| « Back to article | Print this article |

Can 6 new airlines survive in the crisis-hit aviation sector?

Six new airlines, three national and three regional, are set to join the market even as the sector remains dogged by massive losses.

At airports across Chennai, Mumbai and Kolkata, seven ATR and two Airbus A320 aircraft of Kingfisher Airlines stand on the tarmac.

Recently, an aircraft lessor had agreed to take possession of one of the A320s but discovered the aircraft was inoperable.

Components had been removed, which had compromised its airworthiness, alleged the lessor. Vendors, lessors and airport operators want to monetise the assets of the grounded airline to recover their dues, even as employees agitate against non-payment of salaries and banks initiate processes to declare Kingfisher Airlines a willful defaulter.

Recent reports suggest SpiceJet owes about Rs 200 crore (Rs 2 billion) to the Airports Authority of India, or AAI, and various tax authorities as "adverse operating environment has impacted its performance".

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Aviation is not a business for the faint-hearted. In the last financial year, Jet Airways and SpiceJet, the two carriers listed on the stock market, reported record losses of Rs 4,130 crore (Rs 41.30 billion) and Rs 1,003 crore (Rs 10.03 billion), respectively.

For state-owned carrier Air India (which is surviving on a bailout package of Rs 30,000 crore running up to 2020-21), net losses widened to Rs 5,388 crore.

Advisory firm Centre for Asia Pacific Aviation, or CAPA, estimates in the current financial year the industry is set to lose $1.3-1.4 billion as compared $1.7 billion in 2013-14. IndiGo continues to be the only airline to consistently report profits.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Amid all this gloom, the civil aviation ministry has granted no-objection certificates to six new airlines: three scheduled national carriers (Air One Aviation Services, Zexus Air Services and Premier Airways) and three regional operations (Air Carnival, ZAV Airways and Turbo Megha Airways).

Though all these airlines are yet to secure flying permits from the Directorate General of Civil Aviation, the latest round of permissions doubles the number of incumbents clawing out for a piece of the Indian skies.

The country already has half a dozen airlines: Air India, Jet Airways, SpiceJet, IndiGo, GoAir, and Air Costa.

In addition, price warrior AirAsia India started operations in June, and Tata-Singapore Airlines is expected to take to the skies in October.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Crowded skies

The big question is: won't six new carriers at this stage push the sector further into the red?

The new carriers, say government officials, are largely meant to improve connectivity and make way for greater competition which, in effect, will lead to more consumer-friendly practices (read lower fares) in the domestic aviation market. A civil aviation ministry official says, "The new minister (Ashok Gajapathi Raju) wants to improve connectivity; his focus is to benefit the consumer."

Some experts say it is not the government's job to restrict competition in any sector in order to benefit the incumbents.

Attrition happens in every industry, and the less efficient players have to make way for the more efficient ones.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

The civil aviation ministry should ensure that rules do not favour one over the other and the highest standards of safety are maintained.

"It is good to see new players entering the airline industry. This indicates the new government's intention to focus on larger issues of aviation safety and security and quit playing God. Industry dynamics are best left to market forces," says Amber Dubey, partner and India head of aerospace and defence at KPMG.

Surely, it cannot be denied that new airlines will make the sector more competitive, but it won't be all smooth sailing for them. In seven years leading up to 2014, high costs and a weakening operating environment have meant that cumulative losses of airlines in the domestic space have piled up to $10.6 billion.

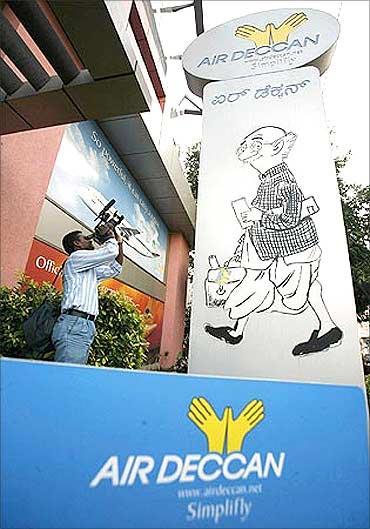

The ensuing years have seen apart from Kingfisher Airlines, Air Deccan, Deccan360, MDLR, IndusAir and Paramount Airways wrap up operations.

