Photographs: Courtesy, The Nasdaq Stock Market Inc Bibhu Ranjan Mishra in Bangalore

In the beginning of this month, Nasdaq-listed Cognizant, the rising star of information technology, gave a shocker.

In a regulatory filing in the US, it had said its top executives will be paid 100 per cent of their performance-linked stock units only if the company achieved a sales target of $8.5 billion in 2013, a growth of 16 per cent over 2012.

That created shock waves, as analysts assumed Cognizant may be targeting a revenue growth of 16 per cent in 2013, compared to the 20 per cent it is expected to achieve in 2012.

It was considered alarming because Cognizant had revised its top line guidance for 2012 from 23 per cent to 20 per cent. The IT stocks took a beating on the market after the news came out.

The company, growing at a scorching pace in spite of the adverse business environment in the past couple of years, has not yet given its revenue guidance for 2013.

It was just an indication of the kind of growth it might be expecting, assuming it achieves 100 per cent of its growth objective. But, there was no stopping the rumour mills.

So, does it indicate that Cognizant is also starting to fall in line with the rest of the industry and show some inertia?

...

Is Cognizant's dream run over?

Photographs: Reuters

Well, it may not be the case. Even most rivals don't think so. But they do say that Cognizant's problem could be the 'law of big numbers'.

This means a $10-billion company can't grow at the same rate as a $1-billion company. "The law of large numbers is applicable to all companies. Cognizant can't be an exception," says a senior officer of an IT services company.

Jaideep Mehta, vice-president and country general manager of research and analysis firm IDC, echoes the same opinion.

"I don't think it had anything to do with the environment or internal problems. The law of big numbers is catching up with Cognizant. It caught up with Google. There is no company in the history of mankind which has escaped it," he says.

Mehta says even if Cognizant grows 16-17 per cent in 2013, it will still add more dollars in revenues than in 2012. "So, how does that in anyway mean that growth has slowed down," he asks.

Top performer

Among the Indian and offshore-centric IT services companies, Cognizant's growth has been the fastest in the recent years. Year after year, the company, which largely banks on India for offshore delivery, has grown at a rate which sometime baffles its own executives.

"From the beginning, our strategy was to focus on the customer. So, we knew we would be growing. We were also sure we would be growing faster than the industry. But what came as a surprise was the quantum of growth. And, the margin by which we have led this growth from the rest of the competition was something that took us by surprise," Lakshmi Narayanan, vice-chairman and former CEO of Cognizant, had told Business Standard in an earlier interview.

...

Is Cognizant's dream run over?

Image: Cognizant group chief executive (technology and operations) R ChandrasekaranPhotographs: Courtesy, Nasscom

Even in the most recent statement following its regulatory filing on executive payment, Cognizant has exuded faith that the growth indication it has given would be the best in the industry. Cognizant's goal is to maintain industry-leading revenue growth.

"We believe that the (statement) filed recently containing the equity compensation targets for our executives set forth by our board aligns well with this goal, and the revenue target at 100 per cent payout would represent industry-leading growth," R Chandrasekaran, group chief executive (technology and operations), Cognizant, says in reply to an email query.

The company, however, has made it clear that the targets it has set in 2013 "are appropriate", based on its understanding of the current environment and discussions with its clients.

According to industry insiders, Cognizant's guidance could also be the reflection of the fact that overall, IT outsourcing is expected to continue to witness challenges as uncertainties prevail in major economies of the world including the US and Europe.

"If you look at the trend across various companies, everybody is talking about declining growth. That is a function of the environment," says a senior executive of an Indian IT services company, which competes with Cognizant.

Despite all the macroeconomic challenges, Cognizant has, time and again, delivered performances which have so far not been replicated by its Indian peers. Last year, it overtook Wipro in terms of IT services revenues.

...

Is Cognizant's dream run over?

Photographs: Business Standard

Going by its annual revenue run rate, Cognizant is expected to exceed Infosys in terms of revenues in the financial year ending December 31, 2012. In the US, Cognizant is within striking distance of replacing TCS in terms of revenue.

Well-defined strategy

According to industry analysts, Cognizant has been crystal clear from the very beginning about its strategy.

At a time when most other peers were busy in maximising their profits (margins), Cognizant adopted the model of maximising market share, which has paid off quite well for them so far.

"Very early, they defined a very clear and articulated go-to-market strategy. They convinced their investors upfront that it is the right way to go and they executed flawlessly. So, all credit to them, and they have grown to a certain scale coming from nowhere, literally," says Mehta of IDC.

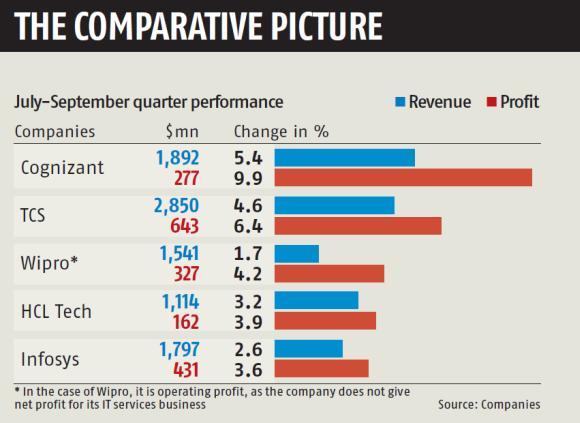

While Cognizant is expected to announce its fourth-quarter and year-end numbers sometime in February, it was leading its peers, both in terms of growth of revenues as well as profit, in the quarter ended September 30.

Revenue for that quarter at $1.892 billion grew 5.4 per cent, even more than what it had projected. Its net income growth of 9.9 per cent was the best among peers.

The only company that grew its profit better than Cognizant on year-on-year basis was HCL Technologies at 51 per cent.

...

Is Cognizant's dream run over?

Image: Cognizant vice chairman Lakshmi Narayanan and CEO Francisco D'Souza ring the Nasdaq Opening Bell from Cognizant Techno-complex in Chennai, IndiaPhotographs: Courtesy, The Nasdaq Stock Market Inc

There are a few industry analysts who believe Cognizant may be more unevenly placed in terms of its geographic exposure because of the fact that it still derives about 80 per cent of its revenues from a single market - the US.

"If you look at the trend, the future demand is going to be more broad-based. Cognizant's growth is more driven by the US where it tends to be the strongest. But outside the US, it is not so strong. So, now that growth is expected to come from the other parts of the world, I think that is where Cognizant may not do as well as it does in the US, and that may be a reflection of its initial outlook," says Partha Iyengar, vice-president and distinguished analyst at research firm Gartner.

On its part, Cognizant says its geographic focus is a part of its strategy wherein its primary focus will be on North America, while it would continue to expand footprint in other parts of the globe.

"We are not everything to everybody. We focus on a limited number of industries and geographies and channel all our energies into helping clients in those areas build stronger businesses," says Chandrasekaran.

"North America is the largest IT market because organisations in North America are traditionally aggressive adopters of technology and generally have mature global sourcing programmes," he adds, justifying the company's big bet on North America.

While the clients budget for 2013 is yet to be finalised, only time will tell whether Cognizant will be able to maintain its leadership in growth next year or not.

article