| « Back to article | Print this article |

RBI rate cut: What India Inc has to say

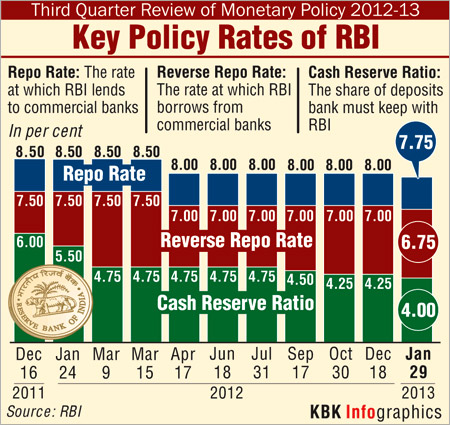

The Reserve Bank of India on Tuesday slashed its key interest rates by 0.25 per cent and released Rs 18,000 crore additional liquidity into the system to perk up growth through reduced cost of borrowing.

RBI Governor D Subbarao in the third quarter monetary policy review surprised the market by cutting short-term lending rate called repo by 0.25 per cent to 7.75 per cent and cash reserve ratio by similar margin to 4 per cent, releasing Rs 18,000 crore primary liquidity into the system.

Click NEXT to know how does India Inc react to this rate cut. . .

RBI rate cut: What India Inc has to say

V Lakshmi Narasimhan, CFO, Magma Fincorp Ltd

The announcement is on expected lines and communicates RBI's concern on the growth.

So long as the twin issues of fiscal deficit and inflation are under control, we can expect RBI to take a proactive action on further rate cuts.

The measures announced by the RBI on Tuesday will spur growth and ease the prevailing tight liquidity condition.

The rate cut is an encouraging move which will infuse liquidity and help in catalysing growth.

The combined impact of repro rate cut and CRR cut will be a boost to our economy and will help in the enhancement of bank credit to the industry".

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Rahul Goswami -- CIO Fixed Income, ICICI Prudential AMC

RBI continued on its calculated management of growth versus inflation with the current policy being a 'tipping point' from managing inflation to driving growth.

The revision of growth forecast from 5.8 to 5.5 per cent and the March 2013 from 7.5 per cent to 6.8 per cent supports this shift and provides further head room for RBI to continue to the monetary easing path.

While reduction of repo rates by 25 bps has been in line with expectations, the 25 bps reduction in CRR has positively surprised given that RBI has already been maintaining low CRR at around 4.25 per cent.

While inflation has started to moderate, systemic risks remain through the elevated levels of Current Account Deficit and Fiscal Deficit.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

However, we do believe that the government has demonstrated intent and also initiated steps towards containing the same.

Continued efforts from the government has the potential to bring down the fiscal deficit by around 100 bps over the next 2 years from 5.3 per cent of gross domestic product this fiscal to around 4.1-4.2 per cent by FY2015.

On the liquidity front, liquidity conditions tightened since November because of build up of government cash balances, strong currency demand and structural pressure through widening wedge between deposit and credit growth.

With Tuesday's reduction in CRR, we expect Rs 18,000 crore (Rs 180 billion) of primary liquidity to be injected into the banking system.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Going forward the next big event trigger is the budget.

The budget will be closely watched on government steps taken on improving the revenue stream and containing expenditure, including subsidies.

In the absence of any significant upswing in inflation, and continued focus by the government on containing fiscal deficit, RBI will be provided with further scope to reduce rates by another 50bps over the next two policies.

This, therefore, still provides opportunity for retail investors to enter the fixed income market.

We continue to recommend investment into duration products in the 18-24 months maturity bucket based on risk appetite.

From the retail perspective, we recommend funds like the Regular Savings Fund, Corporate Bond Fund, Short Term Income Plan & Income Plan.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Pawan Goenka, president, Automotive and Farm Equipment Sectors, Mahindra & Mahindra Ltd

Over the past few months, the economic growth has clearly bottomed out and the slowdown in manufacturing is a concern.

Today's combination of a repo as well as CRR cut is a welcome announcement and hopefully will help revive investments in the core sectors which the economy needs.

