| « Back to article | Print this article |

India's darkest hour: Hopes recede of economic recovery

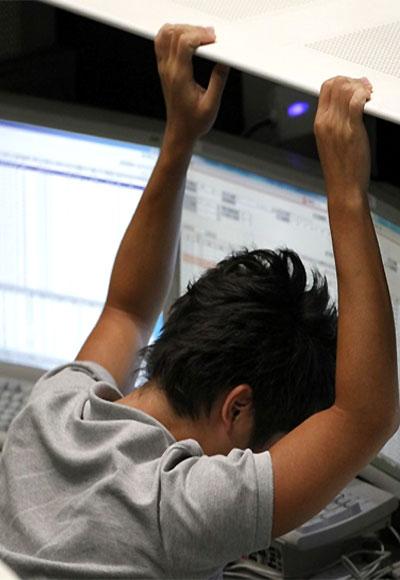

Indian companies, bankers and experts have all given up hope of an economic recovery, rues Akash Prakash.

I recently spent a week in India meeting a wide range of economic participants — companies (both large and small), banks, industry experts and economic commentators.

As a result, I was exposed to a diverse cross section of opinion. What is clear is that the economy is entering another down leg.

The bountiful monsoon may save us to an extent, but things are getting worse in terms of industrial production and private sector capital expenditure.

We may end up showing higher gross domestic product (GDP) growth in print than last year’s growth of five per cent, but this will be solely because of agricultural growth on account of good monsoon rains. On a like-for-like basis, independent of agriculture, GDP growth in 2013-14 should be lower than what it was in 2012-13.

Of the factors that were expected to lead to an acceleration in the rate of economic growth – falling interest rates, unclogging of the investment cycle and some pickup in exports – none seem to be playing out. In meeting after meeting, I felt that people had finally given up.

All the enthusiasm generated by Finance Minister P Chidambaram in his first six months in office has dissipated. People have realised that things cannot turn on a dime. It is extraordinarily difficult to implement most of the policy.

Click on NEXT for more...

India's darkest hour: Hopes recede of economic recovery

Industrialists have absolutely no interest in making any fresh investments, and have very little confidence that projects that are currently stuck will start moving.

Capital goods providers also seem to see little sign of the public sector investment step-up that the finance minister talks about.

Domestic order books remain subdued. Even consumption seems vulnerable; most of the participants agreed that consumption beyond a point couldn’t keep growing independent of the broader economy.

Everyone is convinced that this growth slowdown is largely self-inflicted. We have lost the plot and cannot blame our travails on external factors. The business class has given up the hope that the country would ever get back to the high growth rates achieved in 2003-07.

Most have made business plans assuming that growth will be at best six per cent over the coming few years. Cost cutting and asset rationalisation, not growth, are at the top of their agenda.

While there has been some improvement in competitiveness among many sectors, such as engineering and auto components, a large number of companies still complained, surprisingly, about the rupee, which is now at 60.

There was no sense of a broad-based export surge around the corner. The complaint that India was uncompetitive in terms of infrastructure, land, labour (adjusted for productivity) and capital remains. If this is true, how will any new manufacturing investment happen?

Click on NEXT for more...

India's darkest hour: Hopes recede of economic recovery

Corporate India believes the rupee will remain weak. Everyone is hoping that, now that the Reserve Bank of India (RBI) has seemingly drawn a line in the sand at 60, they succeed in protecting the currency.

Government decision making continues to be unpredictable — take, for instance, the delay in approving Mylan’s $1.2-billion purchase of an injectables facility in India. At a time of serious foreign exchange stress, one would think that we should welcome foreign direct investment (FDI).

Another example that was highlighted was FDI in retail. After seemingly risking its tenure on this issue, why did the government make the fine print so cumbersome that no one was willing to invest?

The finance ministry is trying to do what it can, but few others in government seem to demonstrate their sense of urgency. On infrastructure, the issues of land, access to equity and government policy clarity remain. Nothing much seems to have changed on the ground.

Most small and medium-sized entrepreneurs seem to be fed up with the daily harassment of doing business in India. Basically, when India was booming, the sheer adrenaline of growing at nine per cent was exciting enough for investors to put up with the hassles of doing business.

Now at five per cent growth – and dropping – the upside of doing business here does not seem to justify the hassles. Every industrialist I met had bought property overseas in the last 18 months and was in the process of creating a parallel establishment as a hedge.

Click on NEXT for more...

India's darkest hour: Hopes recede of economic recovery

Bankers spoke of balance sheet stress on an unprecedented scale, and of the worsening credit quality. Unhedged foreign exchange exposures are a real issue, and most wonder how credit growth will cross 10 per cent.

Those who rely on the wholesale markets are even more depressed since, as a result of recent measures by the RBI, both the cost of funds and access have deteriorated.

If these measures continue beyond two or three months, both the profitability and growth of their business models will be impaired. The decimation in the stock prices of public sector banks is also a worry. How will they recapitalise at these valuations?

What does it signal about the state of an economy that almost 70 per cent of its banking system is trading at below book? Are banks’ share prices a lead indicator of a systemic problem?

There appears to be a total breakdown in trust and co-operation in the system. We seem to be back to the mid-1970s. Businessmen are once again seen only as rent seekers who are trying to monopolise national resources.

The bureaucracy seems to be making sure that no one or no industry is earning more than it should. Trying to promote or grow an industry no longer seems the primary focus of most regulators. The political discourse in the country has lurched very much to the left, with capitalism in retreat.

Click on NEXT for more...

India's darkest hour: Hopes recede of economic recovery

Most felt that we needed fundamental, root-and-branch reform of our governance structures. The way we function is no longer appropriate for a country of our size, complexity and growth potential.

This fundamental reform requires somebody to take on vested and entrenched interests head-on. In today’s political set-up, no one seems ready for this initiative. There was not much hope of a decisive verdict in the elections, either.

In short, the mood was deeply pessimistic. Many now fear for the country’s future. It is always darkest before the dawn, and this deep pessimism may be a contrarian indicator, but even rational and sensible people now seem to have given up.

While it is truly difficult to be positive at present, one should not forget that we are a democracy with checks and balances. We have a very young and hugely aspirational population. The political system will eventually have to adapt to the needs and wishes of this huge demographic.

We will have to make the systemic changes to bring growth back. It is wrong to think that we have permanently lost our way. The risk is that we could have some more pain ahead, maybe even a crisis before the required changes happen.

The writer is fund manager and CEO of Amansa Capital