| « Back to article | Print this article |

300 mn to enter banking net, ATM makers rejoice

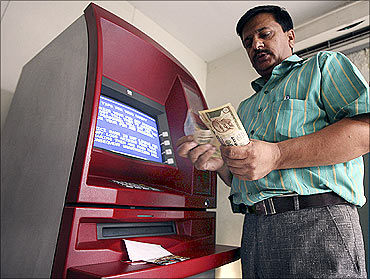

The big challenge, says Karthik Ganapathi, vice-president of automated teller machine maker Diebold's South Asia business, is that India will bring some 300 million people into the banking system for the first time over the next few years.

"That's (almost) larger than the population of the United States," he adds, to put the number into perspective.

By 2017, research provided by NCR Corporation, another ATM maker, suggests that the installed base of these machines in India will reach 400,000 machines, from about 100,000 in the third quarter of 2012.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

This translates into a compound annual growth rate of 28 per cent compared to 2011, and overall growth of 350 per cent during the full period.

That is precisely why some of the world's largest ATM makers, such as Diebold and NCR Corporation, are fixated with India -- and Finance Minister P Chidambaram's Budget announcement, that every public sector bank branch in the country will have an ATM by March next year, has only added to the momentum.

Together, Diebold and NCR Corporation claim to control about 70 per cent of the country's ATM marketplace -- and India, along with Brazil and China, are the three big growth markets of the future for these 'self-service' solutions firms.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

But beyond the surface of spectacular growth opportunities, there is also a gradual commitment to invest in the subcontinent that could effectively put India at the centre of a global ATM revolution.

Diebold, for instance, has its largest engineering presence outside the United States, where it's headquartered, across three locations in India, while NCR Corporation, too, has one of its largest collection of manufacturing and R&D centres anywhere in the world based out of the country.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

Big business

"India is one of our top priority markets, and the only other market comparable to China in terms of growth," explains Diebold's Ganapathi, "India's ATM density has tripled in the last four years, but it still remains lower than China."

India has 74 ATMs per million, while China's density is about 300 ATMs per million.

Over the next three years, it's projected that the Chinese will have about 400 ATMs per million, though India could struggle with 120 ATMs per million, Ganapathi adds.

But that's still big business.

"The anticipated deployment of ATMs in the next five years is huge," said NCR India managing director Jaivinder Gill.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

"Most of the concentration of ATMs in India are seen only in urban areas and relatively low in the interiors or Tier-II and Tier-III towns and villages.

The recent RBI directive on inclusion banking and the public sector banks' assurance to expand their presence to reach the unbanked will see significant action in rural India."

Gill and his sales team, incidentally, were away in Hawaii recently to celebrate a successful year after meeting company targets.

So, even though money may be tight in the economy, are those who dispense it raking in the cash?

Diebold's 2012 Q4 earnings presentation says that the firm "expects relatively flat revenue for 2013" despite "growing backlog activity in certain areas, such as its Asia Pacific".

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

Ganapathi remains bullish on India in the longer term.

"The rapid ramp-up will happen in Tier-II-and-III cities, and that's where the challenge comes in," he adds.

India, simply, is where future growth lies.

Yet, these self-service firms will require more than just enough ATMs to go around, along with proportionate service manpower and infrastructure.

They will also need to content with the subcontinent's challenges of remote locations, unreliable power and quick rollouts.

That's where innovation rooted in this region can play its part.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

Investing in India

Take the Diebold D429, for instance.

Touted as the 'world's first intelligent-powered automated teller machine' because it can automatically switch between using solar, AC grid or internal battery power, it's been designed for -- and in -- India.

"India is at the heart of Diebold's R&D, and this (the Diebold D429) is the first manifestation of the reserve engineering move that is taking place," says Ganapathi.

"From scratch, it was conceived, designed, developed and delivered, here."

Of course, Diebold's global network supported the entire project, but this ATM was particularly designed to ensure the firm could remain central to the banking services expansion in India, especially the extensive rural roll-out of ATMs.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

This meant that Diebold's 500-odd engineering and application development workforce was plugged into the project, to create an ATM that the firm says consumes 40 per cent less energy than the previous generation of cash dispensers available in the Indian market.

For NCR, India is a part of a dedicated Emerging Markets Group, comprising Brazil, India, China, Hong Kong, Taiwan, West Asian countries and Africa, a segment served by the company's manufacturing facility in Puducherry.

It works in tandem with NCR's R&D centre in Hyderabad, which started in 2004 with a 40-member team focused on ATM application development, but now houses over 600 employees developing software for all lines of business including financial, retail, travel and payments, and serves customers in more than 50 countries.

Click NEXT to read further. . .

300 mn to enter banking net, ATM makers rejoice

"Over the next few years, we will look at expanding in new sectors such as general retail, telecom and technology," adds NCR's Gill.

But, for now, India's lucrative ATM business is likely to remain at the centre of the action.

MONEYED MOVE

- 400,000 will be the installed base of automated teller machines in the country by 2017, as projected by ATM maker NCR Corporation

- 28% is the compound annual growth rate of the business compared to 2011

74 ATMs per million are there in the country, compared with China's density of 300 ATMs per million - 120 ATMs per million has been projected in the country over the next 3 years, compared with China's 400 ATMs per million