Some analysts even draw parallels to 1991 when the sector was opened up: six-odd private airlines had started operations - Damania Airways, ModiLuft, East West, Span Air, Gujarat Airways and Skyline NEPC - only to down shutters within five years.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

The operating environment continues to be challenging. High taxes on aviation turbine fuel, or ATF, have made its price in India among the highest in the world. Fuel comprises around 50 per cent of an airline's operating expenses.

To add to it, the salaries of pilots have risen through the roof and international airlines have often raised concerns about the high airport charges in India.

AirAsia India, for one, had initially said it would not fly to Delhi and Mumbai citing steep charges and only recently considered revisiting these options due to traffic considerations.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Also, one sector - Delhi-Mumbai - accounts for the bulk of the traffic in the country.

Given the operating dynamics, Dubey admits there are serious challenges for a new airline in the country.

"Some of the new airlines may prove to be trailblazers, while others may simply fold up or get acquired by larger players. Given the low air traffic penetration in India, there cannot be more than four strong pan-India carriers. The others may have to focus on niche routes and avoid head-on competition with the larger players."

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Room for more?

So what has lured the new entrants into a business where the odds seem to be stacked against them?

An industry executive who does not wish to be identified says: "India has come a long way from the mid-1990s when it had many failed airline ventures. The airlines at the time suffered from the licence-permit raj, unfair competition with Air India, growth restrictions and unprofitable routes. The policies have become relatively transparent and more business-friendly these days. The government is mulling reforms to boost connectivity through development of low-cost airports, tourist circuits et cetera. Talks are on to lower state taxes on airline and make ATF pricing transparent."

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

Still others say there is a huge upside for the sector in India in the long run.

"Air traffic is expected to grow multi-fold. India is set to emerge as the third largest aviation market in the world by 2020. The opportunity is huge. The new entrants do not have legacy costs attached to them, they can start on a clean balance sheet which is a considerable advantage," says another industry executive.

In fact, India is currently one of the most under-penetrated aviation markets in the world. According to data shared by AirAsia Group while releasing financials in December 2012, India has a fleet of around 422 aircraft for a population of 1.2 billion. In comparison, China has a fleet of 1,981 aircraft for 1.3 billion.

A CAPA study in 2012 indicated the number of domestic airline seats per capita was very low in India: just 0.07 compared with 3.35 for Australia, 2.49 for the US, 1.38 for Canada and 1.05 for Japan.

Please click NEXT to read more…

Can 6 new airlines survive in the crisis-hit aviation sector?

With domestic air passengers in the country projected to triple to around 175 million per annum by 2021 from 58 million in 2012, AirAsia India and Singapore Airlines have announced new ventures to cash in on the growth.

Some observers say the participation of Tata Sons in both the venture highlights the long-term potential of the Indian aviation market.

Among the new airlines, Alok Sharma-promoted Air One, which currently operates charter services to domestic as well as international destinations, will be headquartered in Delhi. Zexus Air Services also has a blueprint to start services out of the capital.

Umapathy Pinaghapani's Premier Airways is likely to be based out of Bangalore. According to the proposal sent to the ministry of civil aviation, regional carriers Turbo Megha and Air Carnival are expected to operate in southern India, while ZAV Airways (registered in Kolkata) is looking at services in the north-east and eastern India. One thing is for sure, the flier won't complain.

RIDING ON HOPE

New airlines and their promoters

PREMIER AIRWAYS

Umapathy Pinaghapani

V Chidambaram

A Boopalan

B Vausmathy

Bavani CT

Vali Umapathy

Shanti Arumugaswami

Ganesh Shanmugham

AIR ONE SERVICES

Alok Sharma

Shashi Bala

Chirag Sharma

ZEXUS AIR SERVICES

Surendar Kumar Kaushik

Ram Kishan Sharma

AIR CARNIVAL

Irudayanathan Selvaraj

Lima Rose Irudayanathan

ZAV AIRWAYS

Vijay Vora

Kishor Chandra Zavery

TURBO MEGHA AIRWAYS

Umesh Vankayalapati

Ram Charan Tej Konidala