| « Back to article | Print this article |

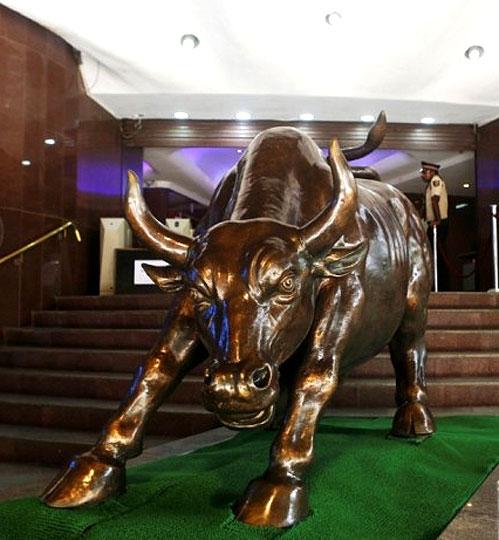

Sensex rally: India among top 10 global markets

The total value of India’s listed companies might well waltz across the $1.5-trillion mark, as well as come close to climbing another step on the top-10 club of countries by market capitalisation if current growth expectations are anything to go by.

It overtook Australia to enter the top-10 club, following the recent election rally.

India’s market capitalisation has risen by 25.1 per cent so far in 2014. At $1.42 trillion, Indian companies are now more valuable than Australia’s, whose companies are valued at $1.4 trillion; according to Bloomberg data.

Click NEXT to read more…

Sensex rally: India among top 10 global markets

Brokerage estimates suggest a further upside in the days ahead. Citigroup, Deutsche Bank, Bank of America Merrill Lynch and Nomura have suggested upsides of seven to 16 per cent; all targets to be achieved in 12 months or less. An average gain of 11.3 per cent.

This would take India’s market cap to $1.58 trillion within 12 months. This would be within kissing distance of the next in line in the top-10 list, Switzerland, which has a market capitalisation of $1.61 trillion.

UBS Securities India Market Strategy said investors would increasingly look to discount future earnings and growth, paying a premium for this and pushing markets higher, as a result.

Click NEXT to read more…

Sensex rally: India among top 10 global markets

“We believe investors will be willing to give a premium for growth hope and also look beyond FY15 earnings estimates. By the end of 2014, investors would start looking at FY16 estimates. Based on our top-down expectation of 15 per cent earnings growth in FY16, and 15x PE, we set our Nifty target for end-2014 at 8,000. There could be an upside to this target based on how policy making evolves over the next few months, which could flow through to earnings estimates and multiples higher than average,” said the report dated May 16 and authored by analysts Gautam Chhaochharia and Sanjena Dadawala.

A Morgan Stanley India economics and strategy report also supported the suggestion that earnings could pick up.

Click NEXT to read more…

Sensex rally: India among top 10 global markets

“Given the rise in corporatisation of the Indian economy, the coming acceleration in GDP (gross domestic product) should benefit the profit outlook. Historically, we have observed a strong correlation between corporate profits and macro growth and do not see this changing in the coming years. Also, at this stage, margin forecasts are pinned to the performance of the down-cycle of the past five years. The relative share of profits to wages is now at a low point and a mean reversion is in sight. Thus, the profit share in GDP will likely rise,” said the May 18 report authored by Chetan Ahya, Ridham Desai, Sheela Rathi, Utkarsh Khandelwal and Upasana Chachra.

The rise in market capitalisation rankings could also be aided by an appreciating rupee, at least in the short term. A rising rupee means the value of these companies would increase in dollar terms, even without share prices going up.

Click NEXT to read more…

Sensex rally: India among top 10 global markets

“We forecast the rupee to strengthen meaningfully compared to forwards, anticipating a structural shift in policy decisiveness and pro-business sentiment under the new government. Over the second quarter of 2014, incremental flows as well as the positive carry are likely to contribute towards rupee appreciation, although the longer-term trajectory for the dollar-rupee value remains upward sloping, given India’s inflation differentials against the US and our expectation for eventual dollar strength,” added the Morgan Stanley report.

Also aiding the upside is the fact that mid-caps, and stocks which have been beaten down, would be likely to rise even more than the rise in frontline stocks predicted by these four brokerages.

Deutsche Bank in its May 16 India equity strategy report suggested such stocks are expected to do well in the days ahead.

Research analysts Abhay Laijawala and Abhishek Saraf said they ‘expect mid-caps to continue to rally as a high-beta play on economic improvement.’