| « Back to article | Print this article |

Important infra projects mirred in trouble

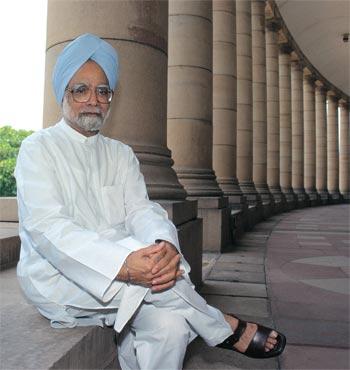

It is not a day too soon that Prime Minister Manmohan Singh felt the need to involve himself in sorting ministerial differences on implementation of major infrastructure and industry-related projects.

With such projects not getting commissioned on schedule, the 12th Plan (2012-17) growth target of nine per cent annually will remain elusive.

Delays in sanctioning new coal projects and in their execution, when all clearances are in place, will leave the country with coal production of 554 million tonnes in 2011-12 against a demand for 696 mt.

Similarly, it has become a ritual to miss the electricity generation capacity addition target for a plan period by a long margin.

The original power capacity building target of 78,700 Mw for the 11th plan was whittled to 62,000 Mw during the mid-term review.

The actual realisation is unlikely to be more than 51,000 Mw.

Delays in land acquisition and forest clearances continue to stand in the way of completing strategic projects like the 82-km Haridaspur-Paradip line and the 154-km link between Talcher and Bimlagarh, both in Orissa.

While the first project is to give good port access to units in the steel hub of Kalinganagar, the second is designed to step up evacuation of coal from mines at Angul and Talcher.

Click NEXT to read more...

Important infra projects mirred in trouble

Delays in implementation of projects of size are of national concern. The Aditya Birla Group s flagship Hindalco Industries is simultaneously executing five new projects, three smelters and two alumina refineries.

All are located in remote parts, where bauxite and coal are found. On their completion, the company will have annual alumina refining capacity of six mt and aluminium smelting capacity of 1.7 mt.

The country will need all this extra aluminium from Hindalco and whatever the growth plans of National Aluminium Company and Vedanta would generate.

This is because demand for the metal will continue to grow at a double digit rate for many years.

In this context, Hindalco recently said: Of late, uncertainty in the regulatory environment has impacted the progress of some of the greenfield projects and it has posed challenges with respect to their commissioning on schedule.

All these projects are located in remote areas, devoid of adequate infrastructure...Project execution also gets impacted by local factors.

For Hindalco, generally not given to complaining, to say all this is likely to make the government sit up and take corrective steps.

What Hindalco is experiencing holds good for industry in general.

The immediate trigger for Hindalco s complaint is delay in securing forest clearances for opening mines in the Mahan coal block in Madhya Pradesh.

Fuel for the 1,000 Mw captive power plant of the 359,000-tonne smelter of the Mahan Aluminium project is to be drawn from Mahan coal mines, to be run as an equally owned joint venture between Hindalco and Essar.

Click NEXT to read more...

Important infra projects mirred in trouble

Till such time the mines start operating at full capacity, the CPP will need coal from external sources.

That will raise power cost, impinging on smelter operation margins. Power being the most significant cost factor in aluminium production, smelters across the world seek space close to coal deposits or where gas-based or hydel power is available cheap.

This is why India, endowed with the world s fifth largest bauxite deposits and the fourth largest coal reserves, has emerged as a preferred place for making aluminium.

Within the country, Orissa is where every aluminium maker wants a presence.

That is why the Vedanta group, in spite of being solidly anchored in Chhattisgarh, thanks to its 50 per cent ownership of Balco, with capacity of 345,000 tonnes and then giving shape to a 650,000-tonne smelter there, wants to create alumina capacity of five mt and smelting capacity of 1.6 mt in Orissa, with adequate upstream integration in bauxite mining and coal-based power.

Click NEXT to read more...

Important infra projects mirred in trouble

Unfortunately, Vedanta is not able to realise what it has set out to do in Orissa, as it fell foul of pressure groups such as Amnesty International and Survival International and also of the ministry of environment and forests.

The Niyamgiri Hills, from where Vedanta s refinery is to draw bauxite, is considered sacred by Dongria Kondh tribesmen.

But why should the company be stopped to take out bauxite from there if it is ready to resettle the displaced people and practise environment-friendly mining?

As a result of the impasse, Vedanta is required to source bauxite from outside, totally upsetting the considerations for hosting a refinery at nearby Lanjigarh.

The denial of mining at Niyamgiri is setting a bad precedent for the mining sector.

Redemption for Vedanta would hopefully come, with the Orissa government committed to offering alternative bauxite deposits.