Photographs: Reuters

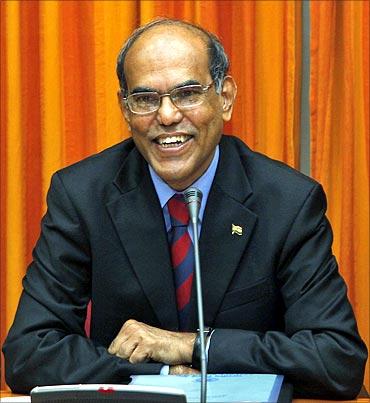

Reserve Bank of India Governor D Subbarao on Friday said that he cannot speculate on when he will start cutting policy rates, but assured that the central bank will ensure that there is enough liquidity in the system by conducting open market operations.

"We have taken into account the inflation situation and also growth moderation. For the moment, we have kept the policy rates steady. However, we will manage liquidity through market operations (but) I cannot speculate when we might start cutting rates," he said while speaking to reporters at an ICAI function in Mumbai.

In its mid-quarterly review of Monetary Policy on Friday, RBI maintained repo (rate at which banks borrow from RBI) at 8.5 per cent, reverse repo (rate at which the RBI borrows from banks) at 7.5 per cent.

The halt in rate increase comes after 13 hikes since March 2010.

The central bank has also decided to retain the cash reserve ratio (CRR), the amount banks need to park with the RBI, at 6 per cent.

. . .

Can't speculate if we will start cutting rates soon, says RBI

Photographs: Reuters

On the steep fall in the rupee, he said, "Certainly, it will put pressure on inflation, and we have acknowledged that in our review today."

The domestic currency had been on a free-fall and it plunged to an all-time record low of sub-54 level on Thursday during intra-day.

Last evening, the RBI moved swiftly to check the slide in rupee value and speculations by imposing restrictions on forward trading in the local currency by FIIs and traders and by capping banks' exposure to the forex market.

The impact of RBI steps was visible today with the rupee surging by a whopping 143 paise to Rs 52.21 per US dollar in early trade on Friday.

Pranab welcomes RBI's decision

Finance Minister Pranab Mukherjee on Friday welcomed the Reserve Bank's decision to keep policy rates unchanged and expressed the hope that inflation would moderate in the coming weeks.

. . .

Can't speculate if we will start cutting rates soon, says RBI

Photographs: Reuters

"The need to improve the business sentiments and recover the growth momentum in the remaining months of the current fiscal necessitated a review of the monetary policy stance,"

"I believe that inflation will moderate further in the coming weeks and, therefore, the announcement today is welcome," Mukherjee told reporters outside the Parliament House complex.

Concerned over economic slowdown, the Reserve Bank of India kept policy rates unchanged.

The finance minister also welcomed steps taken by RBI on Thursday to check the rupee's slide and speculations by imposing restrictions on forward trading in the local currency by FIIs and traders, and by capping banks' exposure to the forex market.

. . .

Can't speculate if we will start cutting rates soon, says RBI

Photographs: Reuters

"I also welcome the RBI governor's resolve to check the speculative interventions in foreign exchange market which among other factors have contributed to the sharp depreciation of the Indian rupee against the US dollar," Mukherjee said.

He further hoped that Friday's announcement should help in regaining India's growth momentum with improved macro economic parameters in the remaining period of fiscal year 2011-12.

"(RBI) Governor has chosen to reflect his concerns on growth which has faltered in the past few months with October IIP reflecting a significant contraction across all industry sectors," Mukherjee said.

He also said the "appreciable decline" in food inflation in November has resulted in a dip in headline inflation for November.

. . .

Can't speculate if we will start cutting rates soon, says RBI

Photographs: Reuters

A sharp fall in vegetable prices has pulled down food inflation to a near four-year low of 4.35 per cent for the week ended December 3. Headline inflation in November fell marginally to 9.11 per cent from 9.73 per cent in the previous month. Inflation in manufactured goods remains firm around 7.7 per cent.

Halt in rate hikes on expected lines: Rangarajan

Meanwhile, PMEAC chairman C Rangarajan said RBI's move to keep all the key policy rates unchanged in its mid-quaterly policy review is on expected lines and the central bank might start revising downwards its monetary stance only if inflation continues to decline further.

"...the move is on expected lines...if inflation continues to show a declining trend, then perhaps the RBI will start reversing its policy. Therefore, it is predicated only on one assumption and that is the inflation going down," Rangarajan said.

He added that inflation will start declining, "particularly food prices will come down more sharply as we have indicated, not only in December but in January as well".

. . .

Can't speculate if we will start cutting rates soon, says RBI

Photographs: Reuters

"The impact of the base effect will be seen as food prices generally come down in winter season... so I do believe inflation will come down sharply and that might provide the correct environment in which the RBI can act further in the direction of easing action," he said.

Industry was expecting a marginal cut in the CRR to induce liquidity in the system to promote investments.

Meanwhile, Planning Commission Deputy Chairman Montek Singh Ahluwalia declined to comment on RBI's policy stance.

"If there is no change (in policy rates), then what is there to comment on. I don't want to speculate (on the impact of the pause)," he said.

The RBI will make an assessment of its growth and inflation projections for 2011-12 in the third quarter review next month, the policy statement said.

article