| « Back to article | Print this article |

The ASTOUNDING story of the fall of Kingfisher Airlines

Had it been the United States, Kingfisher Airlines would have closed down.

The airlines shareholders have not got any value for their money. Now we have a strange spectacle where those holding the airlines tickets are not getting their seats as it has simply stopped flying.

This follows the sudden decision of Kingfisher Airlines to cancel many of its important trunk route and metro flights simply 'unannounced'.

Not just that even when the announcement did come, the actual no go flights were far more than the planned no go flights. Obviously the problem inside Kingfisher is far more serious than what has been perceived so far.

That the Directorate General of Civil Aviation, the supposedly tough regulator, had no clue about it was shocking. That it has now started investigating the matter can only be of minor comfort to those not choosing to fly Kingfisher and definitely of no comfort to those who bought tickets to nowhere.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

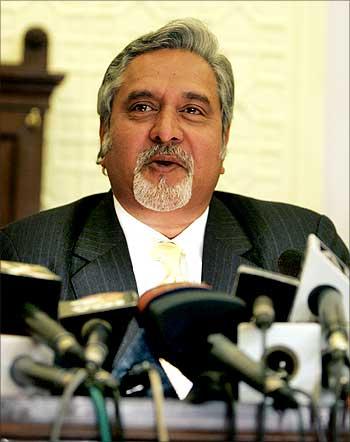

Perhaps, it is time to rewrite the famous television ad that said 'Neighbour's Envy, Owner's Pride'. It is the other way round with Kingfisher Airlines promoter Dr Vijay Mallya, who as the owner of the airline must be surely envious of neighboring airlines (other domestic carriers) which are still flying, though not with as much pride.

Kingfisher Airlines has accumulated loss of over Rs 4,283 crore (Rs 42.83 billion) at the end of March 31, 2011 and never made even a rupee in profit since it was launched in 2005.

Its total debt rose to an alarming proportion before the Reserve Bank of India approved debt restructuring by public sector and private banks in early 2011. After recast, Kingfisher Airlines total debt reportedly came down to Rs 7,057 crore (Rs 7,057 billion) which is still considered very high for a private domestic carrier.

In the process of restructuring, lending banks also lost a lot of money. In the debt restructuring done by banks, 13 in all, they agreed to convert a big part of their debt into equity by acquiring the Kingfisher Airlines share at Rs 63 per scrip as against the then prevalent price of Rs 40.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

The banks, in all, hold over 24 per cent of the airline equity. But between then and now, the share value has eroded sharply to around Rs 22 which is just one-third of what it was when the shares were given to them as part of debt restructuring.

So one can imagine how the banks have also suffered a serious blow. A top State Bank of India official has now said that the bank has stopped extending any kind of credit to airlines in India. We don't know if this excludes the state-owned Air India whose problems and financial woes are many times more than Mallya's.

But being state-owned, Air India's maalik -- the Government of India -- can always print notes and monetise the deficit. But Mallya has no such option unless he literally spirits away the spirit money to save his carrier.

However, the speed with which that money is drying up is simply amazing. Obviously, no entrepreneur worth his salt can continue to do business if he does not make money even six years after being in business.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

In the business of booze, you can feel high while on ground, but in the airline business you actually need to fly to be high.

So when Mallya announced that his airline will cancel some major flights till November 19, it seemed to be a clear admission of his airline being in serious financial crisis.

After all, about two months back, media reported the observations made by Kingfisher Airlines' auditors -- namely, B K Ramdhyani & Co. In accounting parlance, they asked if Kingfisher Airlines could be even described as a 'going concern' and these remarks were published in the 2010-11 annual report of the company.

A 'going concern' refers to a company's ability to continue functioning as a business entity in the near future and it is extremely rare that auditors make such mention in the passing.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

If one went by the definition of the erstwhile Sick Industrial Companies Act, if net worth of any company had been eroded by more than 50 per cent then it had to be referred to the (now defunct) Board for Financial and Industrial Reconstruction (BFIR).

Though there are other ways of dealing with sick companies, the spirit behind the original legislation has not changed. Applying that rule, as also logic, Kingfisher Airlines is certainly not a healthy company by any stretch of the imagination.

In response to the observation of its auditor, Kingfisher Airlines top brass responded by saying, "We are 100 per cent viable, strong going concern." Its director on board, Ravi Nedungadi, then noted that when the debt restructuring was done, the airline's lenders -- along with lead bank SBI and SBI Caps -- had independently assessed Kingfisher Airlines' viability.

Nedungadi even said the company's accounts with the banks were classified as 'standard' which meant they were not classified as non-performing. If it was not non-performing and standard then Kingfisher Airlines is surely taking a long time to issue its GDR which incidentally is based on the previous six months average stock price.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

Even when it wanted to raise $300 million -- both, before and soon after debt restructuring -- it felt the ruling share price was not high enough to go in for GDR. Today, the ruling price of its shares is not even one-third of what it was when it was dilly-dallying.

