| « Back to article | Print this article |

In-depth: A complete pension plan guide for you

Every investor has a different investment view. Some invest with a perspective of one-time return whereas others want a regular return after retirement. This allows the investor to get the income tax benefit for an investment up to Rs 1 lakh under Sec 80C.

Pension plan is an instrument offered by insurance companies that generate regular return post retirement of an investor. It is also called a retirement plan or an annuity plan.

In a pension plan, a person makes an investment either by one-time payment or in instalments for a fixed period of time and in return gets a regular return either for a life time or for a fixed term depending on the plan.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

Why pension plans are required

Due to increased life expectancy: The average age of an Indian is 65 at present, and it is expected to improve in coming years due to better living, good sanitation and hygiene. To cater for the needs in increased life, it is necessary to invest in plans like pension.

Financial stability: The old theory of being dependent after retirement is getting outdated in our society, so to achieve self-reliance, it is necessary to focus on a regular income plan such as pension.

Inflation: It is not necessary that our current corpus would be sufficient in the future, because of value erosion caused by inflation. Pension plan is an important tool that helps to get ahead of inflation.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

To cater for the need of investors, there are various types of annuity options are available with pension plans in the market, let's check them one by one:

Immediate annuity plan: These plans are meant for one-time investment purpose in lieu of fixed returns over complete life after the retirement.

Deferred annuity plan: Under this plan, a person can invest in instalments over a period of time. After the completion of a term, the policyholder is entitled to receive a regular return based on corpus invested over a period of time.

Guaranteed annuity: Under this plan, the policyholder is entitled to receive a pension for a fixed period of time, say six years and if he/she survives for two years then the nominee would receive the return for next four years.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

If the policyholder survives complete six years then he/she would get the pension for the entire life:

Life annuity: The policyholder is entitled to receive a regular return throughout his life under this plan. This plan also offers some bonus along with a maturity amount to the nominee, after the death of a policyholder.

Annuity certainty: In this plan, the policy holder gets only a fixed amount for a fixed period of time.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

With and without cover pension plan

The pension plan comes with either with cover or without a cover plan. With cover pension plan, offers assured life cover in case of pre maturity death of the investor however without cover pension plan only provides nominee, the corpus deposited with it until date after deducting the expenses.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

Understanding the maturity benefit

Under traditional plans, the maturity benefit depends on the sum assured. Post maturity, a policy holder gets sum assured along with guaranteed addition (if any) and the bonuses thereof.

It is always advised to select a plan that offers higher than sum assured and accumulated amount if such option is available.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

This table shows the illustrative maturity value at retirement ages 50, 60 and 70 if you pay an annual target premium of Rs 10,000 and assuming the rate of return of on investment of funds at 6 and 10 per cent per annum respectively:

Please note that the assumed rates of return at 6 and 10 per cent per annum respectively are only scenarios of what your policy will look like at these rates after recovering all applicable charges.

These are not guaranteed, and they are not the upper or lower limits of what your policy might earn, as the value of your policy is dependent on a number of factors, including future investment performance.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

ULIP and traditional pension plan

The traditional Pension funds are less attractive when it comes to long-term return, so another Pension plan called unit linked pension plan (ULIP) are available in the market that is based on the equity market as an underlying instrument.

ULIP is more liquid and flexible when compared with a traditional Pension plan. Some company even offers capital guaranteed ULIP.

