| « Back to article | Print this article |

FDI in retail: Why this Kolaveri di?

In Thailand and Brazil, within years global retail giants have destroyed domestic competition. Moreover, they are also accused of adopting bad labour practices, squeezing manufacturers and following predatory pricing policies, says M R Venkatesh.

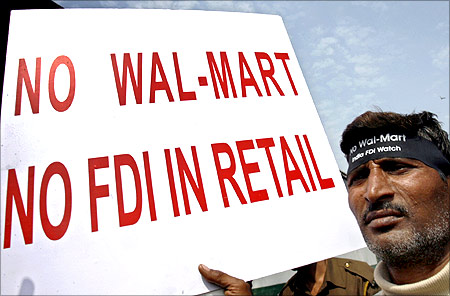

Frankly, one is stunned by the Cabinet decision to allow foreign direct investment in India's retail sector.

Instantly one is tempted to hum the popular Tamil rap song that is going viral by the minute and ask the powers that be -- "Why this Kolaveri di (roughly translated as 'murderous mood')?"

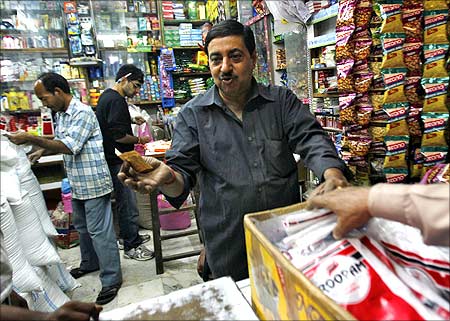

This decision has the calculated effect of impacting over 10-12 million (possibly more, and by extension 10 million families) small retailers who run the risk of being eliminated -- not by market forces but by the pricing and marketing policies of these multinational giants, each one with a proven track record of anti-competitive policies.

In most states across India, retail trade is dominated by backward class and minorities. Most of them are quintessentially the aam admi -- the core voters of the present dispensation in New Delhi.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Yet, bizarrely, the government chose to target its own core voters. Why?

The manner in which the Cabinet has arrived at the decision, its timing, the process and the stipulations that come along with it raise several inconvenient questions? Let me elaborate.

The problem with the decision is not the decision per se. The fact is that the collective credibility of the present Cabinet is so low that there is a lurking fear expressed in the open by well-meaning persons that that this decision was possibly 'pushed', nay 'threatened', by forces abroad and executed faithfully here.

A similar fear has been expressed in the multi-billion-dollar deal involving the purchase of Medium Multi-Role Combat Aircraft (MMRCA) where the Indian Air Force has reportedly shortlisted French aircraft. And that holds true for every decision taken by this Cabinet.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

It may not be out of place to mention that it is a given that several billion dollars of our wealth are parked outside India in tax havens. Details of Indian account holders, suspected to be the high and mighty of the land as evidenced in Liechtenstein and HSBC cases, are with foreign governments.

Given this paradigm, there is a simmering fear all across: Is this data now available with foreign forces influencing all these decisions? Naturally, one fears that every major decision impacting India is made in every capital across the world, except perhaps with the exception of New Delhi!

It may be recalled that an advisor to the Union finance ministry suggested in middle of 2011 the specious argument of allowing FDI in retail to cure the chronic inflation prevailing in India. But the chief executive of a United States-based global retail giant had expressed similar views in his visit to India along with President Obama in November 2011.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Was the advisor to the finance ministry merely echoing his 'master's' voice?

What else could explain the timing of the decision? Why now when Parliament is in session and is extremely polarised on several issues? Crucially, by announcing this decision does not the ruling combine run the risk of derailing the remaining portion of Winter Session of Parliament?

Would heavens have fallen if this decision was taken, say, in February along with the annual Budget? Why this undue haste when the matter was being debated for the past decade or so and in the face of stiff opposition even within the Congress party?

A few senior ministers, led by the prime minister, himself, pushed for this agenda. One wishes that the prime minister were half as assertive on corruption as he was on this agenda.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Who are they fooling?

Now, on to the decision. Put bluntly, this is an anti-national in approach that will do precious little for the Indian consumer in the long run, and will exterminate competition in the medium term, give the short-shrift to the Indian manufacturer even in the short term and finally bring small change as FDI into India.

