Photographs: Reuters Masoom Gupte in Mumbai

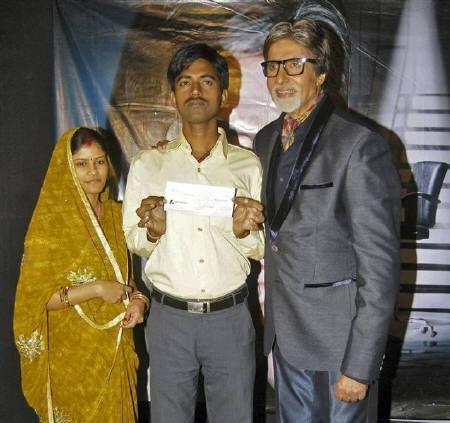

When Sushil Kumar, 27, a teacher from Bihar's Motihari district earning Rs 6,000 monthly won the highest game prize ever on Indian television of Rs 5 crore (Rs 50 million) on Kaun Banega Crorepati (KBC) last week, for many the Oscar-winning Slumdog Millionaire came to life.

People lapped up stories of 'it was the second time he wore a shoe' or he wants to build a house for his family, start a library and, even, fund deserving students in his village.

While the money will come within two months, according to Kumar, the first thing the channel has done is to give him a psychiatrist and a financial advisor, Axis Bank, to help him invest his winnings and plan for his goals.

"I haven't thought about how I should spend this money as yet. The first thing I will do, though, is build a house for my family," says Sushil.

...

Investing tips for the new 'Crorepati', Sushil Kumar

Image: Sushil Kumar on the showPhotographs: Reuters

First, he will take an income tax hit. He will have to make do with Rs 3.5 crore (Rs 35 million), as the Income Tax Department will be quick to demand their 30 per cent share under Section 194B.

After this initial hit, the going should be smooth. But before everything else, he should buy a life and health insurance cover, a family floater, for the entire family.

Also, create an emergency fund. Kartik Jhaveri, director, Transcend Consulting, says Kumar should keep aside at least Rs 20 lakh in a separate bank account for any contingencies. He must also take a term plan, with a cover of about Rs 25 lakh.

The term plan could a single premium for both health and life covers because it ensures there will be no regular outflow for these items in the future.

...

Investing tips for the new 'Crorepati', Sushil Kumar

Photographs: Reuters

After this, he needs to purchase a house, which could cost around 25 lakh. His preparation for the UPSC exam and stay in Delhi for a year for this would cost him, depending on where he stays.

But one could assume an expense of Rs 10,000-20,000 a month for this for at least a year. All these should take out Rs 50 lakh from his corpus. The rest he can use to pursue his goals.

Philanthropy: Kumar's goals of setting up a library and sponsoring the education of children can be best sustained by setting up a charitable trust, transferring the funds therein and funding all activities via the trust.

The charges would include stamp duty (three per cent of the first donation), registration fee and any fee paid to his legal counsel or chartered accountant.

"This will ensure longevity of his cause, as well as help him get tax benefits," says Jhaveri.

Any income earned by a trust can be claimed as an exemption, provided it is used within a stipulated period.

...

Investing tips for the new 'Crorepati', Sushil Kumar

Kumar can transfer about Rs 50 lakh to his trust, which in turn can utilise part of the funds for building the library and the rest can be put in fixed deposits (FDs).

Say, he puts Rs 40 lakh in a 10-year FD with State Bank of India. He can earn 9.25 per cent return or Rs 3.7 lakh annually, which can be used for the trust's activities.

Set up business for family members: Kumar wants to help his five elder brothers to set up their businesses, ensuring a steady livelihood for them and their family.

"It is definitely a priority but I haven't decided how much I would have to set aside for this or what businesses they would be starting," says Kumar.

Investing for the future: The two main goals he must plan for are his children's future (education and marriage) and retirement. He would need at least Rs 1 crore (Rs10 million) and Rs 1.5 crore (Rs 15 million), respectively, for these goals, says Gaurav Mashruwala, a certified financial planner.

...

Investing tips for the new 'Crorepati', Sushil Kumar

As both goals are almost 20 years away, he should invest the amount mostly in equities. "It should be put in liquid funds and invested in equity mutual funds via a systematic transfer plan," says Mashruwala.

He could invest in four-five funds (say two equity-diversified funds, two sectoral funds and a mid-and small-cap fund).

However, the investments should be diversified. He can put aside part of these funds, about Rs 50 lakh, in FDs for security of his funds.

Similarly, he could even consider a part of his investible surplus in real estate. The amount for this investment would depend on the location picked.

An ideal split of investments, according to financial planners, would be Rs 1.5 crore for equities, Rs 50 lakh for fixed deposits and Rs 50 lakh for real estate.

article