| « Back to article | Print this article |

M&A fever returns to pharma

The acquisition of Agila Specialties, the injectibles business of Bangalore-based Strides Arcolab by Canonsburg, Pennsylvania-headquartered Mylan for $1.85 billion, could mark the return of big-ticket acquisitions in the Indian pharmaceutical industry.

After Daiichi Sankyo of Japan had acquired Ranbaxy Laboratories in 2008 for $4.6 billion and Abbott Laboratories bought the domestic formulations business of Piramal Healthcare in 2010 for $3.7 billion, the sector had gone quiet.

But now there are signs of a revival. On February 27, the day Mylan announced the Agila purchase, GlaxoSmithKline Pharmaceutical hinted to analysts at a meeting in Mumbai that the prospects for closing acquisitions in India looked brighter than ever before.

The Indian arm of the London-based pharmaceutical giant has about Rs 2,000 crore (Rs 20 billion) of cash lying on its books and harbours ambition to grow inorganically in the country.

Multinational interest in local pharmaceutical companies is riding high because there has been a correction in the valuations expected by Indian promoters.

Click NEXT to read more...

M&A fever returns to pharma

For instance, Mylan has bought Agila by paying around eight times its last year's revenue to get access to its 61 Abbreviated New Drug Applications (ANDAs) approved by the US Food and Drug Administration (UFDA).

In contrast, Abbott paid 8.7 times the turnover for the Piramal Healthcare buyout in 2010.

Lucrative buys

The market was abuzz with talk that Strides' promoter, Arun Kumar, was initially looking for a valuation of $2 billion for Agila but finally sold it for $150 million less.

The company was earlier in talks with Pfizer of the US after the two had signed a collaboration agreement in January 2010.

The valuations expected by Indian promoters have softened because of the increasing stress on their balance sheets caused by rising power costs, pricing curbs and other policy uncertainties.

So far as price control is concerned, the government wants to increase its ambit from 74 bulk drugs, and all medicines containing one or more of these bulk drugs, to over 640 essential medicines.

Click NEXT to read more...

M&A fever returns to pharma

Pharmaceutical companies have argued that this will curb profits. Also, the companies have said, there is no evidence of super-normal profits in the industry, which could have been a ground for increasing the price controls.

Some others see a political stamp on it - price controls fits in well with the United Progressive Alliance's plans for free medicine for the poor.

At the same time, there is a strong lobby at work against acquisition of Indian pharmaceutical companies by multinationals.

As a result, a few proposals from overseas companies to invest in Indian drug makers are stuck at the government, though 100 per cent foreign direct investment is allowed in the sector under the automatic route.

That's because the domestic lobby has argued that multinational pharmaceutical are buying local companies only to stifle competition.

The day is not far, they have said, when the Indian market will be controlled by multinationals, and medicine will become prohibitively expensive for the aam admi.

Click NEXT to read more...

M&A fever returns to pharma

Checks and balances

So, guidelines are being formed which will enable the Competition Commission to vet all cases of acquisition of an Indian drug maker by an overseas company.

And permission will come with stringent riders: the acquired company will have to take the commission's permission before discontinuing production of an essential drug.

The sentiment is reflected in the stock markets. Stocks of Cadila Healthcare and Ranbaxy Laboratories are down over 20 per cent since September 2012.

"The threshold for valuations in the Indian pharmaceutical sector has historically been high," says Siddhart Nahata, executive director with Morgan Stanley who advised Mylan in its acquisition of Agila.

This, of course, led to deals falling through. But with expectations cooling off now, more mergers and acquisitions could happen.

In the past, acquisitions in the Indian pharmaceutical market were driven by different reasons.

In Ranbaxy's case, the star attraction was the rights it had bagged from USFDA to launch the generic version of Lipitor, the world's largest-selling medicine, in the US ahead of others with six months of exclusivity thrown in.

Click NEXT to read more...

M&A fever returns to pharma

And Abbott bought the Piramal unit for access to the local market. But that's hardly a factor now.

That's because the domestic market is extremely fragmented and competitive. Every medicine has hundreds of brands, and gaining market share is not easy.

