| « Back to article | Print this article |

India Inc's gain could be investors' pain

There is an adrenaline rush in the board rooms of India Inc. Companies are falling over each other to raise capital through qualified institutional placements (QIPs) and initial public offerings (IPOs) till the good times last on Dalal Street.

In the past two months, nearly a dozen companies have raised around Rs 16,500 crore (Rs 165 billion) worth of fresh equity through QIPs alone and many more are in the queue.

A host of others have announced plans to raise capital through either IPOs, rights or bond issues. Lavasa Corp, a subsidiary of debt-laden Hindustan Construction Co (HCC), recently filed documents with the regulator for an IPO, joining Adlabs Entertainment (owner of Imagica theme park) and GMR Energy in the queue.

The Tata group's Indian Hotels Company plans to raise nearly Rs 1,000 crore through rights issue, while construction major NCC wants to raise Rs 650 crore. Experts say while it makes sense for companies to raise capital, taking advantage of the recent rally in their stock prices, the gains to investors are doubtful for three reasons.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

India Inc's gain could be investors' pain

First, there is hope of an economic revival, but nothing has happened on the ground. Second, most companies are raising capital at the upper end of the recent highs in their stock prices.

First, there is hope of an economic revival, but nothing has happened on the ground. Second, most companies are raising capital at the upper end of the recent highs in their stock prices.

And third, companies are expanding their balance sheets despite having failed to fully service their existing equity. Unless there is a revival in economic growth and corporate earnings in the next three to four quarters, there is a likelihood of companies failing to deliver again, leading to sell-off at the first hint of bad news.

At the end, the people who could be left holding the can are the investors who have rushed in at new valuations.

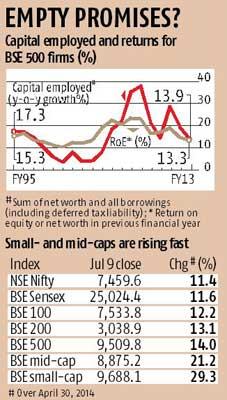

Historically, India Inc's profitability, relative to investments, is at its lowest in over a decade. The BSE 500 companies, excluding banks and oil & gas, in 2012-13 reported return on capital employed (RoCE) of 11.7 per cent, the lowest in the past 20 years, while return on net worth (RoNW), at 13.3 per cent, was the lowest since the year ended March 2002.

In the past, companies responded to low profitability by putting the brakes on new fund-raising. Between 1998-99 and 2003-04, the combined balance sheet of companies in the sample expanded at compound annual growth rate (CAGR) of 5.5 per cent.

During the same period, their net profit rose at 20.5 per cent CAGR, while their capex (gross block) expanded at 9.8 per cent, resulting in a sharp increase in their return ratio and setting the stage for a bull run.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

India Inc's gain could be investors' pain

Large-scale capital raising started happening only from 2004-05, when return on capital employed crossed 20 per cent and stayed in that zone for four years.

Large-scale capital raising started happening only from 2004-05, when return on capital employed crossed 20 per cent and stayed in that zone for four years.

The sequence has reversed now, casting doubts about companies' ability to service their expanded capital base.

"A sub-par return ratio means either companies have over-invested or there is a lack of demand, or both. To address this, companies need to lighten their balance sheet through disinvestments, sell-offs or monetisation," says Dhananjay Sinha, head of institutional equity at Emkay Global Financial Services.

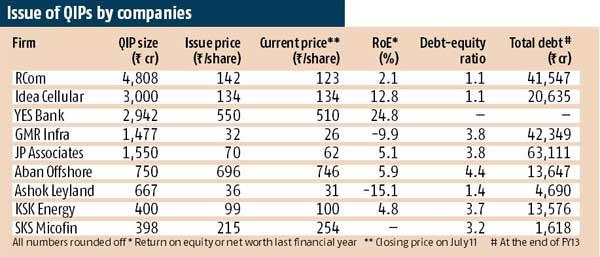

For example, construction and infrastructure major Jaiprakash Associates, early this week raised Rs 1,550 crore through a QIP issue, expanding its equity base (or net worth) by 12 per cent. The company reported a dismal return on equity (RoE) of 5.1 per cent in 2012-13 - the lowest in 11 years.

