| « Back to article | Print this article |

How the govt can ensure a house for every Indian

While private sector initiatives in low-income housing sector are burgeoning, further growth requires some government subsidies, writes Rajni Bakshi.

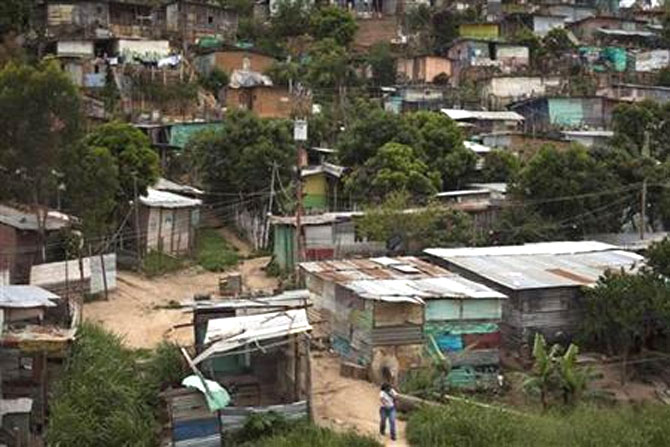

Supplying housing for low-income customers has been seen as a big opportunity for the private sector over the last decade. Why then is the gap between supply and need still so huge?

According to government estimates there is a shortage of more than 18 million homes in India. Out of this about 15 million homes are required in the segments known as ‘economically weaker sections' and 'low income group'. These are families with a monthly income of about Rs. 16,000.

A recent study by the consultancy firms Monitor and Deloitte shows that while private sector initiatives in this sector are burgeoning further growth may require some government subsidies.

Housing for the low income sector is a crucial element of future economic growth which relies partly on urbanisation. Such urbanisation is being stunted by the exclusionary nature of our cities, according to Amitabh Kundu of the Centre for the Study of Regional Development at Jawaharlal Nehru University.

Prof Kundu has shown that the growth rate of population in cities with a population of 0.1 and one million has declined steadily from 2.96 per cent in 1981-91 to 2.76 per cent in 1991-2001 and 2.45 per cent during 2001-11.

Click on NEXT for more...

How the govt can ensure a house for every Indian

Lack of affordable housing is one of the elements of exclusion. Ironically, generating this kind of housing is a potentially huge business opportunity.

The study, by Monitor-Deloitte, titled “State of Low-Income Housing Market” estimates that supplying homes to the low income segment is a business opportunity worth about Rs 9 lakh crore for developers and Rs 7 lakh crore for housing finance companies.

This calculation is based on data which indicates that households with an income between Rs 10,000 to Rs 25,000 a month are in the market for privately built 'pucca' housing within the range of Rs 4 to 10 lakh.

It is widely known that both developers and finance companies have been stepping into this space. This is why at least 30,500 units below Rs 10 lakh (Rs 1 million) were launched in 132 projects across 22 cities between June 2011 and January 2013.

Ahmedabad, Mumbai and Indore have emerged as the leading locations for this expansion.

Click on NEXT for more...

How the govt can ensure a house for every Indian

Why then does the gap between demand and supply persist? According to the Monitor-Deloitte study, based on interviews with 27 active developers and 9 housing finance companies in 22 cities, low-income housing developers are operating in a difficult environment.

Among the key areas of difficulty are -- increasing land prices, increasing construction costs, long approval timelines, limited access to debt and high cost of debt.

The good news is that the government is recognising the important role of the private sector in this sphere. Therefore in some cases extra FSI, reduced taxes, fast approvals and earmarking of land for low income housing is playing a positive role.

However, the report argues, the key element may be targeted subsidies to low-income customers from the government. Additionally there is need to lower the cost of credit to both housing finance companies and developers serving low-income customers.

Click on NEXT for more...

How the govt can ensure a house for every Indian

At present a privately built flat with a carpet area of 269 sq.ft., which is the minimum stipulated size, would cost about Rs 560,000 in most cities.

Even a family at the top end of the economically weaker section category with the ability to make a down payment of Rs 60,000 can only afford a home worth Rs 295,000.

This means that unless there is a subsidy of Rs 260,000 such families may not be able to afford even the smallest privately built home.

There is also need to increase the number of developers in this sector. Affordable debt is the key requirement for this.

At present most developers spend about 18 months to get the required approvals and then another 18 months to construct. The study claims that if the approvals were given more rapidly the same developer could produce up to twice as many low income housing units with the same capital.

Click on NEXT for more...

How the govt can ensure a house for every Indian

Digitising land records would help to reduce transaction timelines. Earmarking areas in cities for housing for economically weaker sections could also increase the supply in this sector.

The study also recommends that certain regulations should be reconsidered. For example, it favors reducing the minimum size of a dwelling unit to 21 sq. mt.

A robust industry also requires public investment in customer education about the home buying process – including more transparency and better communication on issues like maintenance and delivery timelines.

Above all, there is need for state governments to provide an enabling economic climate for the low income housing sector to grow outside the metros in smaller cities and towns.