| « Back to article | Print this article |

India's Billionaire club: Who won, who lost

India's Billionaire club sees one entry, five exits in first 7 months of year.

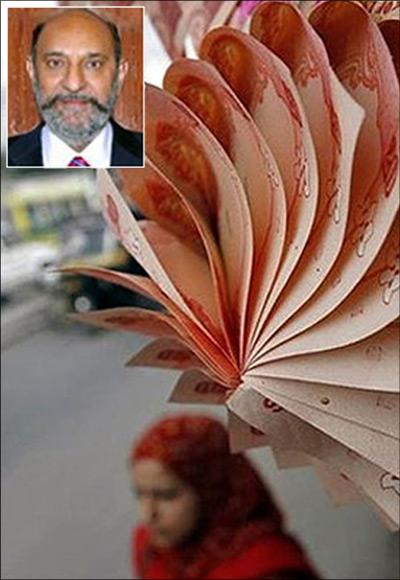

The slowdown clouds may be getting denser but Kuldip Singh Dhingra has little to complain about.

The 66-year-old chairman and promoter of Berger Paints is the latest - and in fact, the only - entrant to India’s dollar-billionaire club in the first seven months of this year.

Dhingra, who holds a 75 per cent stake in the Kolkata-based firm, has seen his net worth surge by 43 per cent to $1.04 billion.

Click NEXT to read more…

India's Billionaire club: Who won, who lost

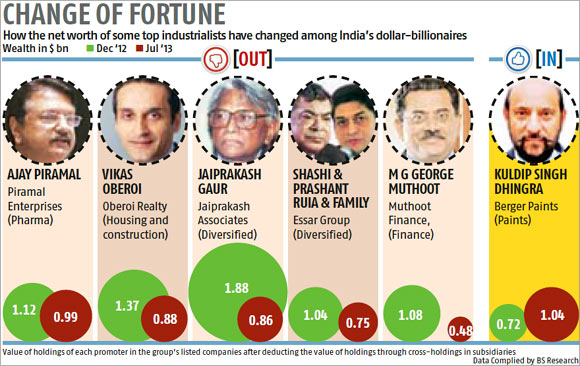

However, five of his peers in India Inc have not been as lucky.

January-July saw Shashi and Prashant Ruia of Essar Group, Jaiprakash Gaur of construction giant Jaiprakash Associates, Vikas Oberoi of Oberoi Realty, Ajay Piramal of Piramal Enterprises and M G George Muthoot of Muthoot Finance losing their memberships in the 40-member exclusive club.

The number was 44 at the end of 2012.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

Those who have remained in the club have also seen huge changes in their fortunes, though the benchmark BSE index, the Sensex, remained at about the same level. The Sensex closed at 19,343 on July 31, against 19,426 at the end of December 2012.

What has changed in this period is the valuation of the rupee, which depreciated by 9.2 per cent to an average of 59.75 in July, from 54.67 against the US currency in December.

The rupee’s depreciating value, coupled with a slowing domestic economy, has seen investors preferring stocks of pharmaceutical companies such as Sun Pharmaceutical and Lupin which have a high component of exports to the US in their businesses.

This has resulted in a sharp rise in the net worth of their respective promoters - Dilip S Shanghvi (Sun) and Desh Bandhu Gupta (Lupin) - by 37 and 29 per cent to $11.99 billion and $3 billion, respectively, in the last seven months.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

To highlight the impact due to a change in the economic climate, Business Standard used the holdings of the promoters in the public domain at the end of last year and calculated the change in their value in the last seven months.

Stocks of pharmaceutical and fast-moving consumer goods’ companies are considered to be defensive. Being non-discretionary goods, demand for such products is least affected by the economic slowdown. This led to a 15 per cent gain in the net worth of the V C Burman family, the promoters of Dabur, at $3 billion.

This also helped Dhingra of Berger Paints, which has also been getting traction for its high-margin decorative paint business.

“The rupee’s depreciation against the dollar has certainly benefited export-oriented companies, but there are so many other factors that affect the market capitalisation of a company and, hence, the net worth of a promoter,” says Alok Ranjan, head portfolio management service at domestic brokerage Way2Wealth Securities.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

“Market capitalisation is largely driven by earnings growth of a company, which is linked with economic growth of the country, and this is broadly reflected in the promoter’s wealth.”

Companies in housing, construction, industrial and manufacturing industries have seen significant impact on the demand for their goods and services.

Billionaires such as Naveen Jindal of Jindal Steel & Power, Gautam Adani of Adani Enterprises and K P Singh and his family, promoter of DLF, have seen one of the sharpest decline in their net worth, which eroded by 54, 32 and 28 per cent to $2.12 billion, $2.93 billion and $4.07 billion, respectively.

At the same time, the depreciation of the rupee due to the trade deficit has helped promoters of export-oriented information technology companies such HCL Technologies.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

Its promoter Shiv Nadar has seen 22.7 per cent gain in his net worth, to $6.25 billion. This is also linked with operational improvement in company’s performance during the period.

Among the top-five Indian billionaires, Sun’s Shanghvi is the only promoter to have gained.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

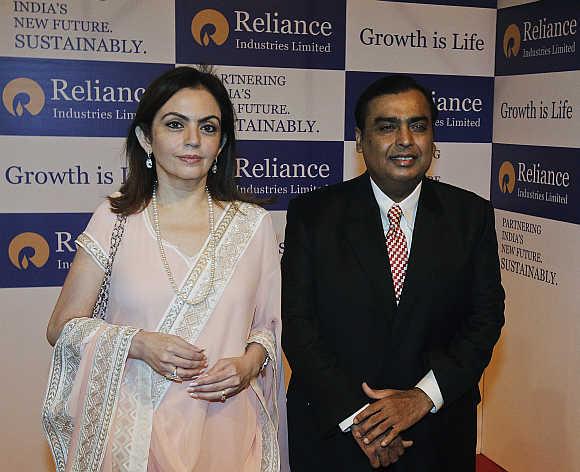

Mukesh Ambani, Sunil Mittal, Azim Premji and Anil Agarwal have lost their net worth by two, nine, 10 and 25 per cent to $19.95 billion, $14.39 billion, $12.10 billion, $7.43 billion, respectively.

Their losses get sharper as their net worth is converted from the rupee into the dollar. This is likely to affect their position in the global billionaire club.

Click NEXT to read more...

India's Billionaire club: Who won, who lost

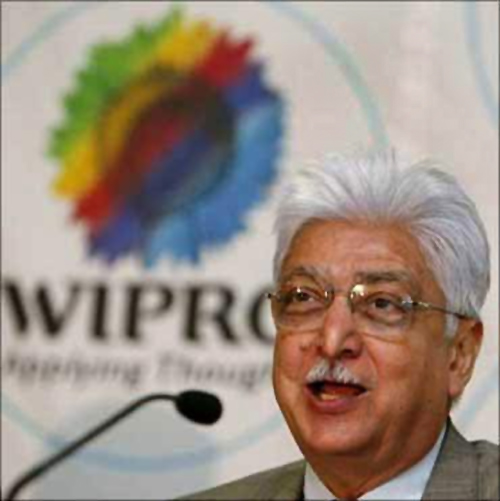

The loss in net worth of Premji is also attributed to the demerger of non-IT business of Wipro that saw a correction of over 12 per cent in the market capitalisation of the company in April.

Besides, its growth in the US has not been as robust as that of HCL Technologies.