Photographs: Reuters

What the industry and observers have been saying for quite some time -- that there is a lot of regulatory confusion on developing a corporate debt market -- has come out in the open with the RBI Governor and the Plan panel head speaking on the same topic in different languages.

In fact, regulatory and policy confusion reigned supreme when Reserve Bank Governor Duvvuri Subbarao questioned the feasibility and the ability of, both, the government and the banking system to meet the ambitious $1-trillion infrastructure investment planned for the next five years.

Meanwhile, Planning Commission Deputy Chairman Montek Singh Ahluwalia said that a corporate debt market can take the burden off and pitch in to meet the $500-billion funding gap in this regard.

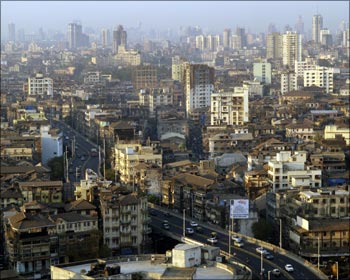

Subbarao and Ahluwalia were at the second foundation day of the Indira Gandhi Institute of Development Research, which is chaired by the RBI Governor late on Monday in Mumbai.

In fact, the Governor even disagreed with the finance ministry and the Planning Commission on inflation management and fiscal deficit cuts too.

. . .

$1-trillion for infra: RBI, Plan panel at loggerheads

Image: Planning Commission Dy Chairman Montek Singh Ahluwalia.Photographs: Reuters

In his address on the Challenges in the 12th Plan, Ahluwalia underlined the imperative for pumping $1 trillion into infrastructure such as highways, roads, ports and airports among others so that the country can achieve the 9 per cent growth trajectory over the next half a decade.

In his concluding remarks, Subbarao said, "Corporate bond market looks more like an impressionist view and not exactly based on proven facts. We need to really study the issue before going ahead with."

However, during his interaction with the press, Ahluwalia stressed that corporate debt market is the way out as the government and the banking system can meet only up to 50 per cent of the needed funding requirement.

"With the current level of capital account deficit and slowing FDI and high fiscal deficit, we cannot expect the government to fund the entire $1 trillion. Nor can banks take up this challenge head on. Therefore, only a corporate bond market can help chip in with the funding gap," he said.

These comments come on the heels of the government stepping on the gas by recently commissioning Ernst & Young India to draw up a roadmap on the corporate debt market. The E&Y study is being funded by the World Bank. E&Y will submit its report within the next six months.

. . .

$1-trillion for infra: RBI, Plan panel at loggerheads

Photographs: Reuters

These comments also come within a month of RBI Deputy Governor Subir Gokarn allaying any doubts about regulatory confusion on the issue. He had said that corporate debt market development is a complicated process as it involves all the regulators and the finance ministry, but all are earnestly involved in the process and are working in tandem.

Subbarao meanwhile pointed out that in the current Budget, only under $150 billion is allocated to capital investments and it will not be easy for the government to scale this up to fund infrastructure.

"Our regulation governing infrastructure finance is among the most accommodative in emerging markets," said Subbarao.

Bank lending to infrastructure is already stretched and more loans to the same sector might affect financial stability of the banks as their long-term nature would leave banks with huge asset-liability mismatches, he added.

"If the bank's non-food credit goes up to 15 per cent from the current 13.1 percent, it can meet only $250 billion . . . but banks are already overstretched. Along with plan allocation of under $100 billion and another $150 billion from the government will still leave us with a $500 billion gap. From where are we going to find this money?

. . .

$1-trillion for infra: RBI, Plan panel at loggerheads

Photographs: Reuters

Today RBI regulations allow a bank to fund up to 50 per cent of an infra project developed by a single entity, while it is only 40 per cent if the project is developed by a consortium, Subbarao said.

As per a Boston Consultancy forecast, domestic market can grow four-fold, from about $400 billion or 45 per cent of GDP in 2006 to about $1.8 trillion, or 55 per cent of GDP, by 2016. Within this, non-government segment can grow six-fold, from $100 billion in 2006 to $575 billion in 2016.

In the absence of a developed retail bond market, corporates do not have any incentive to raise capital, though this is mode of fund raising is cheaper than bank funds.

As per an Asian Development Bank report, the government bond market -- at around 40 per cent of GDP -- stands ahead of most emerging East Asian markets, while corporate bonds account for just about 4 per cent of GDP.

In absolute terms, total outstanding volume of government bonds stood at $364 billion as of end 2008, slightly behind only China and Korea.

. . .

$1-trillion for infra: RBI, Plan panel at loggerheads

Photographs: Reuters

Banks dominate the domestic bond market with over 85 per cent of total bonds/paper issued being dominated by government securities/bonds. Moreover, there is little retail participation as banks under the statutory liquidity ratio management are mandated to buy these government papers.

Currently, as much as 80 per cent of infra funding is met by banks, which is not sustainable in the long-run. Going by the long gestation period of infra projects, bank funding to the sector can lead to asset-liability mismatch of banks.

Also, up to 50 per cent of household savings, which stand at over 34 per cent now, go to banking and financial sector as there is no viable options left to them. Experts believe that if corporate bond trading picks, some of this money could go into this.

"The increasing view is that developing a corporate debt market can solve this gap, which is something to be studied and analysed," the RBI Governor said.

Subbarao also had a different view on government's ability to cut spending and bring down its deficit than that of with Ahluwalia.

. . .

$1-trillion for infra: RBI, Plan panel at loggerheads

Photographs: Reuters

In his speech, the Plan panel head indicated that a 9 percent GDP growth target was achievable and outlined the efforts at raising Plan expenditure over the 12th Plan period, beginning 2013 while consolidating its finances by cutting down on non-Plan expenditure and subsidies.

Subbarao also questioned the government's ability to do so and said it might not be feasible to cut down non-Plan outgoes, saying a significant part of non-plan spending is used to pay salaries to teachers, doctors and for maintenance of irrigation projects.

The Governor did not even spare the finance ministry and took issue with the latter's argument, presented in the Economic Survey, that a high inflation rate may be the new normal and an acceptable outcome of high growth. He stressed his resolve to an inflation rate below 5 percent this fiscal.

The last Economic Survey had said in evaluating the trade-off between lower inflation and lower growth, policymakers often overlook impact inflation control measures have on unemployment. Such an argument does not hold true in most parts of the world and certainly not here when inflation is as high, said Subbarao, citing research by RBI economists.

"If you try to drive up growth by driving up inflation, what you will get left with is high inflation," the Governor concluded.

article