Photographs: Reuters. Somasroy Chakraborty

Standard Chartered Plc has seen 6 billion pounds wiped from its market value following allegations it violated US anti-money laundering rules.

The New York State Department of Financial Services (NYSDFS) claimed the bank helped its Iranian clients launder around $250 billion in secret transactions between 2001 and 2007.

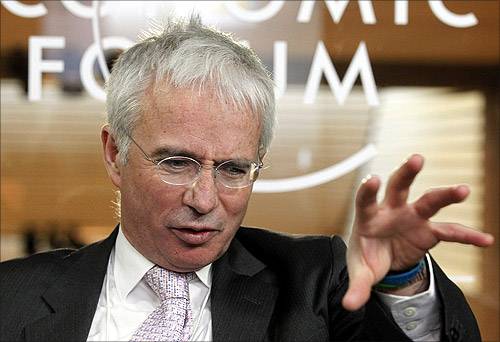

In his first interview with an Indian newspaper since the allegations, Peter Sands, group chief executive of Standard Chartered, tells Somasroy Chakraborty that he doesn't believe the bank will lose its New York banking licence. Edited excerpts from his emailed response:

Investor confidence in the bank appears to have eroded after the allegations by NYSDFS. Are clients also apprehensive of doing business with you?

Our clients have been very supportive during this difficult time. They know us well as we have been doing business with many of them for many years. We have been able to reassure them that we reject the position set out by the NYSDFS.

...

Money laundering charges: What StanChart CEO has to say

Photographs: Reuters.

The bank has admitted it processed some transactions that had not complied with US anti-money laundering rules. Won't this affect the bank's outsourcing plans to India? Will you review your systems and processes here to avoid recurrence of similar events in the future?

This was not about money laundering. We undertook a review of our historical compliance with US sanctions between 2001 and 2007. We discovered that during that period, relatively few transactions did not comply with the so-called 'U-turn' framework put in place by the US to allow dollar transactions to be processed by Iranian parties.

These were good faith mistakes, not malfeasance or an attempt to undermine sanctions. Proper due diligence was conducted on these transactions, mostly in London. The group takes its responsibilities very seriously, and seeks to comply at all times with the relevant laws.

...

Money laundering charges: What StanChart CEO has to say

Photographs: Reuters.

Some of the European banks are scaling down operations in Asia due to a slowdown in growth. In this environment, will you continue to invest in Asia and India?

We are stepping up investment in India and the rest of Asia. We hope to have 100 branches in India and China by early next year.

India is a vital part of our international network and one of our largest and key growth markets.

We see plenty of opportunities to build and deepen our relationships with retail customers, SMEs and large businesses as they invest and trade internationally.

...

Money laundering charges: What StanChart CEO has to say

Photographs: Reuters.

Some of the European banks are scaling down operations in Asia due to a slowdown in growth. In this environment, will you continue to invest in Asia and India?

We are stepping up investment in India and the rest of Asia. We hope to have 100 branches in India and China by early next year.

India is a vital part of our international network and one of our largest and key growth markets.

We see plenty of opportunities to build and deepen our relationships with retail customers, SMEs and large businesses as they invest and trade internationally.

...

Money laundering charges: What StanChart CEO has to say

The profitability of the bank in India has been declining since 2011. What's the action plan?

India remains one of our key growth and strategic markets. Our business in India is skewed towards wholesale banking and our performance reflects the current market sentiment, slowing economic growth and a sharp depreciation of the rupee.

That said, we absolutely believe the medium to long term India opportunity remains intact.

article