| « Back to article | Print this article |

Jet-Etihad yet to tap synergies

The first year of the alliance between Jet Airways and Abu Dhabi-based Etihad Airways saw an expansion of flights between the two countries but top-level exits at the Indian carrier impacted the synergy.

On April 24, 2013, the two signed a deal for equity infusion by Etihad in Jet, loan guarantees, purchase of Jet's slots at London’s Heathrow airport, investing in Jet’s frequent flyer programme and cooperation in commercial, engineering and operational areas.

The Rs 2,057-crore (Rs 20.57-billion) investment for a 24 per cent stake in Jet concluded last November and the Rs 900-crore (Rs 9-billion) investment in Jet's frequent flyer programme was completed last month.

The deal was concluded after the two parties diluted the agreements to meet regulatory concerns but trouble is far from over.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

The Securities and Exchange Board of India is examining if there was a violation of the takeover code by Etihad.

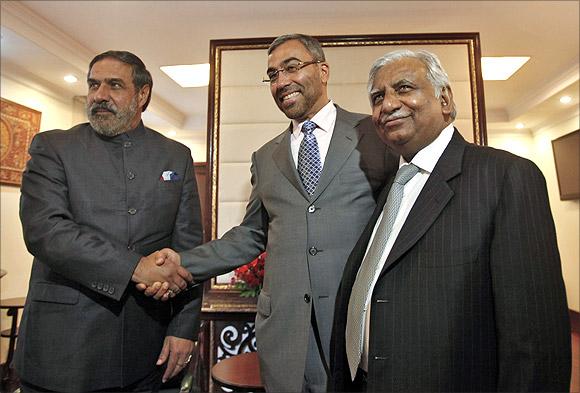

Etihad's chief executive officer, James Hogan, and chief financial officer James Rigney have joined the Jet board.

Appointment of independent board members has not been completed, with both sides yet to select members, an airline source said.

The revamped Jet board has positions for four directors from Jet, two from Etihad and six independent members.

Jet’s promoter-chairman Naresh Goyal's wife, Anita, and chief operating officer Hameed Ali will represent Jet Airways on the board but their appointment is yet to be finalised.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

At present, the airline board has three independent director, appointed before Etihad's acquisition; they might be retained.

"Both Jet and Etihad will have to decide on board composition,'' the source added.

The deal was to get both airlines some synergies and cost savings in areas such as fleet acquisition, maintenance, product development and training.

However, sources say, progress is limited on this front because of a vacuum in Jet’s top management.

Last April, the two airlines said they’d explore joint purchasing opportunities for fuel, spare parts, equipment and catering supplies, as well as external services such as insurance and technology support.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

Other areas of cooperation will include joint training of pilots, cabin crew and engineers, maintenance of common aircraft types and consolidation of guest loyalty programmes.

"There are no synergies. In the absence of senior management, who will take all the decisions?

“Mr Goyal cannot be involved in all the nitty-gritty,'' a Jet executive said.

The airline is currently without a CEO and a chief commercial officer.

CFO Ravishankar Gopalakrishnan, also acting as CEO, stepped down last month.

Plans for common corporate deals and a common productivity-linked bonus agreement for agents have been postponed.

The sales teams work separately, though the idea was to have joint sales and marketing initiatives.

Jet Airways did not respond to an email query on the topic.

Etihad did not participate for the story.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

Impacts

The deal has, however, led to a few positive developments.

The equity infusion from Etihad was utilised to repay high-cost debt and overdue creditors.

Jet has debt of around Rs 10,000 crore (Rs 100 billion) and it had reduced this by Rs 1,600 crore (Rs 16 billion) by December 2013.

It is awaiting Reserve Bank of India approval to raise $300 million (Rs 1,800 crore) in external commercial borrowing to replace high-cost domestic debt.

Also, both Etihad and Jet have added flights between India and Abu Dhabi.

Their commercial cooperation agreement says Jet will use Abu Dhabi as an exclusive hub to launch flights to Europe, Africa and the US. Prior to the deal, Jet flew to Abu Dhabi from Mumbai and Delhi.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

In the past 12 months, it has added services from Bengaluru, Chennai, Hyderabad and Kochi. More services will be added in the winter schedule.

The two airlines’ code-share on flights between India and Abu Dhabi; the civil aviation ministry’s approval is awaited for Etihad code sharing on Jet's domestic routes.

On the other hand, Jet's domestic schedule has shrunk in the absence of fleet addition. The airline has returned a few Boeing 737s on expiry of lease terms and deferred induction of 17 others.

"We have night departures to Abu Dhabi and planes are being used on both the domestic and international network,'' said an executive.

Jet has also been able to save on costs by selling or leasing its widebody Airbus A330s and Boeing 777s to Etihad.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

The latter is operating the Abu Dhabi-New York flight on a Boeing 777 leased from Jet. Federal Aviation Administration's downgrade of India's safety ranking has hit the plan for Jet to operate on the route from May.

Additional flights to the US by Jet are on hold with the downgrade.

Aviation consultant Mark Martin said, "The imperatives that lie ahead of the Jet-Etihad alliance is to transition to a common airline working framework as fast as one can, integrate key departments and operational functions and simplify critical operational structures into one.''

Kapil Kaul of the Centre for Asia Pacific Aviation said, "Nothing significant is visible in terms of achievement, expect that Jet is heading for a massive FY14 loss which will almost wipe out the entire $ 379 million equity from Etihad.

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

“Near-term profitability challenges will remain and turnaround might take longer than expected.

“Jet will need another round of large capitalisation soon and much of this would depend on FY2015 performance.

Though the cash position post the frequent flyer programme sale will be adequate, the expected losses in FY15 will make it necessary for another round of capitalisation.

“A proven and stable top management is the first necessary step towards inspiring confidence.

“We remain concerned with Jet’s domestic business, which is structurally unviable.

“The network plan is under evaluation but business model challenges remain.''

Click NEXT to read further. . .

Jet-Etihad yet to tap synergies

A CLOUDY SKY

- In April 2013, Jet Airways and Etihad signed the alliance. Investment of Rs 2,057 crore (Rs 20.57 billion) for 24 per cent stake in Jet was completed last November. Equity infusion helped Jet reduce debt by about Rs 1,600 crore (Rs 16 billion)

- Sebi issued a show-cause notice to Etihad for alleged violation of takeover code regulations in February

- Jet and Etihad added flights between India and Abu Dhabi. Jet's US expansion plans were put on hold after the US regulator downgraded India's safety ranking

- Synergy between the two airlines has not taken off partially due to the top-level exits at Jet Airways

Click NEXT to read further. . .