Photographs: Reuters

A few Indian companies have learnt how to manage risk arising from volatile currency, but many have not this skill and as a result red ink shows up on their balance balance sheets.

There are people who love horses, and there are people who are curious about them but don’t really know what to do with them.

As a kid, I was drawn to horses in the abstract through the pages of the Cole, the ubiquitous-about-the-house-during-the-horse-racing-season bible, about what was going to happen on the next race day.

With the entire family-- from grandmother down -- always trying to make a buck at the track, my young mathematically inclined mind was drawn to the form sheet and, quite often-- beginner’s luck or, perhaps, simple objectivity-- I was able to select long-priced horses that brought in the goods.

....

Why India Inc needs to be cautious in dealing with China

Image: Cautious investment can yield good returnsPhotographs: Reuters

A decade or so later, as a never-do-well student, I got drawn to the track in my own effort to make money.

With a close friend, I became extremely successful, and, before I turned 20, made what seemed like a fortune and ended up buying more than a dozen horses, all away from family eyes.

The bonus was that, going to the stables, I began to really get a sense of horses for the fine, grand animals they were.

Unfortunately, the success didn’t last and by the time I headed overseas to graduate school, I had reverted to being an only modestly endowed -- financially speaking, that is -- young student.

I visited the track in the United States a few times, but it was ever more abstract compared to the real thing.

...

Why India Inc needs to be cautious in dealing with China

Image: China is considered largest trading partner of IndiaPhotographs: Reuters

A few decades later, riding – or, more correctly, being led on – a horse in Mahabaleshwar, I tried to dismount and found my foot tangled in the stirrup and discovered that it was a long way from the back of the horse to the ground. I’ve learned to be more careful about horses since then.

Now, this is the Chinese Year of the Horse and, given that China is already India’s largest trading partner, there is, perhaps, a lesson for companies that are doing business with China.

......

Why India Inc needs to be cautious in dealing with China

Image: Volatility in Yuan is expected to risePhotographs: Reuters

This past week’s sudden fall in the yuan, after almost a decade of inching strength, is doubtless something to take note of. As is well known, the yuan was devalued savagely in 1994, after which it was kept steady at 8.27 to the dollar till 2005, during which time the Chinese export juggernaut changed the face of global trade.

By this time, China had become the second most important country in the world and, naturally enough, it shifted gears to develop its domestic market. Part of this was permitting the yuan to appreciate in, of course, a controlled fashion.

The evolution has not been without hiccups, but it is clear that the Chinese are staying the course and there has been a lot of talk about making the currency more flexible in preparation for full internationalisation.

The move last week appears to be part of this strategy. Clearly, yuan volatility is going to rise, and, irrespective of the efforts of the Chinese central bank, at some points in time, rise uncontrollably.

.....

Why India Inc needs to be cautious in dealing with China

Image: Some Indian corporate houses have learnt to manage currency risk wellPhotographs: Reuters

Indian companies know just how devastating dramatic currency volatility can be. Since 2009, rupee volatility has moved between four per cent and 20 per cent with an average of over nine per cent--- and four episodes of sustained 12+ per cent volatility.

While some Indian companies have learned how to manage this risk, many have not and it has resulted in much red ink on balance sheets; it is also partly responsible for the currently increasing non-performing assets in the banking sector.

A recent survey has shown that 84 per cent of Indian CEOs cited exchange rate volatility as their number one problem.

.....

Why India Inc needs to be cautious in dealing with China

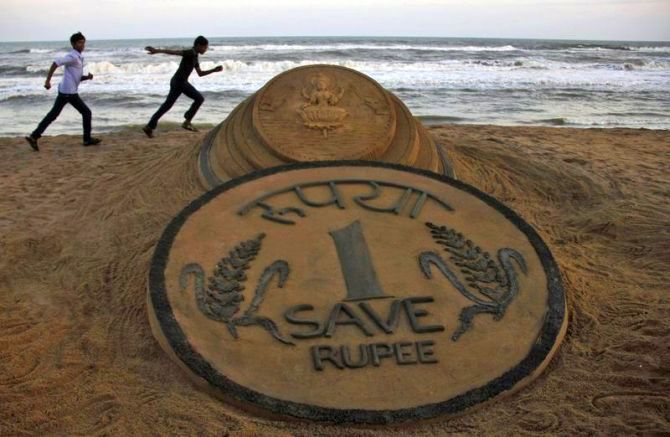

Image: India Inc is learning to deal with volatility in rupeePhotographs: Reuters

Indian companies know just how devastating dramatic currency volatility can be. Since 2009, rupee volatility has moved between four per cent and 20 per cent with an average of over nine per cent--- and four episodes of sustained 12+ per cent volatility.

While some Indian companies have learned how to manage this risk, many have not and it has resulted in much red ink on balance sheets; it is also partly responsible for the currently increasing non-performing assets in the banking sector.

A recent survey has shown that 84 per cent of Indian CEOs cited exchange rate volatility as their number one problem.

.....

Why India Inc needs to be cautious in dealing with China

Image: China's central bank governor Zhou XiaochuanPhotographs: Jason Lee/Reuters

Chinese companies have near-zero experience in dealing with currency volatility. Since 2009, the average volatility of the yuan has been just a bit over one per cent, with a high of under three per cent.

Thus, as the yuan internationalises, Chinese companies will have to go through a very steep learning curve, with likely equally difficult results.

This should be a signal not only for investors, but also for Indian companies doing business with China.

......

Why India Inc needs to be cautious in dealing with China

Image: Chinese guards stand near the India-China border at Nathula, SikkimPhotographs: Desmond Boylan/Reuters

From anecdotal reports, Chinese business ethics are, to use a racist euphemism, inscrutable, and there have been any number of occasions when Chinese buyers/sellers have not honoured contracts when commodity prices moved dramatically.

But since they were at the time the second-biggest daddy, Indian companies had little option but to live with it.

Now China is the biggest daddy of all and will soon have one more wildly unpredictable – and all-pervading, as far as trade goes – variable to deal with.

Companies need to build in an increased risk of default as an additional cost of doing business in China, and, indeed, into their strategy in terms of investment and long-term business planning.

This is the Year of the Horse -- be ever more careful

article