| « Back to article | Print this article |

Is Chidambaram's plan to create big banks feasible?

Chidambaram's plan is to take a shortcut: He wants to merge some small banks into bigger ones.

Finance Minister P Chidambaram wants to see at least two to three Indian banks among the world's largest.His best bet is state-owned State Bank of India.

Its assets (along with those of its five associate banks) are worth $355 billion but that's nowhere close to the top lenders.SBI was ranked 60th in the list of world's top 1,000 banks by The Banker magazine in July.

Bank of America, which topped the list, had assets of $2.16 trillion.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

It might take State Bank of India several years to reach that size organically, and by the time it does so Bank of America will have grown even bigger.

Chidambaram's plan is to take a shortcut: He wants to merge some small banks into bigger ones.

It's more than megalomania at work here.

Bigger banks can offer bigger loans and derive efficiencies of scale in operations.

A bigger network helps in deposit mobilisation and meeting priority-sector lending guidelines better.

Smaller banks struggle to meet capital-adequacy norms and face perennial talent crunch.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

The general wisdom, in spite of the crash of Lehman Brothers and others in the West, is that large banks are too big to fail.

This is not for the first time the government has pushed for bank consolidation.

The talks first started in the early '90s when Narasimham Committee-I said in its report on improving efficiency and productivity of financial institutions that three to four big banks, led by SBI, should be developed as international banks, followed by national banks with a countrywide presence and then local and rural banks.

Narasimhan Committee-II, in its 1998 report, also stressed consolidation.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Now that Parliament has passed amendments to the banking law, paving the way for the Reserve Bank of India to issue new bank licences, consolidation in the sector is inevitable.

Banking saw about a dozen mergers between 1990 and 2000, and 15 more amalgamations in the past decade.

While mergers of banks with weak financials dominated the '90s, the next decade saw coming together of healthy banks, driven by commercial reasons.

The acquisition of Centurion Bank of Punjab by HDFC Bank in 2008 for Rs 9,510 crore (Rs 95.1 billion) was the biggest merger in Indian banking history.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

However, none of those was big enough to take Indian banks into the global league. "Not one of our banks is among the top 20 of the world.

China has three.

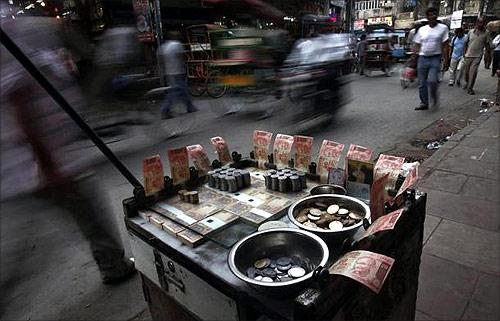

"Today, if a loan size is, say, Rs 6,000 crore (Rs 60 billion), there is not a single bank which can take the portfolio on its book.

It has to put together a consortium," Chidambaram recently told Parliament while trying to sell his idea on consolidation.

India has both public-sector and private banks.

The finance ministry, on its part, can drive consolidation in the public sector.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

In December 2009, the finance ministry had called chiefs of five leading public sector banks -- Punjab National Bank, Canara Bank, Union Bank of India, Bank of Baroda and Bank of India -- to take their views on consolidation.

But the banks could not come up with a concrete plan and owing to stiff resistance from small banks, the idea was dropped.

In fact, then-finance minister Pranab Mukherjee said the government would not force any merger and the proposal would have to come from the banks themselves.

Now that the consolidation buzz has restarted and has the blessings of Chidambaram, the finance ministry has begun to move fast.

It is learnt to have called the chiefs of a few large banks to discuss the issue.

Though the government has not formally given any road map to the banks for a merger, it has created an enabling environment for the marriage of some small banks with large ones.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Stumbling blocks

The two biggest challenges it can face in its endeavour are technology and human resources management.

Bank employees and their unions fear there might be cultural issues when two banks are brought together and overlapping branches would have to be closed down, leading to large-scale job losses.

Employees of small banks fear they might not be treated favourably under the new management and could be asked to take transfers or forgo promotions.

