Photographs: Reuters

The Gurgaon police on Wednesday ruled out the possibility of questioning Citibank's global CEO Vikram Pandit and other top honchos in connection with the Rs 300 crore (Rs 3 billion) fraud at a bank branch in Gurgaon, near Delhi.

"At this point of time the possibility of involvement of the global CEO looks remote," Gurgaon Police Commissioner SS Deswal told reporters.

Police, however, will question the local staff of the Gurgaon Citibank branch in connection with the FIR filed by a high net worth individual and managing director of Helion Advisors Sanjeev Aggarwal who lost Rs 32.43 crore (Rs 324.3 million) in the fraud case.

"We are examining the details provided in the complaint as well as by the bank," Deswal added.

Aggarwal in his FIR had named Indian-born global CEO of Citibank Pandit, Chairman William R Rhodes and some other top officials of the bank in connection with the fraud masterminded by relationship manager Shiv Raj Puri.

. . .

Fraud: Cops not to question Citibank CEO Pandit

Image: (Inset) Shiv Raj Puri.Photographs: Reuters

In the FIR, Aggarwal, who is a resident of Gurgaon, alleged criminal breach of trust, falsification of accounts, cheating and criminal conspiracy by the officials of the Citibank.

"All persons named (in FIR) ... in collusion and conspiracy with each other and other known or unknown persons, (and) have misappropriated large sums of money to the tune of Rs 32.43 crore," Aggarwal said in his complaint.

Senior executives not involved in Rs 300 cr fraud: Citibank

Citibank has dismissed allegations of involvement of its senior executives in the fraud at its Gurgaon branch as claimed by high net worth individual Sanjeev Aggarwal who lost Rs 32.43 crore in the cheating case.

"As this individual (Sanjeev Aggarwal, managing director of Helion Advisors) knows well, Citi identified the fraud and immediately reported the matter to the regulators and the law enforcement agencies," Citibank said in a statement.

"His claims against senior executives are completely without basis and we intend to contest them vigorously. It was on Citi complaint that the Gurgaon police lodged an FIR and are currently investigating the matter," the statement said, adding the bank would continue to work with authorities on the investigation.

. . .

Fraud: Cops not to question Citibank CEO Pandit

Photographs: Reuters

Aggarwal had alleged that it was not possible for an employee to commit such a big fraud without the knowledge of the bank.

"Being a multinational bank of formidable repute, we trusted Citibank NA with our life savings which have now been wiped out by an illegal act and offence committed by the bank and its employees.

"It is impossible for an employee to undertake fraud of such a scale without the knowledge of the bank. I am devastated at this loss on my savings and strongly feel that Citibank NA is accountable to return my money," he had said in a statement.

The fraud at the bank's Gurgaon branch, involving diversion of depositors' money into the stock market, was uncovered last week.

The others who were been named in the FIR include Citibank's senior officials CFO John Gerspach and COO Douglas Peterson (both based in New York).

. . .

Fraud: Cops not to question Citibank CEO Pandit

Image: The Reserve Bank of India is investigating the case now.Photographs: Reuters

Besides, Amit Zarpuri, Ashwini Chaddha, Amrita Farmahan, Rahul Soota, N Rajshekaran, Pramit Jhaveri and Shiv Raj Puri (main accused in the fraud case) also figure in the FIR.

RBI investigating Citibank fraud

The Reserve Bank of India is investigating the Rs 300 crore fraud in Citibank's Gurgaon branch, which saw diversion of depositors' funds in stock markets.

"RBI is investing the matter (Citibank fraud)," a key Reserve Bank source said.

The fraud at the Citibank's Gurgaon branch, involving diversion of depositors money into the stock market, was uncovered last week.

Several high net worth individuals (HNIs), including promoters of Hero Group, were lured by Citibank's relationship manager Shiv Raj Puri, the main accused in the scam, into investing funds on promise of high returns.

. . .

Fraud: Cops not to question Citibank CEO Pandit

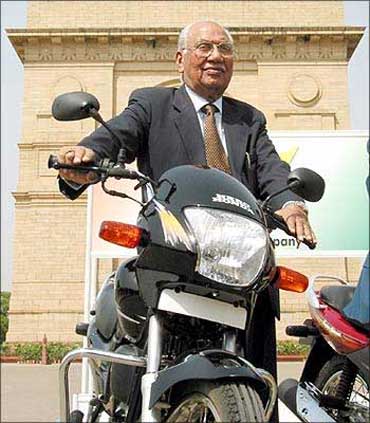

Image: Hero Group chairman Brij Mohanlal Munjal.Photographs: Reuters

2 more Hero employees identified in fraud

Hero Corporate Service said on Wednesday that it has identified two more employees who could have colluded with its former associate vice president Sanjay Gupta and Citibank employees in the Rs 300-crore fraud.

"Following an initial internal enquiry, two employees -- Ganpat Singh and Gaurav Jain-- working in the accounts department have also been identified to have been in possible collusion with Sanjay Gupta and Citibank employees," Hero Corporate Service said in statement.

They have been sent on leave with immediate effect by the company, it added.

"This is in addition to the suspension of Gupta by the company. Further appropriate action will be taken after the final outcome of the enquiry," it said.

. . .

Fraud: Cops not to question Citibank CEO Pandit

Photographs: Uttam Ghosh/Rediff.com

Earlier this week, Gupta was remanded to a five-day police custody in connection with the Citibank fraud case for allegedly investing about Rs 250 crore (Rs 2.50 billion) belonging to promoters of the Hero Group companies.

The Gurgaon police arrested him under the section 120B of the Indian Penal Code that deals with criminal conspiracy.

According to the police, Gupta had invested around Rs 250 crore from different Hero Group companies and their promoters.

For this, Gupta had formed two finance companies BG Finance and G2S, and took commission of Rs 20 crore from Shiv Raj Puri, the alleged mastermind in the estimated Rs 300-crore fraud discovered at the Citibank's Gurgaon branch, for investing the amount.

article