Unless there is a spike in its earnings in 2014-15 and beyond, the RoE is likely to fall further, as the same profit will be spread over a greater number of shares.

On a consolidated basis, the company reported a net loss of Rs 824 crore during the year ended March 2014, against a profit of Rs 462 crore in 2012-13.

It is the same for other companies in the boat, including Reliance Communication (RoE of 2.07 per cent in 2012-13), GMR Infra (-9.2 per cent), Ashok Leyand (-15 per cent), Aban Offshore (5.87 per cent), KSK Energy Ventures (4.84 per cent), Indian Hotels (net loss in 2012-13) and NCC Ltd (1.76 per cent). Idea Cellular, which reported an improvement in RoE to 12.8 per cent in 2013-14 from 7.4 per cent in the previous year, though, is an exception.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

India Inc's gain could be investors' pain

Bulls are, however, placing their bets on faster economic growth and a quick uptick in corporate earnings. "Companies will use the proceeds to lower debt, resulting in lower interest burden and better profitability next year. Part of the proceeds might also be used to complete unfinished projects that will generate incremental revenues and profits," says Nandkumar Surti, chief investment officer, JP Morgan Mutual Fund.

He remains bullish, despite the recent bull run that pushed the benchmark Sensex to a new all-time high, while small- and mid-cap stocks rose faster than frontline stocks. The BSE Small-Cap Index has rallied nearly 30 per cent since the end of April, against a 11.6 per cent rise in Sensex during the period.

However, a positive impact on India Inc's leverage ratio from the recent flurry of equity issues is doubtful, given the extent of indebtedness, mounting losses and working capital problems for most companies in the construction & infrastructure space, which are the most active in the QIP market. Fund-raising by JP Associates will fund just 2.5 per cent of its estimated gross debt of Rs 61,000 crore as at the end of 2013-14. For Reliance Communications, the ratio is 11.2 per cent and it is 5.5 per cent for Aban Offshore.

"QIPs will lead to a dilution in earnings per share and return ratios, unless companies use the funds to sharply improve their operational and financial performance in the next few quarters. Otherwise, expanded balance sheet will have a hang over their stock prices," says Sinha.

Contrary to general perception, only part of the funds raised in the past were spent on creating new capacity. Increase in gross block (investment in fixed assets) accounted for only 65 per cent of the rise in debt and equity of BSE 500 companies, excluding banks and oil & gas between 2007-08 and 2012-13.

Please click NEXT to read more...

Please click here for the Complete Coverage of Budget 2014 -15

India Inc's gain could be investors' pain

This ratio was 155 per cent for the same set of companies during the years from 1998-99 to 2003-04. In other words, companies' liabilities (equity and debt) are now growing faster than their assets (or earning capacity), while it was the other way around in the run-up to the last bull run.

This might make it tough for companies to deliver high returns to shareholders, even if growth recovers in the near term. A similar mismatch is visible in the Sensex's current valuation and the underlying GDP growth rate. In the past 15 years, Sensex (in terms of price-to-earnings multiples) has typically traded at 2.5-three times India's GDP growth at constant prices.

At its current level, this ratio has shot up to around four. The benchmark index is currently trading at 18.5 times the combined net profit of its 30 constituents stocks in the past 12 months. By comparison, India's GDP grew 4.8 per cent in 2013-14. When the Sensex was that expensive the previous time, India's economy was growing at over seven per cent a year.

Experts blame it on valuation expansion on the back of ample liquidity globally. The interest rate in the London inter-bank market has fallen to a 40-year low, allowing foreign investors to assign higher valuation for similar earnings. It is anybody's guess how long this will last.

Please click here for the Complete Coverage of Budget 2014 -15