Shyamal Majumdar

Jindal Steel & Power's (JSPL) shareholders have dismissed the call made by a proxy advisory firm to put Chairman and Managing Director Naveen Jindal's huge pay package under the scanner.

The firm, Stakeholders Empowerment Services (SES), had also asked institutional shareholders to restrain India's highest-paid executive from having the powers to decide his and that of his whole-time directors' salary.

At a package of Rs 73.42 crore, Jindal's package is around 25 times the pay of the next highest-paid director, SES had said in a client note.

Nobody expected a defeat for Jindal when the resolutions came up before Wednesday's annual general meeting since minority investors hardly have a voice in India (institutional shareholding in JSPL is 28 per cent against the promoter's 59 per cent).

...

Are high salaries for CEOs justified?

Photographs: Reuters.

Besides, JSPL's move was perfectly legal, which is why SES said the opaque remuneration policy and the absence of a remuneration committee is more of a governance and ethical issue.

The SES move comes amid a series of moves by the government (even the prime minister had some time back advised Indian companies to resist paying large salaries to their top executives) and, more recently, the market regulator who talked about making remuneration committees headed by independent directors mandatory in Indian companies.

The formation of such committees is now a non-mandatory requirement in Clause 49 of the listing agreement.

...

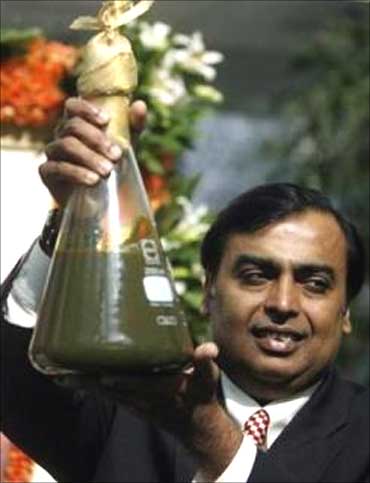

Are high salaries for CEOs justified?

Image: Mukesh Ambani, chairman, Reliance Industries.Photographs: Reuters.

Though one can debate the need for such committees, the point to consider is whether there is a case for such interventions.

Under current law, a managing director's compensation cannot exceed five per cent of net profit, and pay and directors' compensation as a whole cannot exceed 11 per cent of profit, without government permission.

Let's look at the top-paid executives in India. Jindal's salary is 1.83 per cent of JSPL's Rs 4,002 crore net profit in 2010-11 and Mukesh Ambani's is even lower at 0.08 per cent.

...

Are high salaries for CEOs justified?

Image: Sunil Mittal.Photographs: Reuters.

The important point is they are the rule and not the exception. Take Sunil Mittal, head of Bharti Airtel.

He took home Rs 21.29 crore, or 0.50 per cent of the company's net profit. Hero MotoCorp's Pawan Munjal earned Rs 34.47 crore, or 1.45 per cent of net profits. Kumar Mangalam Birla's salary was Rs 22.51 crore, which was 0.94 per cent of profit.

The amount of pay does not justify government or regulatory intervention. In fact, pay packages now are far more transparent than what they were before reforms.

...

Are high salaries for CEOs justified?

Photographs: Uttam Ghosh/Rediff.com.

There are stories of how companies in the pre-1991 era created elaborate webs of deceit to mask big payouts so that their top executives can hide income and evade hefty taxes. It's unlikely that we would want to go back to those days.

It's also true that it all boils down to a fierce competition for talent. Surely most of these executives deserve every paisa they are paid, and more.

Being a CEO requires skills that are in short supply. And it's a fact that the competition for talent is fierce.

...

Are high salaries for CEOs justified?

Photographs: Uttam Ghosh/Rediff.com.

Indian CEOs can also take heart from the experience of their UK counterparts. Much had been made out of the non-binding say-on-pay votes authorised by the Dodd-Frank financial reform legislation.

But a majority of corporate shareholders don't seem to mind that CEOs are netting high pay. According to a report in Forbes, only 36 of 2,225 companies reported that shareholders voted against the pay rates of CEOs at the firms in which they hold stock.

Many CEOs argue say-on-pay takes away the fundamental right of every board - that is to determine the payment it wants to give to attract the best talent. Besides, it takes away the board's prerogative to manage.

...

Are high salaries for CEOs justified?

Photographs: Uttam Ghosh/Rediff.com

There is some merit in such positions, but overall, say-on-pay at least clues managements into what shareholders are thinking.

Besides, there can't be any quarrel with transparency - shareholders ought to know the reasoning that leads to the choices a company makes.

The moot point is that India Inc should not have any problem in more disclosures regarding pay since no one can argue in favour of a skewed and non-transparent remuneration process.

...

Are high salaries for CEOs justified?

Consider the India Board report by Hunt partners, AZB and PricewaterhouseCoopers that says in many Indian companies, there is no real governance around how top managers were paid.

Decision makers and recipients are not at arm's length, and boards are unable (or incapable) of judging remuneration decisions objectively.

Interestingly, the link between performance and pay is often found to be non-existent or weak. In many instances, performance criteria are not merely lacking in transparency, but also designed to be obscure or complex.

...

Are high salaries for CEOs justified?

Asymmetry in design means limited downside but large upside, encouraging managers to take undue risk.

Many experts say the only way to make executive pay transparent is to subject it to a mandatory audit programme by independent firms that have the expertise to improve the quality of executive compensation practices.

This is more so since most shareholders hardly have the knowledge base to take informed decisions on executive pay.

article