing across categories is done in China, thanks to the cost efficiencies, eco-system and how they come together," says Mehrotra.

Though Micromax didn't create 'reference designs' initially - preferring to simply give instructions to its third-party manufacturers in China - it's winning strategy was to quickly start its R&D facility, create prototypes and instruct contract manufacturers on what the company expected.

...

"The real clincher for Micromax was in identifying the Tier I rung of manufacturers, and then getting those manufacturers to work on our specifications, our innovations," added the former Micromax employee.

Right at the outset, Micromax took pains to mark out those manufacturers in China who were working with global brands.

FoxConn, the world's largest contract manufacturer, for instance, has been associated with Apple products, according to the employee.

BYD, similarly, has been associated with Nokia production and also works on Micromax's handsets, he adds, saying that the company never bothered with the Tier II or the Tier III manufacturers where inferior quality of chipsets etc are used.

"For us, it was always the top tier of manufacturers - those who worked for the Apples and the Samsungs of the world that had to design our products too," says this executive, adding that typically Micromax orders 500,000 handsets at the entry level from their contract manufacturers in China at one go.

The volume growth in turn ensures better cost efficiencies. In 2011, for instance, Micromax shipped four million handsets worldwide in the second quarter.

It cornered 8 per cent share in the home market, grew 48 per cent annually and continues selling roughly 1.5 million phones every month in most of the countries that it operates in.

...

Besides leveraging the cost effectiveness of China ("Tier I manufacturers in China can typically charge $17 upwards per handset," says the ex-employee of Micromax), the company has worked hard at securing sound and formidable partnerships, especially with the chipset manufacturers, points out Mehrotra of Micromax.

On A New Wicket

Micromax's focus these days on is building its manufacturing infrastructure in India. "It is a consumer durables company diversifying into other categories," says Gupta of Gartner.

Micromax's facility in Himachal Pradesh already manufactures television sets and some tablet models.

"Micromax now cannot afford to be just another 'fringe player' that manufactures products in China and sells them in India," says Kumar Kandaswami, senior director, Deloitte in India.

"Eventually, India needs to script a 'China' story in terms of manufacturing its products at home," he adds.

The reason is obvious: China is losing the advantage of labour cost arbitrage, a reason why even companies like Apple and GE have decided to decided to shift product lines from China.

"Because Chinese wages are rising rapidly," says an analyst, "it makes sense to return manufacturing of a wide range of goods, with moderate levels of labour content and high logistics costs, to India."

Re-shoring may also make particular sense for bulky goods, like television sets, which naturally incur higher transportation costs.

...

"There are many hidden factors involved in sourcing heavy appliances from outside suppliers," says a senior marketing executive with an appliances company.

"These variables include greater supply chain complexity, longer cycle times, quality issues and responsiveness to local demand. A local supply chain makes it easier for a company with a wide portfolio to respond to any sudden supply chain disruption or other unpredictable event."

Not everyone thinks the China story is over though. Amitava Chattopadhyay, INSEAD chair professor in marketing and innovation, for example, says, "China is a cheap manufacturing base for almost anything - toys, cars, electronics." so, work will continue to happen in China.

But global players are setting up and growing their own facilities or scouting for opportunities in countries such as Vietnam, Indonesia and Cambodia to have greater control over cost and quality. "Wherever you get economies of scale, it is good. It could be in China, Taiwan, or elsewhere," says Mehrotra.

Ultimately, analysts believe that the correct balance can be struck through careful planning.

And while Micromax grapples with supply chain issues, what works in its favour is that it is no longer a single product company and faces dilemmas that many other brands confront.