| « Back to article | Print this article |

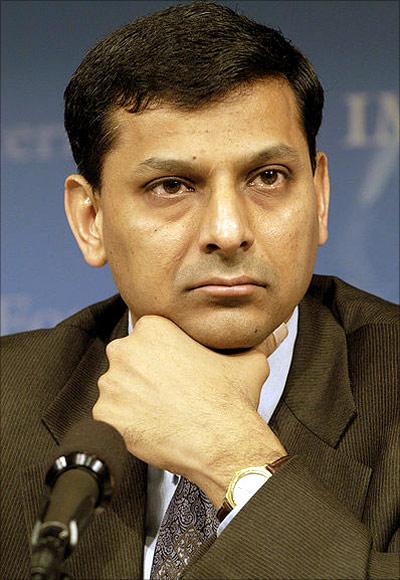

Raghuram Rajan: A lucky mascot for the rupee

Rollback of July tightening measures indicates comfort on currency but a repo rate hike is around the corner.

Raghuram Rajan seems a perfect talisman for the rupee. Ever since he's taken over as governor of the Reserve Bank of India (RBI), the currency has appreciated 8.76 per cent and is now stabilising between 61-62 against the dollar.

Not surprisingly, then, that Rajan has opted to cut the marginal standing facility or MSF (short-term rates) by another 50 basis points (bps), barely weeks after he cut it by 75 basis points on September 20.

Click NEXT to read more…

Raghuram Rajan: A lucky mascot for the rupee

Incidentally, his predecessor had opted to tighten short-term rates to bring more stability to the rupee, and Rajan's rollback indicates the currency crisis is over for now - unless something drastic happens in the developed world, which seems unlikely as of now, with the US Federal Reserve choosing to defer the gradual rollback of its quantitative easing programme to January 2014.

But the rollback of July's tightening measures and a 50 basis point cut in the MSF rate are not symbols of monetary easing.

Click NEXT to read more…

Raghuram Rajan: A lucky mascot for the rupee

In fact, all that Rajan is attempting to do is stabilise the monetary policy conditions, wherein the differential between the MSF rate and repo rate is back to normal levels of 100 basis points.

After cutting MSF by 50 basis points, Rajan is expected to hike repo rates from the current 7.5 per cent levels so that the difference between the repo rate and the MSF rate is no more than 100 basis points.

Click NEXT to read more…

Raghuram Rajan: A lucky mascot for the rupee

The differential between the two currently stands at 150 basis points.

Ritika Mankar Mukherjee, economist at Ambit, says: "We expect RBI to further normalise this spread to 100 bps by reducing the MSF rate by another 25 bps and hiking the repo rate by 25 bps. We expect this monetary policy intervention to be administered anytime between now and the scheduled October 29 monetary policy review, depending on the evolving conditions in foreign exchange markets."

The other possibility is that the repo rate may be hiked in two tranches to eight per cent.

Not everyone believes MSF may be cut by another 25 bps. Tirthankar Patnaik, chief economist at Religare Institutional Research, expects a pause on the October 29, but expect rates to move up 25 bps (on the repo) by December, and another 25 bps if needed by the last quarter of the current financial year, as the central bank moves from emergency rupee-measures to an old-fashioned anti-inflationary stance.