Interestingly, the Cabinet seems to have put in place several conditions for such FDI into India. Let us examine them in some detail.

Let me begin on FDI flows into the country. The best estimates by the Cabinet suggest that FDI flow into the country would be approximately $6-7 billion in the next few years on this count.

What is appalling is that with such small investments, global giants could well be in control of the $500-billion Indian retail market. That is called leveraged buyouts -- pay small and get maximum benefits.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Secondly, if the benefits are so widespread, it is inexplicable that the same is to be limited to only 53 cities across the country. Why should not such policy initiatives benefit our rural brethren?

The answer is to that is obvious -- global retail giants are not interested in our rural markets. No wonder a necessity has been converted into a virtue by the government.

Another stipulation put forth is that FDI backed retailers must source 30 per cent of all their products from small-scale sector. Fair enough, except for the fact that one is not sure whether the policy meant Indian small-scale or elsewhere.

Importantly, experts opine that this would be determined on a self-declaration basis by the retailer himself!

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Nevertheless, the largest myth propagated by the government has been that opening up of retail trade would create job opportunities for 10 million people. Well, turn around and ask anyone what is the basis of this and you would be greeted by a thundering silence.

Assuming that this indeed has a basis one is tempted to ask the next question: how many jobs will be lost on account of policy? I can assure you people will squirm in their seats.

The number 10 million is at best a gross exaggeration. The net figure could possibly be far less, perhaps even negative.

There is yet another dimension. The government wants to believe that global retailers will source from Indian manufacturing. This, in turn, is supposed to provide a fillip to our manufacture. This is pure hogwash as global retailers are known to source their supply chain from the cheapest source and will comply with such conditions in breach.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

Therefore, the claim of the government that this decision will improve competition, lower prices, increase remuneration for farmers, revolutionise distribution and reduce wastage are unproved assertions, at best, and damned lies, at worst.

On the contrary, there will be huge economic loss which seems to have been glossed over by the Cabinet. More importantly, in all cities real estate prices will shoot up making housing unaffordable for a significant section of our populace.

No wonder, and given the level of protests from trade, political parties and social activities, a massive exercise has been undertaken by the ministry of commerce and industry through full page advertisements in leading dailies (to silence critics in print media?) explaining the rationale behind such a decision.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

If all this would lead to milk and honey as claimed in these advertisements, could the government then explain why did it take so long to arrive at this decision?

"Retailers will benefit from existing policy of sourcing their requirement from wholesale cash-and-carry stores at a discount. In countries such as China, Thailand, Indonesia, Brazil, Singapore, Argentina and Chile, where there are no caps for FDI and where there are no conditions, small retail stores have flourished leading to more employment." This is not a global retail giant arguing the case.

"Farmers will receive better remuneration for their produce and will benefit from additional job opportunities resulting in overall improvement in their quality of life." Again this is not an apologist for global retailers speaking at some conclave. Rather these are assertions contained in full page advertisement issued by Government of India.

That is not all. Finance Minister Pranab Mukherjee shocked many when he said that if the Cabinet did not approve FDI in retail, the Sensex will fall by a whopping 400 points the following day. So is he Minister for Finance or Minister for Sensex?

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

The experience of countries with these global retailers across continents has been varied. Possibly, they could have been a success in a country like Singapore, which can be compared to at best Mylapore -- a small area in Chennai -- but not with a country like India.

China allowed these global retail giants to operate as a quid pro quo.

Crucially all these retail giants, not countries, are its largest trading partner. So comparison with other countries is odious.

Likewise, some of these retail giants have known to exit countries like South Korea and Germany, while in Japan they have been neutralised by regulatory intervention.

Click NEXT to read on . . .

FDI in retail: Why this Kolaveri di?

In Thailand and Brazil, within years, they have been seen to have destroyed domestic competition.

Moreover, uniformly they are accused of adopting bad labour practices, squeezing manufacturers and following predatory pricing policies.

While they have been known to sell below cost initially to 'stomp the comp', their deep pockets and ability to influence political decisions allow them to bear the loss, stay put and recover all these at a later date.

Remember, all these experiences of various countries with global retail giants are well documented, accepted and publicised. The pity is that we are determined not to learn from others' experience. We want to experience Kolaveri firsthand.

The author is a Chennai-based chartered accountant. He can be contacted at mrv@mrv.net.in