Coupled with the recent policy announcement by the government, I see this as a good beginning.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Dipen Shah, head of Fundamental Research, Kotak Securities

RBI has cut both repo as well as CRR by 25 basis points each, better than the street expectations.

CRR cut would release Rs 180 billion immediately into the system.

While it is much lower than the Rs 900 billion plus LAF deficit, this is positive from monetary transmission perspective as banks can now earn interest on the money released from lower CRR.

Nonetheless, we believe most banks may wait for some more time before cutting their base rates.

Only few days back, large private sector banks have raised their fixed deposit rates for few buckets as the gap between deposit mobilisation and loan growth has increased (incremental C/D ratio during last 9 months: 102 per cent).

We believe, unless deposit mobilization picks up, banks are less likely to cut their base rates aggressively, going forward.

Hence, we believe, that while the RBI action is positive, asset quality would continue to drive stock performance in the near term."

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Paras Gundecha, president, MCHI-CREDAI

MCHI-CREDAI, voice of the developer community, described the RBI's decision to cut repo rate and CRR by 25 basis points as a small, but good beginning.

"Though it is a small step, we do hope that RBI will come out many more steps to facilitate bankers to cut rates of interest," said Paras Gundecha, president of MCHI-CREDAI.

Also, developers hope that bankers will follow suit by cutting down lending rates and help home buyers, he said.

The CRR rate cut should boost liquidity in the real estate market, thereby releasing the pressure off cash-strapped developers, Gundecha said.

He recalled that the last year was particularly bad for the real estate sector with very few new project launches due to tight liquidity conditions and fall in sales due to high rates of interest and costly equated monthly investment schemes.

"We sincerely hope that RBI will take some pragmatic decision to support the capital and labour intensive real estate sector," he said and called for making the market conditions helpful for an unrestricted growth of realty which supports hundreds of other industries.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

Welcoming the RBI's decision to reduce repo rate by 25 bps and the cash reserve ratio by another 25 bps, Adi Godrej, president, CII, said that Industry appreciates the signal from the RBI that the Central Bank is ready to promote growth in addition to anchoring inflationary expectations.

In terms of quantum, the industry would have appreciated a higher repo rate cut, but under the present circumstances the 25 bps lowering of repo rate does send the correct signal, Godrej said.

The government has been actively pursuing a fiscal consolidation agenda and therefore, it is fair to expect that in the Union Budget to be presented on February 28, the Finance Minister would outline a clear roadmap and measures which would bring down fiscal deficit within reasonable levels.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

A very high level of government borrowing to bridge the fiscal deficit would nullify any reduction in headline interest rates as real effective rates would continue to be high, and from that point of view the government's actions of late are most encouraging, as they show a clear intent and purpose of bringing the fiscal deficit down.

However, the current account deficit would remain a matter of worry for policy makers, the CII president said, echoing the concern that has been highlighted by the RBI in its macroeconomic indicators published on Monday.

The RBI's projection of GDP growth for 2012-13 in the First Quarter Review of July 2012 was 6.5 per cent.

In the Second Quarter Review of October, this was revised downwards to 5.8 per cent, signalling increasing global risks as well as accentuated domestic risks on account of halted investment demand, moderation in consumption spending and erosion in export performance. CII has noted with great concern that the RBI has now reduced it to 5.5 per cent.

Click NEXT to read further. . .

RBI rate cut: What India Inc has to say

In addition, CII is in agreement with the RBI on its assessment of risks to the economy, said the CII release.

Domestically, the widening of the CAD to historically high levels in the context of a large fiscal deficit and slowing growth exposes the economy to the risks from twin deficits.

Financing the CAD with increasingly risky and volatile flows increases the economy's vulnerability to sudden shifts in risk appetite and liquidity preference, potentially threatening macroeconomic and exchange rate stability.

Global risks remain elevated, with the potential for spillovers on the Indian economy through trade, finance and confidence channels.

Inflation over the last three years has been a result of largely supply constraints.

The supply constraints need to be urgently addressed.

This will require developing an adequate, credible and flexible supply response in respect of those commodities and segments of the economy characterised by structural imbalances.

In the absence of an effective supply response, inflationary pressures may return and persist with adverse implications for macroeconomic stability.