Raghavendra Kamath in Mumbai

Sanjay Sanghvi, a real estate consultant in the Dadar area of Central Mumbai, says these days he barely manages to broker two-three apartment deals a month, compared to half-a-dozen almost a year ago.

"It is difficult now. People are reluctant to buy, as prices have gone up sharply. They will buy only if prices come down," says Sanghvi.

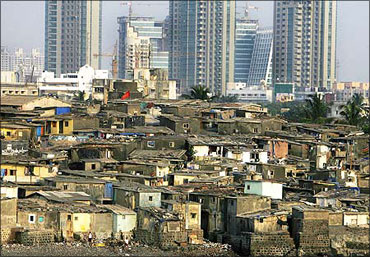

Sanghvi says he is flooded with sales calls from developers -- including Indiabulls, Lodha Group and DB Realty -- building high rises in Lower Parel-Worli-Parel area of south-central Mumbai. Prices in this erstwhile textile hub range from Rs 22,000 to Rs 35,000 a square feet.

. . .

Home sales dip in Mumbai, rise in NCR

Sanghvi's case is just an instance of dwindling home sales in the country's commercial capital, following steep rises in prices over the last one year.

According to realty research company PropEquity, home sales in Mumbai have fallen 35 per cent since the beginning of the year and 45 per cent since June this year.

But the scene is quite different in the national capital region, or NCR, which comprises New Delhi and its satellite towns such as Noida, Gurgaon, Ghaziabad and Faridabad. Property sales in these areas have gone up nearly 90 per cent since the beginning of the year.

Price is obviously the main factor. Data show that prices in Mumbai city have risen 28 per cent since the beginning of the year and 13 per cent since June.

. . .

Home sales dip in Mumbai, rise in NCR

"During 2008-09, nobody was buying and prices were at reasonable levels.

"A lot of pent-up demand came into the market after that. But after so much hectic buying and price rise, sales are bound to take a knock," says Anshul Jain, chief executive of DTZ, an international property consultant.

In most areas of the NCR, however, prices have remained stagnant since the beginning of the year.

For instance, in Noida, average property price hovers around Rs 3,341 a sq ft, compared to Rs 3,140 in January, a mere five per cent increase. Prices have gone up by 1.48 per cent in New Delhi since the beginning of the year.

. . .

Home sales dip in Mumbai, rise in NCR

Anuj Puri, India head of property consultant Jones Lang LaSalle, reasons that since half of the NCR's home buyers are investors, they came out to buy homes in the last couple of months as stock markets picked up.

In Mumbai, investors form only a fourth of total home buyers.

Apart from steep price rise, the recent anti-inflationary measures by the Reserve Bank of India are also expected to hit home sales.

The RBI increased the standard asset provisioning by commercial banks for teaser home loans from 0.4 per cent to two per cent, capped the loan-to-value ratio to 80 per cent, and increased the risk weight on loans of more than Rs 75 lakhs (Rs 7.5 million) to above 125 per cent.

. . .

Home sales dip in Mumbai, rise in NCR

"Sales are coming down, but it did not have any impact on prices so far. Developers still have availability of finance either through conventional or unconventional routes,'' says Shashi Kumar, head, real estate investment advisory, Birla Sun Life Asset Management Company.

Puri says prices have peaked and if they go up further, demand will drop from the current levels and stagnate.

But developers do not agree that their sales are hit.

For instance, Vikas Oberoi, managing director of Oberoi Realty, says the company has sold more apartments than in all of last year, mainly because of more launches.

. . .

Home sales dip in Mumbai, rise in NCR

Image: Courtesy: Lodha group."Our sales continue to be robust. Our apartments are selling. We have to wait and watch about how sales pan out," says Oberoi.

"Everything depends on sentiments. If sentiments turn negative, it will impact prices."

Abhisheck Lodha, managing director of Lodha Developers, says his company's sales have been growing for the last six quarters.

"In the first two quarters of this financial year, we have sold units worth Rs 3,500 crore (Rs 35 billion), which is 30 per cent higher than DLF and Unitech," he said.

However, Lodha concedes that property sales in general have reduced by 15-20 per cent in the last three-four months due to run-up in prices.

The PropEquity data shows that property sales in Bengaluru and Hyderabad are almost stagnant from the early 2010 levels.

article