| « Back to article | Print this article |

Petrol price hike: How does it affect the common man?

The steep hike in the petrol prices have left people across all sections of the society completely enraged. We find out how it really affects the common man and how one can circumvent the situation with right investment.

On the eve of UPA government completing three years in power in its current term, it gave the country a jolt - the state-owned oil marketing companies increased petrol prices by a record Rs 7.5 per litre. Petrol prices went up to Rs 78.57 to create a historic high on May 23, 2012.

While RBI is still battling rising inflation, it now has the tough task of managing inflation in the light of increased petrol prices.

This has obviously sent shockwaves to the common man who is trying hard to make ends meet in an inflationary environment.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

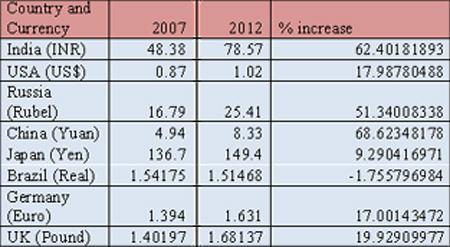

Is the Indian consumer the only one facing a price rise?

Seen here, the price of petrol has risen over the period of five years in different countries. India's petrol price has grown over by 60 per cent during the past five years.

If the turmoil in the Middle East continues and the rupee falls unabated, this price rise will continue. For the common every rise in petrol prices could sound the death knell for his savings.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

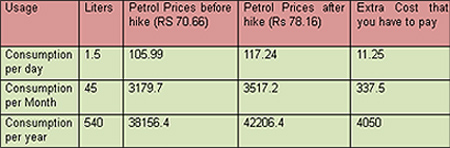

Extra buck: How much more are we paying?

Now, let's see how much extra we have to shell out due to this increase in petrol prices. To measure the impact, I used my own personal example. I use a bike to commute to my office, so the first thing that came across my mind is how much I have to shell out extra for this price hike.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Thus, I need 1.5 liters of petrol on a daily basis whether I go to work or for some leisure trips. So I have taken 1.5 liters as the average use.

By looking at the above illustration one can easily start to feel the pinch. On a yearly basis I have to pay Rs 4,050 more. This amount may seem to be a miniscule amount, but it is actually not so.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Have you ever wondered how much do you actually save after paying income tax, wealth tax, service tax, water tax, tax on house property and etc. So this Rs 4,050 is an additional burden for me that I have to pay.

Further, inflation adds more to the misery. Inflation has also surged during the past eight years.

This fuel price rise coupled with an increased rate of inflation has surely impacted your pockets. Inflation rate has never gone below the 4 per cent mark since January 2006 which remains a major cause of concern.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

But are we ready to face the issues of slowing down of economy, high inflation rates and continuous price rises? I hardly doubt.

We Indians know how to save our money but we don't know how to multiply it, and in today's uncertain market conditions, only a mere savings from the bank deposits and insurance won't suffice much.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Common investment instruments

Most of us save our hard earned money in safer investment instrument like bank deposits and savings account and buy one-two life insurances and we tend to think that is enough.

But, what we don't realise is that investing in these instruments won't help to grow our money.

Savings account is the most common avenue and almost everyone deposits their money in it. But does it really help you to multiply your money?

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Forget about multiplication it doesn't even add value to your money. Your savings account offers you 3-4 per cent returns which is less than the inflation rate, which is currently at 7 per cent. So one can easily see that savings account is decreasing the growth rate of money by 3 per cent.

Same thing applies to your bank deposits too. The banks may be offering you lucrative interest rates of 8-8.50 per cent, but when you compare with the inflation rates, you are only getting 1-1.5 per cent more.

Separately, you have to pay taxes on the interest income so that reduces your return to quite some extent.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

In case of life insurances, people tend to confuse them with investment instruments. Life insurance is something which insures your life against the odds.

Stop thinking this to be one of your investment instruments and treat them as a protection measure. Separately, the returns are quite low when compared with returns of other asset classes.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Impact of this price hike:

Let us quickly glance through what can be the negative consequences for this price rise and how it can affect us.

Inflation figure is bound to go up and with it price of goods and services are also expected to go up.

Major sector to get affected is transportation, textiles, Auto, FMCG etc, as all of these major sectors requires petrol and other fuels to manufacture and transport them.

When transportation costs rises, prices of essential commodities also gets increased, which are transported on a daily basis.

Banking sector is also expected to suffer due to high inflation level. In order to control inflation, the RBI has to implement strict monetary policy that will directly affect the banks.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Word of advice

It's high time you do your financial planning and invest in some other asset classes which have the potential to outperform the inflation rate and also keep up with the price rise.

Our expenses increase every year, be it for household purposes, branded goods or tuition fees for children.

Considering the price index data for last several years, a simple fixed return will not be sufficient to supersede the effect of inflation and counter the effect of price rise.

Click NEXT to read more...

Petrol price hike: How does it affect the common man?

Now let us see how we can minimise the effect of the latest petrol price hike. Say, Rs 50,000 invested into the savings bank account will fetch me Rs 2,000 extra on a yearly basis taking the interest rate as 4 per cent.

And if I invest the same amount into any liquid funds, which is currently giving me a return of 9-9.5 per cent, I can get as much as Rs 4,500 as interest on a yearly basis.

So this extra amount of money will certainly help me out to pay for my fuel expenses.

Liquid funds invested into the various money market instruments can be easily redeemed within a short span of time, which makes them one of the most viable financial instruments currently available.