Hence, the investors can ensure return of capital and bonus along with it.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

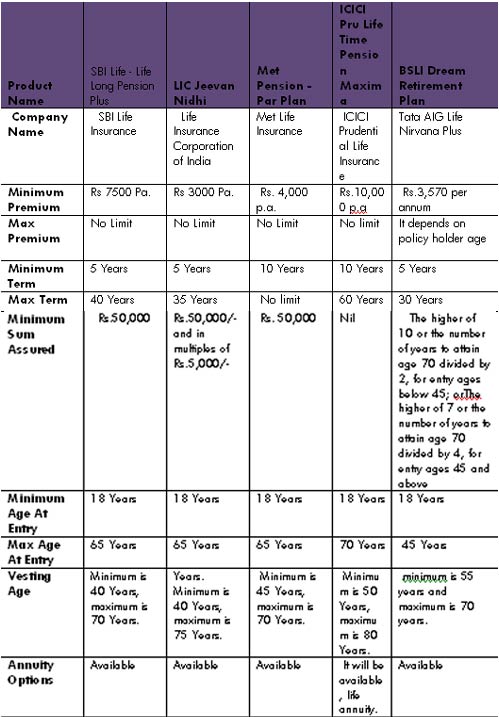

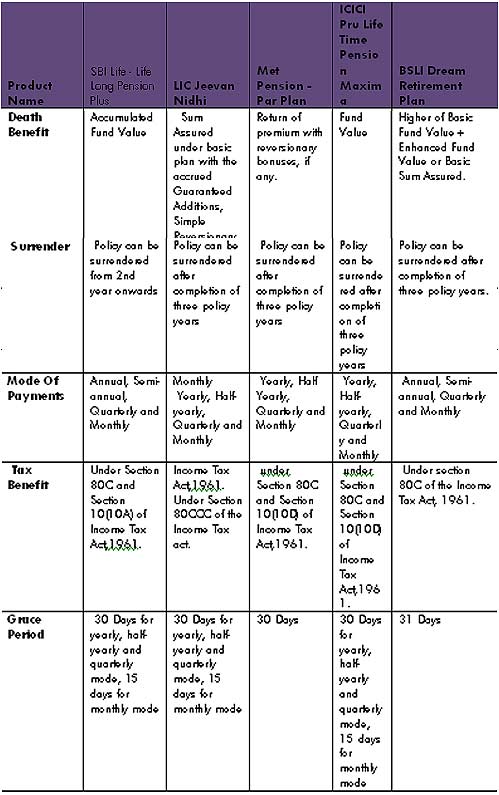

Some popular Pension funds available in the market are shown here:

Though data in above mentioned table has been taken from respective company's websites, it is further advised to confirm the data to rule out any sort of discrepancy.

The return from the pension plan is very low compared to other investment instruments. The conventional plan provides a return of around 4 to 6 per cent, which is not impressive when the inflation is on the higher side in long term.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

Since the pension plan invests major chunk into government securities and bonds so risk associating with it is very low. Looking at higher return in equities and long-term nature of pension plans, the ULIPP seems to be better investment option.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

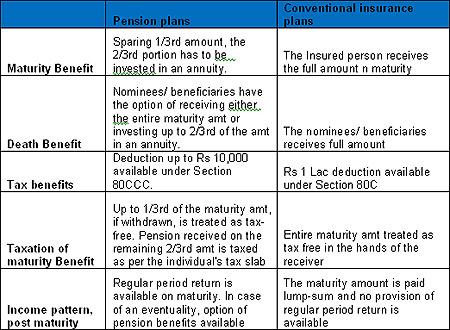

Difference between insurance and pension plan:

Many investors confuses between Insurance and Pension plan. It should be noted that the basic difference between both is that the basic purpose of Insurance is to cover the risk of death and insurer is liable to pay only when a policy holder dies; whereas, in pension plan, the policy holder has to live across maturity to claim the return.

So, the most important and basic difference between Insurance and the Pension plan is difference in their objectives.

Click NEXT to read more...

In-depth: A complete pension plan guide for you

Income pattern, post maturity regular period return is available on maturity. In case of an eventuality, options of pension benefits are available.

The maturity amount is paid lump-sum and no provision of regular period return is available. Finally, it can be said that pension plan offers a variety of options to the investors to customise the future plan as per one's requirement.

For diversification of investment portfolio and reducing risk in the long-term plan, the pension fund is always advised to be attractive option for every investor.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2024 www.BankBazaar.com. All rights reserved.