Formidable line-up

Instead, multinational interest this time is meant to gain access to the pipeline of generic drugs being developed by small and mid-sized Indian companies for the US market.

"The trend would broadly be to leverage cost-effective R&D and low-cost manufacturing in India through collaborations, with acquisitions taking place when valuation expectations match," Nahata says in a telephonic interview from London.

Thus, Mylan, the world's third largest generic drug maker, had acquired Mumbai-based Unichem Laboratories' export-oriented plant in February for $30 million and the manufacturing unit of Hyderabad based SMS Pharmaceuticals for about $33 million in October.

The company had also announced strategic collaboration with Bangalore-based insulin maker Biocon for global development and commercialisation of its three products.

Click NEXT to read more...

M&A fever returns to pharma

Generic market

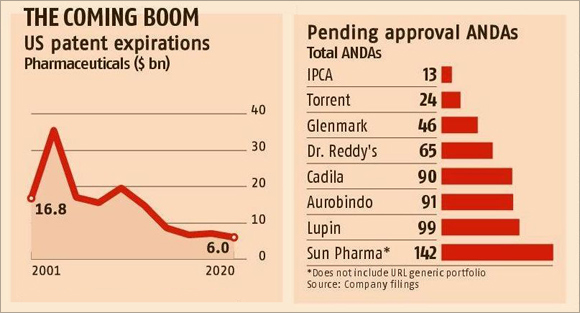

According to various estimates, nearly a quarter of the $230-billion patented drug market in the US (it is the world's largest market for pharmaceuticals) is going off patent in the next two to three years. This has made multinationals look at Indian generic companies.

"Increased focus on generics adoption globally, the rising number of blockbuster drugs going off-patent, R&D pipelines drying up for innovators and constant demand for reduction in manufacturing costs are some of the driving forces that are attracting multinational players to the Indian market," says Ramesh Swaminathan, chief finance officer, Lupin.

This has seen a spurt of inbound acquisition for India generic drug makers who have a robust pipeline for these drugs with pending approvals from the USFDA.

Lupin, for instance, has 99 ANDAs pending for approval with the USFDA. This follows the highest 142 from Sun Pharmaceuticals. Aurobindo and Torrent have 91 and 24 ANDAs, respectively, pending for approval.

Click NEXT to read more...

M&A fever returns to pharma

"Pharmaceuticals will remain one of the active sectors for inbound M&A activities, driven by the global majors and others looking to acquire prospective API (Active Pharma Ingredient) pipeline as well as domestic formulations market share," says Anjani Kumar, managing director and India investment banking head of South East Asia-based CIMB.

"Club that with activities in biotech and increasingly in healthcare services, and you will find that for most global investment banks India remains a key coverage market," he adds.

In India, the manufacturing cost is about 30 per cent cheaper than that in the US and it has the largest number of USFDA-approved manufacturing facilities outside the US. Besides, the cost of developing a generic drug in India is about half of that in the US.

For Indian companies too, collaborations are important. "Capabilities, in terms of developing and manufacturing the product, are there with all Indian pharmaceutical companies, the lacking part is the marketing setup in local geographies," says Hemant Bakhru, analyst with global brokerage firm CLSA.

"They obviously have expertise in India but to develop expertise outside India is difficult." This is where tie-ups with multinationals come in handy.

Click NEXT to read more...

M&A fever returns to pharma

Large Indian pharmaceutical companies such as Sun Pharmaceutical and Dr Reddy's Laboratories have their infrastructure in place in the US because they have got critical mass- each of them is now reaching $1 billion in sales there.

They can do pretty much most of the market development on their own as they have tie ups with distributors and retail chains for the sale of generic products.

But small and mid-sized companies such as Lupin, Aurbindo Pharma and Torrent Pharma face a challenge in commercialising the product in the US; as a result, their names as potential acquisitions targets have been doing the rounds. Lupin in fact had about $500 million sales in the US last financial year; despite that it is seen as a potential target.

Another acquisition target is Ahmedabad-based injectable drug producer Claris Lifesciences. Many companies, including Teva Pharmaceutical and Pfizer Inc, have evinced interest in the company, according to Mumbai-based brokerage India Infoline.