| « Back to article | Print this article |

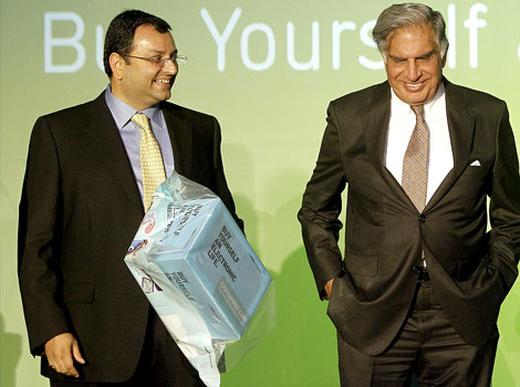

Why Tata Power is a big challenge for Mistry

Tata Power, the country's largest power utility in the private sector, would like to forget 2012. It had a loss for the first time in over two decades, quite a setback for a company which not so long ago was a key source of growth capital for the entire group.

It helped fund the acquisition of Tata Communications and is a promoter of the group's telecom venture, Tata Teleservices.

The company remains a heavy hitter in the group, with the third largest balance sheet after Tata Steel and Tata Motors.

Ratan Tata became the chairman of Tata Power quite late, six years after he became chairman of Tata Sons in 1991.

The company now finds itself in a financial storm, as its biggest investment, on the 4,000 Mw Mundra Ultra Mega Power Project (UMPP) didn't go according to the script.

Scheduled to be fully operational by the middle of next year at a total cost of Rs 18,000 crore (Rs 180 billion), it will nearly double Tata Power's generating capacity but is extracting a big financial cost. The total investment in Mundra accounts for nearly a third of the consolidated assets.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read further...

Why Tata Power is a big challenge for Mistry

When the company won the bid to develop the Mundra UMPP, to be based on imported coal, this was supposed to free Tata Power from the constraints of its regulated business that capped returns from its bread-and butter-power distribution and generation business in the Mumbai region.

The company was hoping to earn better returns from Mundra through economies of scale and energy-efficient super-critical technology. It had bid aggressively, promising to supply power at Rs 2.26 a unit.

In comparison, NTPC, the country's largest operator of coal-fired plants, sold power at an average of Rs 2.66 a unit in FY12. The government had envisaged imported coal-based power plants, as domestic supply was not able to meet the demand.

Tata Power's calculations were based on plans to import coal from Indonesia when international prices were around $40 a tonne at the time of bidding in 2006.

It then bought a 30 per cent equity stake in two major Indonesian thermal coal producers, KPC and PTA, in March 2007. But global coal prices surged past $100 a tonne in 2011 and the Indonesian government banned exports below the notified price from September 2011.

This made import of coal economically unviable for Tata Power and the Mundra project is now unable to make even operational profit; it cannot service the project debt on its own.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read further...

Why Tata Power is a big challenge for Mistry

Coastal Gujarat Power Ltd (CGPL), the special purpose vehicle set up to implement the project, reported operating losses of Rs 2.3 crore (Rs 23 million) on revenues of Rs 363 crore (Rs 3.63 billion) in the quarter ending September.

The total loss, including finance and depreciation cost, was Rs 461 crore (Rs 4.61 bilion). In comparison, the Tata Power standalone business reported an operating margin of 27 per cent in the last quarter.

Pleading

Cyrus Mistry, the new chairman of the group, now faces the challenge of convincing Mundra customers - six beneficiary state governments - to agree to a price rise so that the project becomes financially viable.

CGPL is seeking intervention from the Central Electricity Regulatory Commission for an upward revision in rates to above Rs 3 a unit. "We are hopeful of an early resolution of the issue," said Anil Sardana, managing director, Tata Power.

Global rating agency Standard & Poor's has downgraded Tata Power's long-term rating to BB-. This is a speculative and non-investment grade rating.

"The outlook revision reflects our expectation that Tata Power's cash flow and financial risk profile could deteriorate over the next six to nine months because the company has breached a debt-to-equity ratio covenant on loans to its Mundra project," S&P credit analyst Rajiv Vishwanathan said in a statement this July.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read further...

Why Tata Power is a big challenge for Mistry

To mitigate the risk, the company has offered to restructure - it will transfer 75 per cent of its equity interest in Indonesian coal mines to CGPL, so that it uses the dividends from coal to service the debt in the interim period.

"To an extent, Tata Power was aware of the risk it was taking on coal prices, so it tried to mitigate it by taking part-ownership of the mines," said Murtuza Arsiwalla, analyst at Kotak Institutional Equities. "But the extreme volatility of coal prices that followed was completely unexpected."

The setback at Mundra has, however, not deterred Tata Power's growth plans or to go slow on globalisation.

It is aiming for 26,000 Mw of generation capacity by 2020, by setting up more power plants in India and expanding abroad, to de-risk itself from fuel shortages here.

Its non-Mundra business, however, continues to be healthy and are growing at a steady pace. The company enjoys a strong AA-rating for its domestic and rupee-denominated borrowing programmes, thanks to its regulated power generation and distribution business.

"The rating on Tata Power continues to reflect its strong business position as an integrated power company. Its cash flows from core licensed operations are stable due to the regulated nature of the business," said Amod Khanorkar, analyst with CARE Ratings in a note last month.