| « Back to article | Print this article |

Dell to go private in landmark $24.4 billion deal

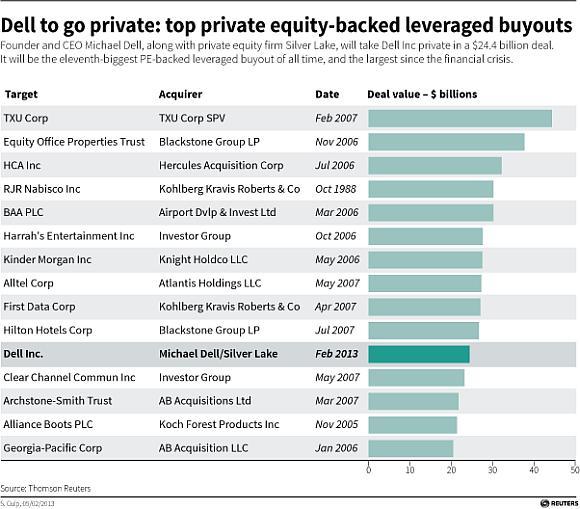

Michael Dell struck a deal to take Dell Inc private for $24.4 billion in the biggest leveraged buyout since the financial crisis, partnering with the Silver Lake private equity firm and Microsoft Corp to try to turn around the struggling computer company without Wall Street scrutiny.

The deal, which requires approval from a majority of shareholders excluding Dell himself, would end a 24-year run on public markets for a company that was conceived in a college dorm room and quickly rose to the top of the global personal computer business - only to be rendered an also-ran over the past decade as PC prices crumbled and customers moved to tablets and smartphones.

Dell executives said on Tuesday that the company will stick to a strategy of expanding its software and services offerings for large companies, with the goal of becoming a full-service provider of corporate computing services in the mold of the highly profitable IBM.

They played down speculation that Dell might spin off the low-margin PC business on which it made its name.

Dell did not give specifics on what it would do differently as a private entity, angering some shareholders who said they needed more information to determine whether the $13.65-a-share deal price - a 25 percent premium over Dell's stock price before buyout talks leaked in January - was adequate.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

"This feels like the ultimate insider trade. Why weren't the plans and projections that Michael Dell has going forward been shared with me and other shareholders?" said Frederick "Shad" Rowe, general partner of Greenbrier Partners and a trustee of the $22 billion Texas Employees Retirement System.

Rowe said he dumped about 400,000 shares of Dell on Tuesday, adding, "I was so irritated I didn't want to think about it anymore."

Dell spokesman David Frink said the board had conducted an extensive review of strategic options before agreeing to the buyout to ensure that the best interests of all stockholders were served.

Although Dell shares were trading at more than $18 a year ago, many analysts said they believed the majority of shareholders will accept the buyout because of pessimism over the growth prospects of the PC business.

"A private Dell is likely to more aggressively cut costs, in our view. But we think merely restructuring only postpones the inevitable, creating a value trap," said Discern Inc analyst Cindy Shaw. "Dell needs to do more than reduce its cost structure. It needs to innovate."

Dell was regarded as a model of innovation as recently as the early 2000s, pioneering online ordering of custom-configured PCs and working closely with Asian component suppliers and manufacturers to assure rock-bottom production costs.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

But it missed the big industry shift to tablet computers, smartphones and high-powered consumer electronics such as music players and gaming consoles.

As of 2012's fourth quarter, Dell's share of the global PC market had slipped to just above 10 percent from 12.5 percent a year earlier as its shipments dived 20 percent, according to research house IDC.

Some of Dell's rivals took pot shots at the deal, in unusually pointed comments that reflect how bitter the struggle is in a commoditized PC industry that has wrestled to reverse a decline in sales globally.

Hewlett-Packard Co, which itself has suffered years of turmoil in the face of challenges in the PC business, said in a statement that Dell's deal would "leave existing customers and innovation at the curb," and vowed to exploit the opportunity.

Lenovo, which consists largely of the former IBM PC unit, referred to the "distracting financial manoeuvres and major strategic shifts" of its rival while emphasizing its own stability and strong financial position.

The deal will be financed with cash and equity from Michael Dell, $1 billion cash from private equity firm Silver Lake, a $2 billion loan from Microsoft Corp, and between $11 billion and $12 billion in debt financing from Bank of America Merrill Lynch, Barclays, Credit Suisse and RBC Capital Markets.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

The company said Michael Dell will contribute his 16 percent stake in the company but did not say how much cash he would inject. The company will now conduct a 45-day "go-shop" process in which others might make higher offers.

