| « Back to article | Print this article |

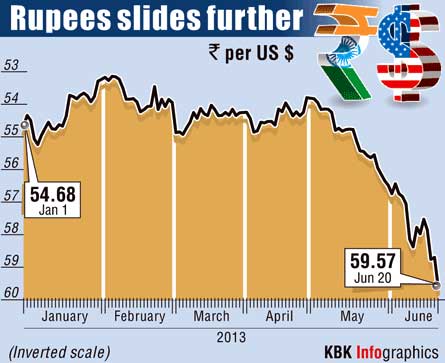

Re falls to nearly 60-level, ends at 59.57

Hit hard by hefty outflows on US Fed's plan to exit stimulus, rupee on Thursday closed at all-time low of 59.57 against dollar retreating from nearly 60-levels on suspected RBI intervention and pep talk from government.

At the Interbank Foreign Exchange market, the domestic currency commenced sharply lower at 59.50 a dollar from Wednesday's close of 58.70 and dipped further to log its all-time low of 59.93 as market participants panicked after US Federal Reserve chief Ben Bernanke said $85 billion a month bond buying programme may be slowed down from this year.

The rupee saw a marginal recovery to end at 59.57, still down 87 paise or 1.48 per cent over Wednesday's close, after Chief Economic Advisor to Finance Ministry Raghuram Rajan said the government is ready to take steps to curb volatility and is "not short of instruments" to tackle slide in the rupee.

"Today's movement is knee-jerk reaction of market to Fed Chairman's comments. "We saw a lot of panic in market which was sentiment driven, pushing rupee to touch all-time low. Also, possibly there was some intervention by RBI near low levels," said Hemal Doshi, Currency Strategist, Geogit Comtrade.

Continued selling by foreign funds in equities also put pressure on the rupee as overseas investors pulled out over Rs 2,000 crore (Rs 20 billion) on Thursday.

The dollar index was up by 0.72 per cent against a basket of six major global rivals after the Federal Reserve said the central bank may have scope to reduce the pace of monthly bond purchases, if the economy improves in line with its forecasts, shattering the global stock as well as forex markets.

"Ballooning current account deficit and cloudy outlook of reforms have added to the local currency's woes.

"Outlook of rupee is expected to remain weak till structural steps are taken to improve CAD...," said Kuntal Sur, Director, KPMG.

The Indian benchmark S&P BSE Sensex today tanked by over 526 points, biggest fall in 21 months, to end at over two month lows.