| « Back to article | Print this article |

Reliance profit up 1.5%, turnover tops Rs 1 lakh crore

Reliance Industries on Monday reported a 1.5 per cent increase in September quarter profit, the slowest in a year, as refining margins declined even as it became the first company in the country to achieve sales of more than Rs 1,00,000 crore (Rs 1 trillion) in a quarter.

Net profit rose to Rs 5,490 crore (Rs 54.90 billion) in July-September from Rs 5,409 crore (Rs 54.09 billion) a year earlier, Reliance said in a statement.

Turnover or sales soared 14.2 per cent to Rs 1,06,523 crore (Rs 1.06 trillion). The oil-to-yarn and retail conglomerate said higher sales in the refining and petrochemicals businesses and a weaker rupee helped to cushion the impact of falling gas production at its main fields in the Krishna Godavari basin, a dip in refining margins and muted revenue from organised retail.

The company earned $7.7 on turning every barrel of crude oil into fuel in Q2 compared with a gross refining margin of $9.5 a barrel a year earlier and $8.4 in the preceding three months.

The company processed a record 17.7 million tons of crude oil in the quarter. Profit was also impeded by a 13.6 per cent rise in spending on power and fuel and selling expenses on increased exports to Rs 13,101 crore in the first half.

Click NEXT to read more...

Reliance profit up 1.5%, turnover tops Rs 1 lakh crore

The company had cash and equivalents of Rs 90,540 crore (Rs 905.40 billion) at the end of Q2, more than enough to cover Rs 83,982 crore (Rs 839.82 billion) of debt.

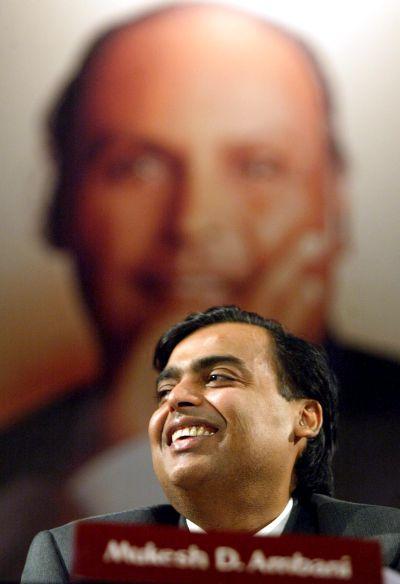

RIL Chairman and Managing Director Mukesh Ambani said the performance reflects the resilience of the firm's business model in "a period of volatility and uncertainty."

"Our diversified and integrated petrochemicals business captured margins across segments – delivering near-record profit levels even as the domestic economy slowed," he said, adding the company earned healthy operating profits by optimal utilisation of its twin refineries.

"Reliance's ongoing counter-cyclical investments will strengthen our competitive position in each business segment," he added.

Click NEXT to read more...

Reliance profit up 1.5%, turnover tops Rs 1 lakh crore

RIL's profit before interest and tax from the refining business dipped almost 10 per cent to Rs 3,174 crore (Rs 31.74 billion) as petrol and diesel demand slumped.

KG-D6 gas output fell to about 13.4 million standard cubic meters per day due to "geological complexity and natural decline in the fields." The segment pre-tax profit dipped 59 per cent to Rs 356 crore (Rs 3.56 billion).

Higher petrochem prices helped the company to post a 44 per cent higher segment pre-tax profit of Rs 2,504 crore (Rs 25.04 billion).

In the retail business, RIL said the September quarter was "difficult" as factors such as "subdued economic growth, continued inflation and devaluation of the rupee have resulted in the dip in consumer confidence."

"Additionally, high volatility in gold prices coupled with high import duties and restrictions on import have impacted the jewellery sector. Further, extended business disruptions due to regional unrests in Andhra Pradesh also had an impact on the retail sector," it said.

RIL shares rose 0.8 per cent to close at Rs 870.30 on the BSE. The results were announced after close of trading. During 2Q, the Jamnagar refineries processed 17.7 million tons of crude and achieved a utilisation rate of 114 per cent.

"In comparison, average utilisation rates for refineries globally during the same period were 86.7 per cent in North America, 78.7 per cent in Europe and 85.2 per cent in Asia," the statement said.

RIL said its refining business was "positively impacted by increased crude throughput, stable middle distillate and naphtha cracks, and favourable exchange rate movement. This was partly offset by weak gasoline and solid products (pet-coke/sulphur) cracks, widening Brent-Dubai differential and lower domestic sales on weak demand."