| « Back to article | Print this article |

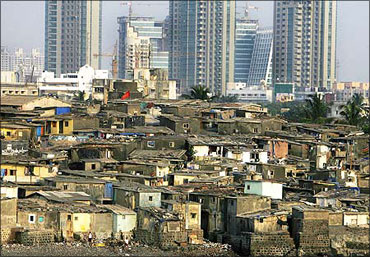

Want to ease your home loan burden? Here's help!

Shweta Malviya is finding it difficult to understand the bank manager's logic. "He wants me to start paying the equated monthly instalment on the entire home loan of Rs 30 lakhs (Rs 3 million), though he is going to disburse only 30 per cent as the first instalment for the under-construction property," she says.

And, that too, when she will not get any tax benefit on the principal payment.

The bank manager explains, "Paying EMI on the entire loan will reduce the overall burden.

"Malviya will reduce her burden by almost 10 per cent by the time she gets possession of the flat."

He wants her to ignore the loss of tax benefit on principal payment under Section 80C of the Income Tax Act, as the limit is only Rs 100,000.

Click NEXT to read further. . .

Want to ease your home loan burden? Here's help!

"Her Employee Provident Fund and life insurance premium exhaust 80 per cent of the limit. For a benefit of a mere Rs 20,000, she should not defer paying the home loan," he argues.

Twenty eight-year-old Malviya has bought an under-construction house and will get its possession after three years.

In such cases, banks stagger the payment according to the stage of construction. For instance, of the total cost of Rs 30 lakhs (Rs 3 million), the bank will release 30-35 per cent in the first stage.

And, depending on the stage of construction, the rest of the amount will be disbursed.

Of the approved Rs 25 lakhs (Rs 2.5 million), the bank will release the money in tranches, at different stages of construction.

Click NEXT to read further. . .

Want to ease your home loan burden? Here's help!

First, the bank-appointed surveyor inspects the construction site.

The payment is made according to the surveyor's assessment of the project.

During the construction phase, the bank may release small amounts (say Rs 500,000 in the first year, Rs 10 lakhs (Rs 1 million) in the second year and so on) and pay the remaining on possession of the house.

"In the first option, the banker says I will lower my liability considerably by the time of possession.

The other option is to service only the disbursed amount," says Malviya. Example: Her EMI will work out to be roughly Rs 29,000 if the bank releases Rs 500,000 as the first instalment.

Out of this, she will pay Rs 4,000-4,500 towards the disbursed amount and the remaining towards the principal.

Click NEXT to read further. . .

Want to ease your home loan burden? Here's help!

Although Malviya wants to start repaying the loan at the earliest, she is in a fix due to two reasons.

One, if the construction gets delayed, the bank will not disburse the amount, but she will have to continue repaying.

Secondly, she doesn't get any tax benefit for repaying the principal in the construction period. So, does it make sense to pay the principal?

According to an executive in Axis Bank, banks encourage borrowers to start repaying in the construction period to be able to lower their liability.

"Irrespective of not being able to claim the principal repaid, clearing the debt burden is more important," he adds.

Payments made during the construction period get added to payments made on possession, and the tax benefits come to you for the next four years.

Click NEXT to read further. . .

Want to ease your home loan burden? Here's help!

The existing limit for interest payment is Rs 150,000 under Section 24B of the Act.

N K Jayananda, AGM-Retail Asset Hub, Corporation Bank, says, "After assessing borrowers' income, we advise them to opt for part/complete repayment in the construction phase.

"And, on possession, when total repayment starts, the interest component is high and can be claimed separately, unlike the principal," he says.

As far as servicing the loan is concerned if the construction gets delayed, bankers say Malviya could choose other repayment options, provided those are available for the project.

Click NEXT to read further. . .

Want to ease your home loan burden? Here's help!

Tranche repayment

For under-construction properties, customers can choose the monthly instalment they wish to pay, till the time the property is ready for possession.

Step-up facility

It is linked to expected growth in income. It helps you to get a higher loan and pay lower instalments in initial years, which is increased proportionately with the increase in your income.

Flexible instalments

It is a customised offer, mainly for those whose repayment capacity is likely to alter during the term of the loan.

If a borrower is nearing retirement, the loan is structured in such a way that the instalment is higher during initial years, and subsequently, decreases later in proportion to the reduced income of the customer.

Accelerated repayment

You can repay the loan faster by increasing your instalments. Whenever you get an increment, prepay the loan. Hence, you can save interest due to loan prepayment.