"Though we were hoping for a higher price, we trust that the Dell board has properly done its job by conducting a process open to any third-party offers and reviewing all strategic options," said Bill Nygren, who manages the $7.3 billion Oakmark Fund and $3.2 billion Oakmark Select Fund, which have a $250 million position in Dell. "Should we hear evidence to the contrary, we'll raise a ruckus."

Sources with knowledge of the matter said Dell's board, advised by the Boston Consulting Group, had considered everything from a leveraged recapitalization to a breakup of the company before agreeing to the LBO.

Although the deal will load Dell with more debt, some Wall Street analysts said that was relatively low compared to the cash the company generates.

Bernstein Research analyst Toni Sacconaghi said that if Dell were to use 40 percent of its annual cash flow of about $2.5 billion to $3 billion to pay down debt, a sale of the company in about five years could net Silver Lake, Mike Dell and other investors close to $10 billion, or 5 times free cash flow at the time.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

Helped by acquisitions, Dell has been building a business selling servers, IT services and other products for corporate clients that - while still dwarfed by IBM's and HP's - is growing at a near-10 percent clip.

Critics say it will not be easy for Dell to beat IBM and HP in this area, no matter what its corporate structure.

Sales of PCs still make up the majority of Dell's revenues. Dell said in a regulatory filing that no new job cuts were expected but it indicated more acquisitions down the road.

The company has spent $13 billion since fiscal 2008 to acquire more than 20 companies including several large software and services companies as it seeks to reconfigure itself as a broad-based supplier of technology for big companies.

"We recognize this process will take more time," Chief Financial Officer Brian Gladden told Reuters. "We will have to make investments, and we will have to be patient to implement the strategy. And under a new private company structure, we will have time and flexibility to really pursue and realize the end-to-end solutions strategy."

Gladden said the company's strategy would "generally remain the same" after the deal closed, but "we won't have the scrutiny and limitations associated with operating as a public company."

Shares of Dell closed 1.1 percent higher at $13.42.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

Fall From Grace

Michael Dell returned to the company as CEO in 2007 after a brief hiatus but has been unable to engineer a turnaround thus far.

Analysts said Dell could be more nimble as a private company, but it will still have to deal with the same difficult market conditions.

There is little history to suggest whether going private makes such a transition easier. IBM's famously successful transition from hardware vendor to corporate IT partner took place while it was trading on public markets.

Freescale, formerly the semiconductor division of Motorola, was taken private in 2006 for $17.6 billion by a group of private equity firms including Blackstone Group LP, Carlyle Group and TPG Capital LP.

Analysts say the resulting debt load hurt its ability to compete in the capital-intensive chip business. Freescale cut just under 5 percent of its work force last year as it continued to restructure.

Microsoft's involvement in the Dell deal piqued much speculation about a renewed strategic partnership, but the software company is providing only debt financing and Dell said there were no specific business terms attached to the transaction. Dell has long been loyal to Microsoft's Windows operating system, which has been at the heart of its PC business since its inception.

Click NEXT to read more...

Dell to go private in landmark $24.4 billion deal

Microsoft's loan will take the form of a 10-year subordinated note with roughly 7 percent to 8 percent interest, a source close to the matter told Reuters.

The Dell deal would be the biggest private equity-backed leveraged buyout since Blackstone Group LP's takeout of the Hilton Hotels Group in July 2007 for more than $20 billion and is the 11th-largest on record.

The parties expect the transaction to close before the end of Dell's 2014 second quarter, which ends in July.

News of the talks first emerged on January 14, although they reportedly started in the latter part of 2012. Michael Dell had previously acknowledged thinking about going private as far back as 2010.

J.P. Morgan and Evercore Partners were financial advisers, and Debevoise & Plimpton LLP was the legal adviser to the special committee of Dell's board. Goldman Sachs was financial adviser, and Hogan Lovells was legal adviser to Dell.

Wachtell, Lipton, Rosen & Katz was legal adviser to Michael Dell. BofA Merrill Lynch, Barclays, Credit Suisse and RBC Capital Markets were financial advisers to Silver Lake, and Simpson Thacher & Bartlett LLP was its legal adviser. Lazard Ltd advised Microsoft.

(Additional reporting by Aaron Pressman in Boston)

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.