Though salaries and perks among state-run banks have seen some harmonisation over the past few years, some variations can still be found among different banks.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Finding the right job for top management of small banks in the merged entity is also an issue.

"Consolidation will affect the nation, customers as well as bank employees.

"They are talking about benefit of scale but two plus two is not four always.

"Experience has shown globally mergers have led to rationalisation of branches and staff," says C H Venkatachalam, general secretary of the All India Bank Employees Association.

The opposition of unions, some bankers say, might not be a huge stumbling block in the way of bank consolidation in the present environment.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Unions no more exercise the kind of influence they used to in the past. In fact, merger of two of SBI's associates -- State Bank of Saurashtra and State Bank of Indore -- into the parent was more or less seamless.

The remaining five subsidiaries -- State Bank of Hyderabad, State Bank of Mysore, State Bank of Bikaner & Jaipur, State Bank of Patiala and State Bank of Travancore -- would also be merged into SBI gradually.

So far, as technology is concerned, the Department of Financial Services has taken care of the issue.

It has divided banks into seven groups based on the core banking solution (CBS) platform (see table).

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

CBS networks all the bank branches and allows customers to bank from anywhere regardless of where he maintains his account.

Each group here has a large bank as the coordinator of two or three small banks.

They will meet on a regular basis and share their collective wisdom on issues such as human resources, e-governance, internal audit, and fraud detection and recovery, among other things.

Efforts have been made to reach standardisation among banks at various levels.

So, if banks in the same group have to be merged it should not be a problem.

A bank executive says people from their coordinator bank have started visiting their head office to ensure there is uniformity in the practices followed by the banks in the group.

"The government's hidden agenda to facilitate mergers through this move is not ruled out," rues Venkatachalam.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

A third deterrent could be the Competition Commission of India (CCI), which has been given the powers to look at all banking mergers and acquisitions.

Perhaps this could be the reason why Chidambaram wanted to keep banking mergers and acquisitions out of the purview of the competition watchdog, but had to relent before the Opposition.

Changing landscape

"Bringing mergers and acquisitions under CCI could be counter-productive, if such consolidation is seen as creating a monopoly," points out Jyoti Prakash Gadia, managing director of Resurgent India, an investment bank.

Experts believe mergers are needed not just for achieving economies of scale but also for survival of small banks, which would find it increasingly difficult to survive with the entry of new private banks once RBI issues more licences and intensifies competition in the sector.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Ramnath Pradeep, former chairman of Corporation Bank, says small banks are losing business because not many people are interested in dealing with them and increasingly want to go with large banks which can provide wider reach, better connectivity and convenient banking.

But to make Indian banks really global, mergers of large banks like State Bank of India and Bank of India are required, he says.

According to the seven groups made by the finance ministry, besides SBI subsidiaries, other small state-run banks that could be subsumed into bigger banks include Punjab & Sind Bank, Dena Bank, United Bank of India, Bank of Maharashtra, Andhra Bank, Vijaya Bank, Corporation Bank, Indian Bank, Allahabad Bank, UCO Bank, Oriental Bank of Commerce, Syndicate Bank, IDBI Bank and Indian Overseas Bank.

Click NEXT to read further. . .

Is Chidambaram's plan to create big banks feasible?

Among private banks, old-generation lenders such as Federal Bank, South Indian Bank, Lakshmi Vilas Bank, Karnataka Bank, Dhanlaxmi Bank and Karur Vysya Bank could be potential targets for large government banks as well as new private banks.

"Old private sector banks don't have deep pockets. But the larger reason why they could be acquired is that after the enactment of the new banking law their valuations would go up.

"This would be the right time for them to sell," says Ashvin Parekh, partner, Ernst & Young.

Notwithstanding all these issues, bankers agree consolidation is inevitable.

At the moment, the finance ministry may not force banks to consolidate, as politically, it may backfire, but sooner or later market forces will compel small banks to come together with large banks.

This is what happened in the '90s and this is how many of the global amalgamations have happened.

Ta-Ta, Ratan