An investor's finances, goals and risk-taking capacity change with time. These changes must be taken into consideration in reviewing one's investment portfolio from time to time.

Life cycle investing theory proposes different portfolios for different stages of one's life in order to stay rich all life long.

All individuals travel through different life stages with different investment goals and risk tolerances associated with them.

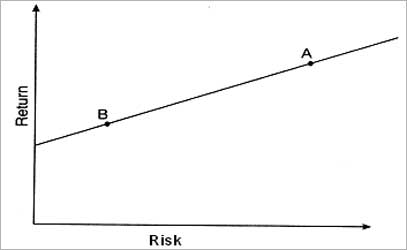

For the average investor, without taking into account the life cycle approach, the risk/return relationship would be depicted as shown in the accompanying Figure 1 (Risk Return Relationship).

Each individual would have to determine for him or herself how much risk they want to assume to achieve greater returns, as evidenced by a move to the right on the risk/return line.

...

How to stay rich all your life

Franco Modigliani first put forward the "Life Cycle Hypothesis of Income, Consumption and Saving."

His treatise contended that people move through a progression of dissaving (spending more than they earn in their younger years) to a period of net saving (as wealth increases) to another period of dissaving as they retire and live off previously accumulated financial assets.

Inherent in the life cycle theory is that certain types of investments and risk postures are more favourable for certain stages of investors' lives.

The theory also recognises the importance of early planning and anticipation of future financial commitments and cash outflows (such as college expenses).

Finally, it stresses the importance of remaining flexible enough to make the appropriate changes in investments as the individual progresses from one life stage to another.

...

How to stay rich all your life

Four phases comprise the life cycle. Each phase and its characteristics are noted in the accompanying Table 1, Life Cycle Phases and Characteristics.

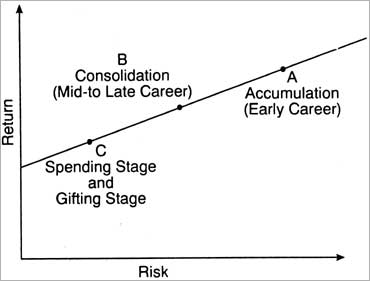

Follow, too, the movement in the life cycles phases in Figure 2 (Risk/Return Relationships at Life Cycle Phases).

According to Donald R. Nichols who wrote a fine book on the subject of life cycle investing, investors must take into account five key elements in constructing a life cycle portfolio:

- Stability of principal,

- Current income,

- Capital growth,

- Aggressive income, and

- Growth and lump sum investments.

| Phase | Characteristics |

| Accumulation | Early career, small net worth, large liabilities such as house mortgage and credit purchases, illiquid assets. Priorities include |

| Consolidation | Mid-to-late career. Best income earning years coupled with declining expenses as children leave home and house expenses taper off. Peak wealth accumulation years. Institution of more risk control to protect built up capital. (Point B) |

| Spending | Retirement years. Financially independent status. Accumulated assets cover living expenses. Low risk posture to converse and protect assets for income generation. (Point C) |

| Gifting | Realiaation that accumulated assets exceed anticipated living expenses. Redirection of assets to provide for heirs or other causes. Still low-risk posture to ensure passing along assets with the exception that some people at this phase take on pet projects without regard to the amount of risk involved. |

...

How to stay rich all your life

Investors achieve principal stability by searching out investments that provide optimum protection against market loss and value fluctuations.

While the investment will earn some return, the paramount consideration is to guard against loss of the principal amount.

Current income generating investments such as dividend from common and preferred stocks, bonds, certificates of deposit, and savings accounts take on more importance as investors progress through the life cycle phases.

...

How to stay rich all your life

Capital growth investments seek long-term capital appreciation to build the desired level of wealth with which to live through the retirement years, an important investment strategy in the early to mid-years of the life cycle.

Ideal growth oriented investments include common stocks, mutual funds and bonds as well as hard assets such as real estate and precious metals.

Company-sponsored pensions, profit sharing, and savings plans also build wealth rapidly, sometimes with the company making a substantial proportion of the contributions.

Individual contributions can also be made pre-tax, adding to the growth capabilities of the investment.

...

How to stay rich all your life

Aggressive income and growth investments combine higher potential returns with a higher degree of risk and are appropriate for those in the accumulation phase of the life cycle.

Again, stocks, bonds and mutual funds join forces with more speculative investment alternatives such as precious metals, currencies, commodity futures, and options.

Lump sum investments provide continual growth and wealth accumulation within a specific time frame.

Zero coupon investments and certificates of deposits represent popular lump sum investments.

These can be utilised during any phase of the life cycle.

[Excerpt from 100 World Famous Stock Market Techniques by Richard J. Maturi. Published by Vision Books.]

(C) All rights reserved.

article