Photographs: Mukesh Gupta/Reuters. Malvika Joshi in Mumbai

The rupee was Asia's worst performing currency this year, and the outlook for 2012 also remains bleak.

Despite measures taken by the Reserve Bank of India (RBI) to prevent volatility in the foreign exchange market, weak domestic fundamentals have corroded the India growth story, prompting foreign investors to pull out, subsequently weakening the rupee.

"The downward pressure on the rupee is expected to persist into early 2012, as balance of payment risks are unlikely to recede until global and local fundamentals improve, leading to sustained portfolio inflows," said Priyanka Kishore, foreign exchange strategist, Standard Chartered.

...

Currency woes: Rupee to remain bleak in 2012

Image: Women stand next to a shop selling garlands made of Indian currency notes.Photographs: Mukesh Gupta/Reuters.

"We expect the rupee to remain at around the 53 level till March," she said.

The rupee has depreciated about 19 per cent since January and the strong downward pull is likely to leave little scope for a substantial rebound in the coming months.

Though the currency fell sharply even during 2008, from 39.42 to 48.8, the probability of a quick rebound is feeble this time, as India's growth prospects are now being questioned.

...

Currency woes: Rupee to remain bleak in 2012

Image: A worker stamps balls before they are packed at a factory in Meerut.Photographs: Parivartan Sharma/Reuters.

Experts said inflows in 2011 were mainly in debt, owing to the attractive yields, and this acted as a cushion for the rupee.

"The situation is worse this time, compared to 2008, because investor confidence in India's growth story has declined," Kishore said.

India's gross domestic product (GDP) growth may even decline to seven per cent in the next financial year, forex strategists said. GDP growth had fallen to 6.8 per cent in 2009 from 9.3 per cent in 2008.

...

Currency woes: Rupee to remain bleak in 2012

Image: A vendor carries garlands of marigold flowers at a wholesale flower market in Kolkata.Photographs: Jayanta Dey/Reuters.

However, the recovery was quick and it bounced back to eight per cent in 2010. RBI's GDP forecast stands at 7.6 per cent, which is likely to be scaled down at the next monetary policy review.

India's high dependence on inflows from Europe severely hit the rupee this year. "During 2008-2009, it was the US that was hit, and spillover impacts on India were short-lived.

This time, the euro nations have been hit, and these are major sources of foreign fund inflows to India," said Abhishek Goenka, chief executive, India Forex Advisors.

...

Currency woes: Rupee to remain bleak in 2012

Image: A shopkeeper counts Indian currency notes inside his shop in Jammu.Photographs: Mukesh Gupta/Reuters.

The ratio of foreign institutional investors (FIIs) flows to emerging economies from the euro zone to that from the US stands at 2:1, he said.

The euro zone crisis has constantly been blamed for the flight of foreign funds from India, while the part played by the US downgrade has been largely underplayed.

The debt crisis of the 17-nation bloc reduced the risk appetite of global investors, and the scenario was further worsened by the US debt downgrade by Standard & Poor's in August.

...

Currency woes: Rupee to remain bleak in 2012

Image: A Kashmiri shopkeeper sits near garlands made of Indian currency notes at a market in Srinagar.Photographs: Fayaz Kabli/Reuters.

The net FII outflow during August stood at Rs 7,902.5 crore, while the net equity outflow stood at Rs 10,834 crore, according to the Securities and Exchange Board of India.

"The US was downgraded in early August. Downside pressure on the rupee mounted, as oil payments to Iran were bunched up and euro zone-related uncertainties increased," said Kishore. During the first half of this year, trade deficit on the oil account stood at $43.4 billion and the overall trade deficit stood at $73.5 billion, according to RBI.

...

Currency woes: Rupee to remain bleak in 2012

Image: An employee arranges Indian currency notes at a cash counter inside a bank in New Delhi.Photographs: Mukesh Gupta/Reuters.

Early this year, India was expected to be one of the best bets for investors on the lookout for safe options, in a fast deteriorating global economic scenario.

Ironically, the US downgrade made investors run for dollar bonds, drying up the dollar supply, and the rupee started depreciating rapidly.

It hovered between 44 and 45 in July-August, and then began touching new lows almost every day.

...

Currency woes: Rupee to remain bleak in 2012

Image: An employee sorts Indian currency notes at a cash counter inside a bank.Photographs: Jayanta Dey/Reuters.

Today, the rupee closed at 53.05, while four months ago, 50 was considered a crucial level, one that could trigger major changes in perception.

"We had not expected the rupee to fall beyond 48 in the beginning this year," said Pramit Brahmbhatt, chief executive, Alpari India.

The rupee crossed the half-century mark in early November. High inflation and monetary tightening by the central bank to curb inflationary pressures further degraded the growth outlook, leading to more FII outflows.

...

Currency woes: Rupee to remain bleak in 2012

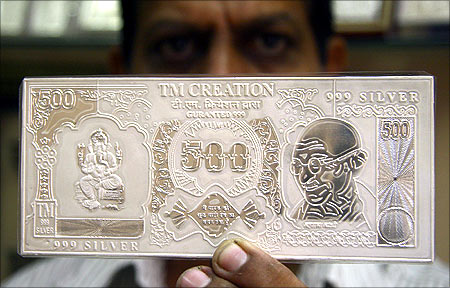

Image: A jeweller displays a silver plate in the form of an Indian rupee note.Photographs: Ajay Verma/Reuters.

"Unlike the last time, we are being hit by multiple issues at the same time. These included high interest rates, high inflation, excessive oil imports and re-payment of foreign currency convertible bonds," said Goenka of Indian Forex Advisors.

The gloomy global scenario, a policy paralysis, burgeoning fiscal deficit and a series of scams further reduced the rupee's appeal.

"This year, the rupee initially weakened on account of the US downgrade and issues in the euro zone. But beyond the 47-48 levels, the depreciation was largely on account of domestic factors," said Brahmbhatt.

...

Currency woes: Rupee to remain bleak in 2012

Image: A bank employee counts bundles of Indian currency at a cash counter in Agartala.Photographs: Jayanta Dey/Reuters.

The central bank, which had been mute on foreign exchange interventions, came out with a series of measures from the last week of November, when the rupee continued on its fast-paced downward trajectory, falling below the 52 level in the second week of November.

The measures to curb sharp volatility in the rupee included removing the cap on foreign currency inflows through rupee swaps, a 50-basis point increase in spreads on external commercial borrowings and de-regulation of non-residential external deposits and non-resident ordinary account deposits.

...

Currency woes: Rupee to remain bleak in 2012

Image: The Reserve Bank of India (RBI) logo is pictured outside its head office in Mumbai.Photographs: Danish Siddiqui/Reuters.

The central bank also sold $1.8 billion so far this financial year, according to recent RBI data.

The intervention was carried out during September and October to curtail the volatility in the rupee.

However, these measures have not been able to lift sentiments and reverse the rupee's movement against the greenback, as domestic factors remain weak.

...

Currency woes: Rupee to remain bleak in 2012

Image: A man deposits his money in a bank in Amritsar.Photographs: Yasir Iqbal/Reuters.

"The firefighting measures by RBI to curb the free fall of the rupee would take time to show results. Till inflation reaches a comfortable level and Bills that are pending for clearance are not passed, the rupee's movement cannot be solely predicted on the basis of the measures announced," said Brahmbhatt.

Also, this time RBI is looking at alternate ways to increase the dollar supply, instead of depleting reserves.

Though reserves stand at $302 billion, compared with $297 billion in 2009, the capacity to firefight is much less this time, as FII inflows are not likely to rise till concerns in the euro zone are addressed, experts said.

article