| « Back to article | Print this article |

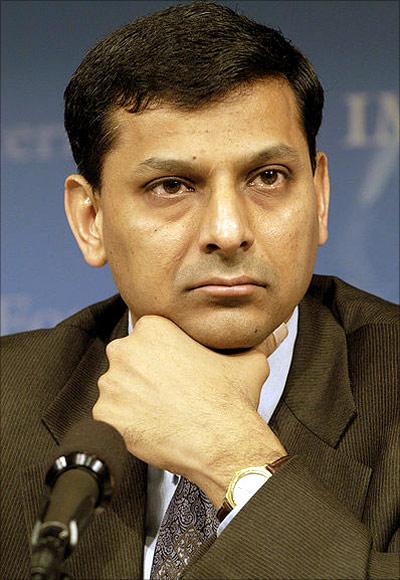

CAD to come down to $56 billion this fiscal: Rajan

Seeking to calm currency markets, the Reserve Bank on Wednesday said the current account deficit in 2013-14 will be $56 billion-- much lower than the quantum projected earlier-- and there is no fundamental reason for rupee depreciation.

"Our estimates now is that CAD this year will be $56 billion, less than 3 per cent of GDP and $32 billion less than last year.... Of course, some of that compression comes of our strong measures to curb gold import," RBI Governor Raghuram Rajan said at a hurriedly called press conference.

The current account deficit (CAD), which is the difference between outflow and inflow of foreign exchange, touched an all-time high of $88.2 billion or 4.8 per cent of the GDP in 2012-13.

Click NEXT to read more...

CAD to come down to $56 billion this fiscal: Rajan

Earlier, the government had projected the CAD in the current fiscal at $70 billion, which was revised downwards to $60 billion by Finance Minister P Chidambaram on back of declining gold imports and recovery in exports.

Referring to the recent decline in the value of rupee, the RBI chief said there is "no fundamental reason for volatility in the exchange rate".

Continuing its slide for the sixth straight day, the rupee lost 17 paise to trade at a fresh two-month low of 63.88 in early trade on strong dollar demand from importers.

Rajan further said RBI was weighing various options to contain exchange rate volatility and would come out with 'appropriate' steps in the future.

CAD to come down to $56 billion this fiscal: Rajan

Rajan also said the central bank would undertake open market operations (OMO) on Monday to inject Rs 8,000 crore (Rs 80 billion) into the system to ease the liquidity situation.

As part of the OMO, the central bank buys securities from banks and release funds in the process.

On interest rates, he said, the RBI would take a decision later taking into account various parameters. The RBI is scheduled to announce the next policy review on December 18.

He expressed the hope that inflation would decline in the coming months once the impact of the good harvest was felt on the market.

As per the official data, retail inflation measured by movement in the consumer price index (CPI), rose to 10.09 per cent, entering double digits after seven months.

Elaborating on exchange rate issues, Rajan said that majority of dollar purchase by oil companies have been shifted to the market.

In order to check rupee slide, the Reserve Bank in August had opened a special window to help the three state-owned oil marketing companies -- IOC, HPCL and BPCL -- to meet daily foreign exchange requirements and buy dollars directly from RBI.

The PSU oil companies are the biggest buyers of dollars, requiring $8-8.5 billion every month for import of an average 7.5 million tonnes of crude oil.

The rupee, it may be mentioned, fell to a record low of 68.85 to the dollar on August 28 and recovered on the optimism that the Fed would delay tapering its bond buying programme.