| « Back to article | Print this article |

Subbarao defends policy stance, warns of 8% inflation

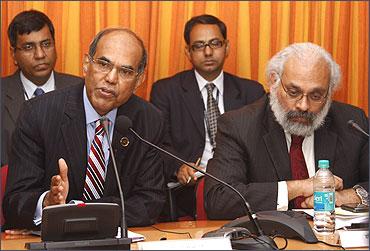

RBI Governor Duvvuri Subbarao on Tuesday defended the bank's decision to keep the key policy rate unchanged saying inflation could rise to above 8 per cent in the near-term.

He said the move to marginally slash the cash reserve ratio was aimed at making available liquidity for productive lending. Subbarao was speaking to reporters at the customary post-policy meeting after unveiling the second quarter review of Monetary Policy for 2012-13.

The RBI Governor, who suggested a reasonable likelihood of further policy easing in the fourth quarter of this fiscal year, was evasive on whether he will slash the policy rates in January.

Subbarao said he may take some action in the next policy review. The third quarter review of monetary policy is scheduled for January 29, 2013.

"If we see that inflation is likely to be coming down even in the January-March quarter, we may take some action in January. But I cannot say anything beyond that," Subbarao said, adding "at its peak, inflation will go up to beyond 8 per cent".

Click NEXT to read more...

Subbarao defends policy stance, warns of 8% inflation

"Looking at the current balance between growth and inflation risks, we thought it is appropriate to maintain the policy rate where it is, (which is) just a little bit above the inflation rate; also considering that inflation is going to go up in the next few months," he said.

Subbarao, who chose to focus on inflation worries over boosting the steeply fallen growth rate in the policy by cutting the policy rates, described his choice as a "complex challenge" and cited high fiscal and current account deficits as inhibiting factors for an easy money policy.

"We have had to restrain demand, even while ensuring flow of credit to productive sectors so as supply constraints are eased," Subbarao said.

Apparently not enthused by the RBI's cautious stance, Finance Minister P Chidambaram today said in Delhi that growth is as much a challenge as containing inflation and government would "walk alone" to face the challenge if it comes to that.

The RBI Governor further said the CRR cut is aimed at liquidity enhancement so as not to restrict credit flow to productive lending.

Click NEXT to read more...

Subbarao defends policy stance, warns of 8% inflation

"We are very conscious of the fact that a rate cut will not help if liquidity is tight. Conversely, even if we are comfortable on liquidity, it will not help if the rates are high. So, we carefully calibrated both the repo rate and CRR.

"So we don't want the tight liquidity to push interest rates higher. So the CRR cut is expected to ensure that the demand for credit at the current policy rate, at the current interest rate structure, is fully met and thereby help ease the supply constraints, help increase capacity utilization which will be non-inflationary," Subbarao said.

When asked if he expects banks to take a cue from his announcement and revise their lending rates lower, Subbarao replied in the affirmative.

Click NEXT to read more...

Subbarao defends policy stance, warns of 8% inflation

"We believe there is scope for that, given the more comfortable liquidity that we will now provide, even at the current repo rate, to adjust interest rates for lending to productive sectors to ease the supply constraints," he said.

The central bank, in its report, sees inflation rising to 7.5 per cent by March as against the earlier estimate of 7 per cent.

Subbarao said the high inflationary expectation was due to a 10 per cent dip in the Kharif harvests, recent trend of cereal prices shooting up, pressure on edible oil prices due to domestic (monsoon-related) and international factors, the rupee depreciation and suppressed inflation coming in through electricity and diesel price hikes.

On GDP growth, he said RBI revised the FY'13 GDP target steeply down to 5.8 per cent on worries over rainfall, industrial production staying flat, weak investment trends and moderate consumption.

Subbarao defends policy stance, warns of 8% inflation

Subbarao declined to give a clear picture on RBI's expected inflation trajectory and when will it peak in particular.

Recent electricity price hikes coming in as way of the recent decisions to price it as per the input costs following the clearing of the discoms restructuring will have a total impact of 60 basis points on inflation numbers while the diesel price hike will have an impact of 110 basis points, he said.

Subbarao, however, said we should not settle at having the higher inflation of around 7 per cent as the "new normal" and we should aim to bring it down under 5 per cent.

Inflation, he said, is coming in both as a result of cost-push factors like food and commodity prices shooting up and also also demand-pull factors like uptick in rural and urban wages, even though the there is a decline in the latter element in the recent months.

On stressed assets and his views on rising NPA levels, Subbarao said the Non-Performing Asset levels are "disturbing" but "not alarming".

Click NEXT to read more...

Subbarao defends policy stance, warns of 8% inflation

Subbarao also asked banks to manage their NPAs better so as to reduce the stress arising out of that. "It is not alarming, our banks are resilient and can withstand but we do not need to be complacent," he said, adding that it is "difficult" to get NPAs down soon.

The provision on NPAs, he said, is an "interim measure" till the recommendations of the B Mahapatra committee are adopted next year following a debate.

On whether the government borrowing is breaching the budgeted target, he said the RBI is currently working by Finance Minister P Chidambaram's statement yesterday that there will not be any change in the government's borrowing target Rs 5.13 lakh crore.

The RBI is waiting for the implementation of recent reform measures by the government and the results thereof, he said, lauding reform measures like acting on the fiscal deficit through diesel price hikes and opening various sectors to greater foreign investment.