Nivedita Mookerji & Raghavendra Kamath in New Delhi/Mumbai

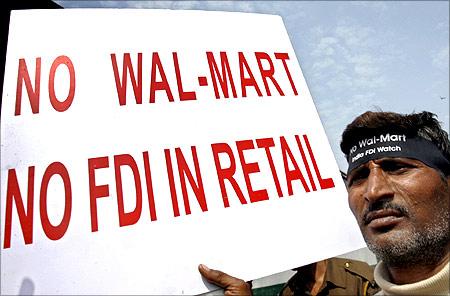

The die had been cast and a rollback would be an international embarrassment, several industry representatives liked to believe a day after Trinamool leader and West Bengal chief minister Mamata Banerjee let out the secret on retail foreign direct investment.

In the 24 hours, since Banerjee made the Centre's intention public to keep the retail FDI policy on hold, the corporate world has been trying to read between the lines of her statement.

The industry is counting minutes and hours in the run-up to the Parliament session on Wednesday, as finance minister Pranab Mukherjee has said any announcement would be made in the House.

. . .

Industry sees red over flip-flop on retail FDI

Banerjee had quoted Mukherjee on Saturday in conveying the Centre's move to suspend the retail FDI policy.

Rajiv Kumar, secretary general, Federation of Indian Chambers of Commerce & Industry, said, "Hope it is not a reversal of the cabinet decision.

"If there's a reversal, it will send a strong, negative signal to the investor community."

He refused to hazard a guess on what announcement the FM would make in Parliament, saying, "Who can say?"

Foreign retailers like American giant Walmart, French chain Carrefour and the UK-based Tesco, which have been closely watching the high-growth Indian market for years, chose to remain silent on the latest development.

. . .

Industry sees red over flip-flop on retail FDI

Walmart's India partner, Bharti Enterprises, also refused to comment. Industry representatives maintained everyone was waiting for 'clarity' on the issue to decide on the next step.

However, a strongly worded statement from two corporate biggies summed up the broad industry mood.

Calling it a 'false drama of apprehension' against investment and modernising trade, Ashok Ganguly, Rajya Sabha member and former chairman of Unilever (India), and Deepak Parekh, HDFC chairman, made a call to the 'saner sections of corporate India to come out and strongly support progressive measures and reforms' of the government.

. . .

Industry sees red over flip-flop on retail FDI

"What is intriguing and bewildering is that the false alarm on FDI is continuing to be used after so many years, as a bogey in modern times against foreigners and foreign investment," the statement said.

Referring to the continuous disruptions in Parliament, the two pointed out there were 32 Bills for consideration in the Winter session. Many of them were of far greater consequence and importance for the country than FDI in retail, they added.

Parekh has been part of several high-level government expert committees over the years.

A top executive of a retail company called the opposition to FDI a "mindless controversy".

. . .

Industry sees red over flip-flop on retail FDI

He added that "the deadlock is at the Parliament functioning level and not at the retail FDI level."

"Retail FDI can only be delayed and not rolled back," he said. One of the reasons was the government was in the midst of negotiating several bilateral agreements, he said.

Arvind Singhal, founder of Technopak Advisors, a retail consultancy firm, pointed out "the implication of this (holding back the policy) would only be to further undermine whatever little credibility the current government has both within India and outside."

. . .

Industry sees red over flip-flop on retail FDI

Image: Labour leader Phil Goff and Chris Hipkins discuss food prices at Stokes Valley New World supermarket in Wellington, New Zealand.Photographs: Hagen Hopkins/Getty Images

He said it would also act as a major dampener not only for FDI (and not only in retail) in India, but even for domestic Indian investment activity.

"It would further reinforce the belief of the private sector that the government is only focused on populist profligacy even if comes at a huge cost to the nation's economic and financial health," Singhal said.

Kishore Biyani, group CEO, Future Group, said organised retail and mom and pop stores could co-exist.

"We run 152 Big Bazaar stores. I have not seen any impact on small traders around these stores. I think it is more of a political issue now," Biyani said.

. . .

Industry sees red over flip-flop on retail FDI

"Till the FM makes a statement, the policy is as good as on the backburner," said another retail company official.

There are differing voices in the industry, too.

The CEO of a Mumbai-based retail company told Business Standard, "I think it is (the decision to allow FDI in multi-brand retail) mere posturing by the government to show that it is pro-reforms.

After that, many political parties want to show they are pro-small traders."

If the government wanted to control inflation, create jobs or improve the lives of farmers, could it not do it without FDI, he asked.

. . .

Industry sees red over flip-flop on retail FDI

Image: Freshly made twenty dollar bills at the Bureau of Engraving and Printing.Photographs: Mark Wilson/Getty Images

According to B S Nagesh, vice-chairman, Shoppers Stop, "If it happens, it's great for the industry. If it does not, the world will not come to an end."

The Cabinet had cleared 51 per cent FDI in multi-brand retail on November 24.

On the same day, it had decided to raise the foreign investment level in single brand retail to 100 per cent, from 51 per cent.

Once the policy comes into effect, after it gets notified by the government through a press note, foreign supermarket majors like Walmart, Carrefour and Tesco will be able to set up front-end multi-brand stores in the India.

The retail market in India is estimated at $500 billion, but organised trade is just six-seven per cent of the total pie.

article