Santosh Tiwari In New Delhi

Implementation of a nationwide goods and services tax (GST) in 2012-13 suddenly seems possible, with the assertion of the chairman of the empowered committee of state finance ministers, Sushil Modi, to work towards meeting the April 2012 deadline.

A senior finance ministry official told Business Standard, "It's difficult but not impossible." This is a complete change of track, as the GST missing the April 2012 deadline appeared to be a foregone conclusion in the ministry before Modi's statement last week.

The official said if there was a consensus, the whole process of bringing in a legislative framework for the GST implementation could be completed before April next year.

Click on NEXT for more...

Finmin readies GST for 2012-13 rollout

Image: Indian traders walk past banners during a protest against value-added tax.Photographs: B Mathur/Reuters

Explaining the possible road map, he said, "The GST Constitutional Amendment Bill is with the standing committee.

If we get the recommendations of the committee in the winter session of Parliament, we can pass the Bill in the same session." After this, both the Centre and states can concretise their GST Bills in due course.

"We will then move the Central GST Bill in the Budget Session of Parliament and get it passed. Simultaneously, all the 28 states can also introduce their State GST Bills in assemblies and get these passed," he said.

The official agreed completing all the legislative processes before April next year would be difficult technically, but as things stood now, if there was a consensus among political parties and states, implementing GST from April 1, 2012, was certainly possible.

Click on NEXT for more...

Finmin readies GST for 2012-13 rollout

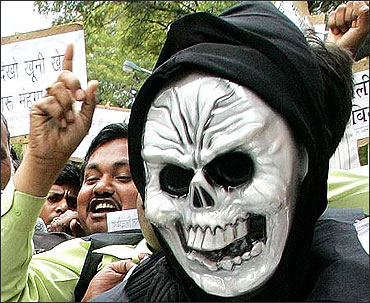

Image: An Indian trader wears a mask during a protest against the Value Added Tax.Photographs: B Mathur/Reuters

S D Majumder, chairman of the Central Board of Excise and Customs, said, "We are getting ready with the back-end work. The back-end work on both business processes and information technology infrastructure is going on full swing."

The advantage with the introduction of GST is that unlike the direct taxes code, GST can be implemented any time during the financial year.

"Even if we miss the April deadline, we need not wait for April 2013. As GST is a transaction-based tax, it can be implemented any time," said the official.

After the empowered committee's meeting on last Friday, Modi had said he was optimistic about meeting the GST implementation deadline the way things were going, if all the parties concerned co-operated.

Click on NEXT for more...

Finmin readies GST for 2012-13 rollout

Modi, who is also the deputy chief minister and finance minister of Bihar, had said the Centre would have to be flexible and address concerns raised by states for meeting the deadline.

The proposed GST framework will subsume Central and state taxes like excise, customs, service tax, sales tax and value-added tax.

The main concern of the Opposition-ruled states is the new tax regime would erode their autonomy to levy taxes.

The Bharatiya Janata Party-ruled states like Madhya Pradesh, Gujarat, Himachal Pradesh and Chhattisgarh have so far opposed the GST.

article