| « Back to article | Print this article |

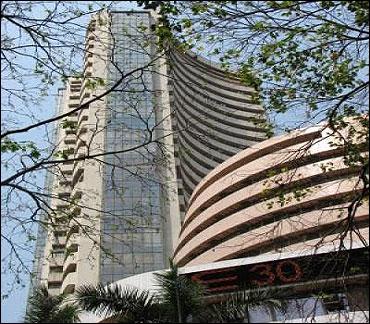

Markets start Dec on a promising note

Benchmark share indices started December on a promising note on the back of strong rally in the global markets Wednesday.

However, both the key share indices ended off their day's highs weighed down by a lacklustre opening in European stocks and Dow futures trading lower.

The Sensex which touched an intra-day high of 16,718 finally ended up 360 points at 16,483 while the Nifty which touched an intra-day high of 5,012 closed higher by 105 points at 4,937.

Earlier, domestic share markets had opened higher and gained momentum after global share markets rallied on Wednesday following a concerted effort by the US Federal Reserve, European Central Bank, Bank of England, and central Banks of Canada, Japan and Switzerland to increase liquidity in the banking system to tide over the debt crisis.

Click NEXT to read further. . .

Markets start Dec on a promising note

They decided to lower pricing on US dollar swaps by 50 basis points from December 5.

Meanwhile in Asia, the decision of the world's six major central banks to tame a liquidity crunch for European banks by providing cheaper dollar funding, took markets higher. Hang Seng soared 5.6% to 19,002.

Nikkei went up 2% to 8,597. European markets were in the red, however, with CAC and DAX slipping nearly 1% each.

Food inflation witnessed a sharp moderation to 8% for the week ended November 19, though prices of most agricultural items, barring potatoes, onions and wheat, continued to rise on an annual basis.

Click NEXT to read further. . .

Markets start Dec on a promising note

Food inflation, as measured by the Wholesale Price Index, was 9.01% in the previous week ended November 12. It stood at 9.03% in the corresponding week of the previous year.

BSE healthcare index slipped 0.3% to 6,036.

However, BSE metal and bankex held on to gains and were up 4% each in trades.

Hindalco jumped 7% to Rs 131. ICICI Bank was the biggest contributor to the Sensex, and along with Reliance, accounted for over 100 point in the rally. Sterlite, DLF, Tata Steel and Jindal Steel surged 4-6% each.

BSE auto index moved up 2.4% to 8,637 as auto majors started to report sales numbers.

Tata Motors surged 6% to Rs 183 after the European Commission listed it as India's top-ranked company for research and development.

Hero MotoCorp surged 4.3%. Bajaj Auto surged 2%. Mahindra & Mahindra rose 1% at Rs 730 after reporting 53% rise in sales in November.

Click NEXT to read further. . .

Markets start Dec on a promising note

However, Maruti Suzuki was down 0.7% on reporting a 18.4% sales drop to 91,772 units for the month of November. Maruti's Manesar plant will, however, run at full capacity by January, producing 800 cars a day.

BHEL shed 2.5% to Rs 275. Bharti Airtel and Hindustan Unilever were also in the negative zone andended down 1.5% each.

Reliance MediaWorks jumped 4.5% after the company signed a pact with Chennai-based media firm VenSat Tech Services.

Cement stocks were up ahead of their monthly sales figures. Burnpur Cement, OCL India, ACC, Prism Cement, India Cements and JK Lakshmi Cement rose 1-4% each.

"Positive outlook over next 3-5 sessions on cement shares. ACC and India Cement might be aowrtha long position," said technical analysts Devangshu Datta.

BSE market breadth was positive.

Out of 2,920 stocks traded, 1,687 shares advanced while 1,113 shares declined.