In the last two-and-a-half years, its fleet size has come down from 89 to 66. The fleet size shrunk because more than a dozen of its aircraft were grounded due to serious engine problems for which it threatened to sue the engine maker, IAE.

But even as the engines were being re-engineered and overhauled, the market was turning the other way with rising fuel severely eroding the yields. At times, Kingfisher did touch a load of as high as 80 per cent, but it simply was not making money as its cost were too high, mainly debt-related.

So it went in for debt restructuring. Six months after that, that is, in September 2011, it announced that Kingfisher Airlines will completely withdraw from the low-fare segment that was being run under the Kingfisher Red brand.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

It said it would take at least four months before it again became a complete full service carrier. For this to happen, it said that many of its all economy planes (be it A319 or A320, besides A 321 which were only in twin configuration) would be completely reconfigured to full service frills with at least eight business class seats and remaining 150 or so in economy configuration.

Under the all-economy configuration, an A320 aircraft could seat 182 passengers. So what was Kingfisher gaining by reducing the seats?

Obviously its calculation showed that a full service flight got passengers who were ready to pay more therefore earn higher yields.

In this context, the airline management has stated that the decision to suspend flights on select trunk routes was to quickly complete the reconfiguration of the aircraft so that it becomes all Kingfisher First.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

This would ensure its early exit from the low-fare segment. This is fantastic logic which flies in the face of everything. The world over every airline worth its name is looking for space in the low-fare segment.

Even a very quality-conscious Singapore Airlines is launching its low-cost variant, called Scoot, for international travel, both medium- to long-haul flights.

We already have Air Asia, besides Air Arabia, FlyDubai, Air India Express, etc on the foreign routes.

As for domestic operations, Jet Airways is going full blast on the low-fare segment. IndiGo has shown how success can be achieved in the segment.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

Besides, SpiceJet and GoAir are also in that segment. Hence wherefrom Mallya's Kingfisher, which till date could not make money on part full-service and part low-fare, will now make moolah when it has no dominant position, it is in serous debt, its fleet size shrunk, nearly 75 of its pilots have quit and the company is unable to even pay salary to the employees and, in some instances, allegedly delayed the depositing of TDS?

Besides, Kingfisher Airlines owes a sizeable amount of money to state-owned Airports Authority of India and GMR Delhi airport, to oil companies that have twice grounded its fleet by not supplying fuel until payment was made, to banks, etc.

This is a long list. Just before the grounding of flights a few days back, Nedungadi said Kingfisher Airlines has sought further cushion from banks to ease its debt burden but denied that it was seeking yet another debt restructuring.

What difference does it make whether you call it reducing debt burden or restructuring of debt? In the new formula, Kingfisher Airlines has sought lenders' help to substitute high-cost rupee borrowing with lower cost foreign currency debt.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

The airline has also asked banks to help it release nearly Rs 170 crore (Rs 1.70 billion) stuck with aircraft leasing companies who gave aircraft to Kingfisher on lease against maintenance reserves by providing necessary bank guarantees.

One wonders if this is the same Dr Mallya who four years ago was talking of operating Airbus A340-500 for long-haul direct flights to the United States from India. He had booked five A380s.

All that is now part of his dream which has truly travelled to a very distant past and his vision has become increasingly blurred due to many factors both within and beyond his control.

True Mallya chose to chew more than he could swallow. In a belated response, DGCA has sought an explanation from Kingfisher Airlines for its sudden cancellation of major domestic flights and a couple of foreign flights to Bangkok.

Click NEXT to read on . . .

The ASTOUNDING story of the fall of Kingfisher Airlines

A side effect of this has been the decision of DGCA to actively engage airlines that are in deep financial crisis and toughen the procedures to grant aircraft acquisition approvals.

What is the purpose of allowing airlines to acquire aircraft, be it outright purchase or through lease, when they do not have the money to pay lease rentals (as it happened with Paramount Airways) or installments for outright purchase? Since the latter was about to happen, Mallya cancelled his huge orders for many more A 320s, A 340s and A 380s.

The economic recession of 2008-09 and its repeat version now were also partly responsible for this. If money does not come into Mallya's kitty, it will become increasingly difficult for him to receive all his flying guests and keep them entertained. Perhaps, he may well have to say bottoms up and the party could be over.

Even Mallya did not expect in his wildest dreams that the valuation of Kingfisher Airlines will drop to just $245 million which is even lower than what he paid Captain G R Gopinath for Air Deccan and Jet Airways' Naresh Goyal for Subrato Roy's Air Sahara.

Mallya must have realised that airline business is not just high flying but also high funda economics. Good luck to him in 2012!

The author is a Delhi-based journalist and consulting editor, Cruising Heights).