Photographs: Reuters

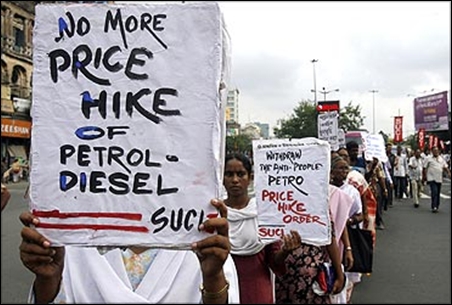

About 38 per cent -- or Rs 26.22 -- in the petrol price of Rs 68.64 a litre in Delhi (in many other Indian cities the price of petrol is much higher) is because of central and state government taxes.

State-owned oil firms had last week hiked petrol price by Rs 1.80 a litre, the fifth increase this year, as oil imports became costlier due to fall in rupee value.

The new rate is based on a basic price of petrol, without including any taxes, refining cost or margin, of Rs 41.38 per litre, oil company officials said.

. . .

Taxes make up 38% of new petrol price

Photographs: Reuters

The retail selling price is calculated by adding customs duty, central excise rates and VAT to the basic price which is nothing by the average of international oil rate.

On Rs 41.38 a litre base price, a customs duty of 2.5 per cent or Rs 1.04 per litre is levied.

Beyond this, the central government levies Rs 6.35 per litre basic Cenvat duty, Rs 6 per litre special additional excise duty and Rs 2 per litre additional excise duty towards highway cess.

. . .

Taxes make up 38% of new petrol price

Photographs: Reuters

The excise duty, after including education cess at the rate of 3 per cent, totals up to Rs 14.78 per litre.

The central taxes do not increase when the base rate is raised because these are fixed rates.

However, VAT, which in Delhi is at 20 per cent, rises with every increase. Earlier, VAT on petrol was Rs 10.62 per litre, but after the hike, it totals to Rs 11.44 a litre.

. . .

Taxes make up 38% of new petrol price

Photographs: Reuters

In the case of diesel, the total taxes account for only Rs 7.66 of the retail price of Rs 41.29 in Delhi. The taxes include Rs 0.76 in customs duty, Rs 2.06 in excise duty and Rs 4.84 state VAT.

There is no central excise duty on diesel apart from the Rs 2 per litre cess for highway construction. Custom duty is 2.5 per cent.

State-run Indian Oil Corp, Bharat Petroleum and Hindustan Petroleum are losing Rs 333 crore (Rs 3.33 billion) per day on selling diesel, LPG and kerosene below cost, officials said.

. . .

Taxes make up 38% of new petrol price

Photographs: Reuters

"The oil marketing companies (OMCs) are currently incurring under-recoveries of Rs 9.27 per litre on diesel, Rs 26.94 per litre on PDS kerosene and Rs 260.50 per cylinder of domestic LPG," an official said.

The current sales price of these retail fuels in Delhi -- Rs 41.29 per litre of diesel, Rs 395.35 per 14.2-kg LPG cylinder and Rs 14.83 per litre of kerosene -- is way below the imported cost of the fuel.

Petrol prices have risen by 33 per cent since they were freed from government control in June last year. The price of petrol in Delhi was Rs 51.43 a litre when the government decontrolled the fuel on June 26, 2010. Today, it costs Rs 63.70 a litre.

. . .

Taxes make up 38% of new petrol price

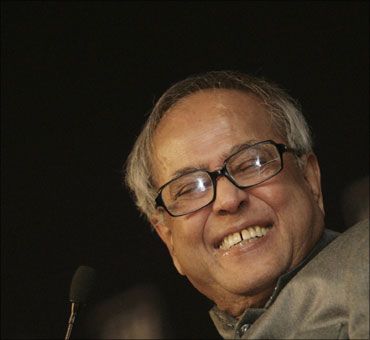

Image: Finance Minsiter Pranab Mukherjee.Photographs: Reuters

Pranab declines comment on petrol price rollback

Meanwhile, in Kolkata, Finance Minister Pranab Mukherjee declined to comment if a rollback of the petrol price hike was possible, saying that Prime Minister Manmohan Singh was meeting Trinamool Congress MPs on the issue.

"I am not making any comment, particularly when the PM is meeting representatives of Trinamool Congress. Whatever decision PM will take, will be implemented," Mukherjee told reporters when asked if a rollback was possible.

All Trinamool Congress members of the Lok Sabha and Rajya Sabha are scheduled to meet the prime minister on the issue.

The party had earlier threatened to withdraw support to the UPA government for the increase in petrol price while keeping its largest ally Trinamool Congress in the dark.

article